Accolade Results Presentation Deck

9

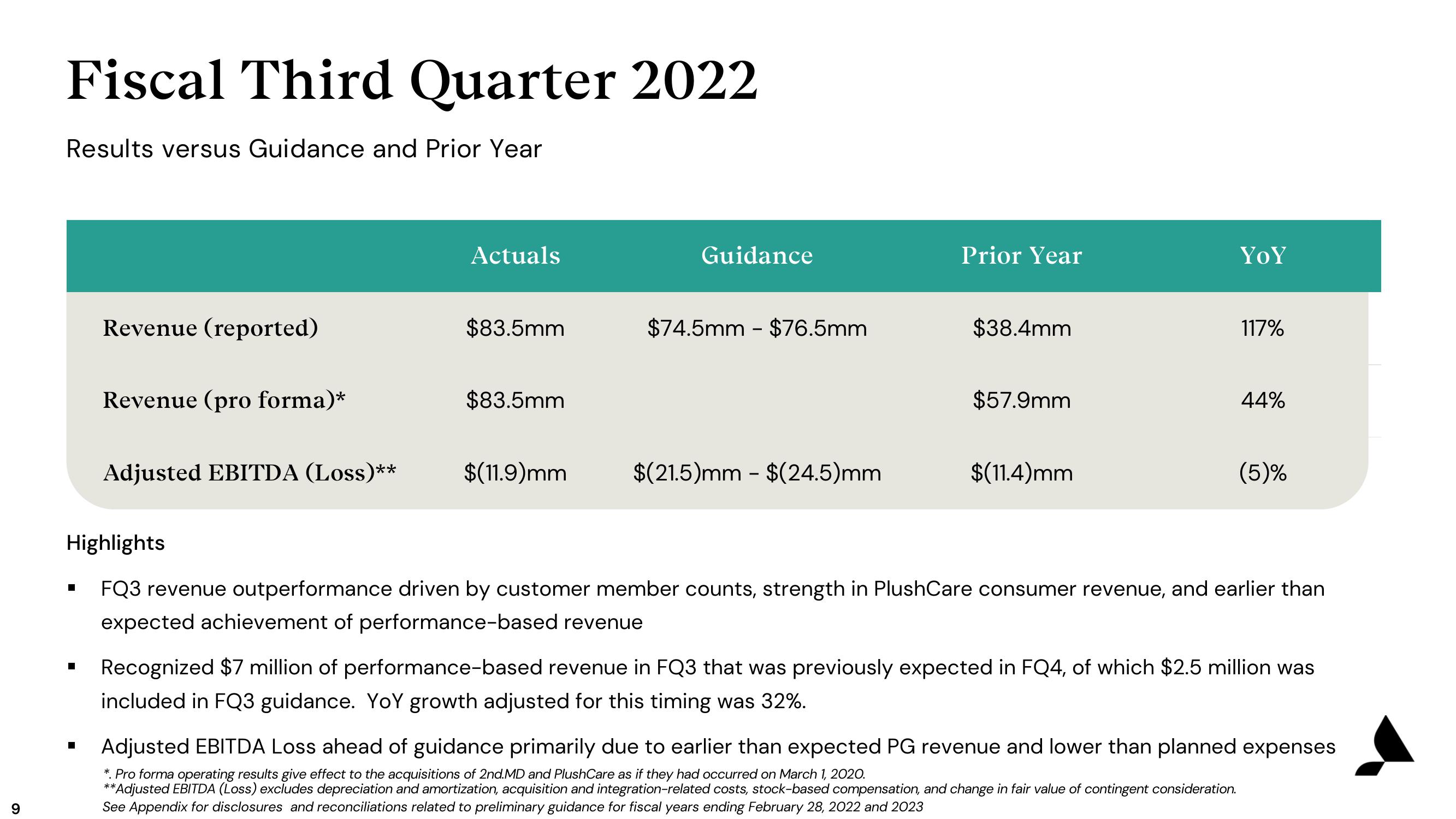

Fiscal Third Quarter 2022

Results versus Guidance and Prior Year

Revenue (reported)

■

Revenue (pro forma)*

Adjusted EBITDA (Loss)**

Actuals

$83.5mm

$83.5mm

$(11.9)mm

Guidance

$74.5mm - $76.5mm

$(21.5)mm - $(24.5)mm

Prior Year

$38.4mm

$57.9mm

$(11.4)mm

YOY

117%

44%

(5)%

Highlights

FQ3 revenue outperformance driven by customer member counts, strength in PlushCare consumer revenue, and earlier than

expected achievement of performance-based revenue

Recognized $7 million of performance-based revenue in FQ3 that was previously expected in FQ4, of which $2.5 million was

included in FQ3 guidance. YoY growth adjusted for this timing was 32%.

Adjusted EBITDA Loss ahead of guidance primarily due to earlier than expected PG revenue and lower than planned expenses

*. Pro forma operating results give effect to the acquisitions of 2nd.MD and PlushCare as if they had occurred on March 1, 2020.

**Adjusted EBITDA (Loss) excludes depreciation and amortization, acquisition and integration-related costs, stock-based compensation, and change in fair value of contingent consideration.

See Appendix for disclosures and reconciliations related to preliminary guidance for fiscal years ending February 28, 2022 and 2023View entire presentation