Bank of America Investment Banking Pitch Book

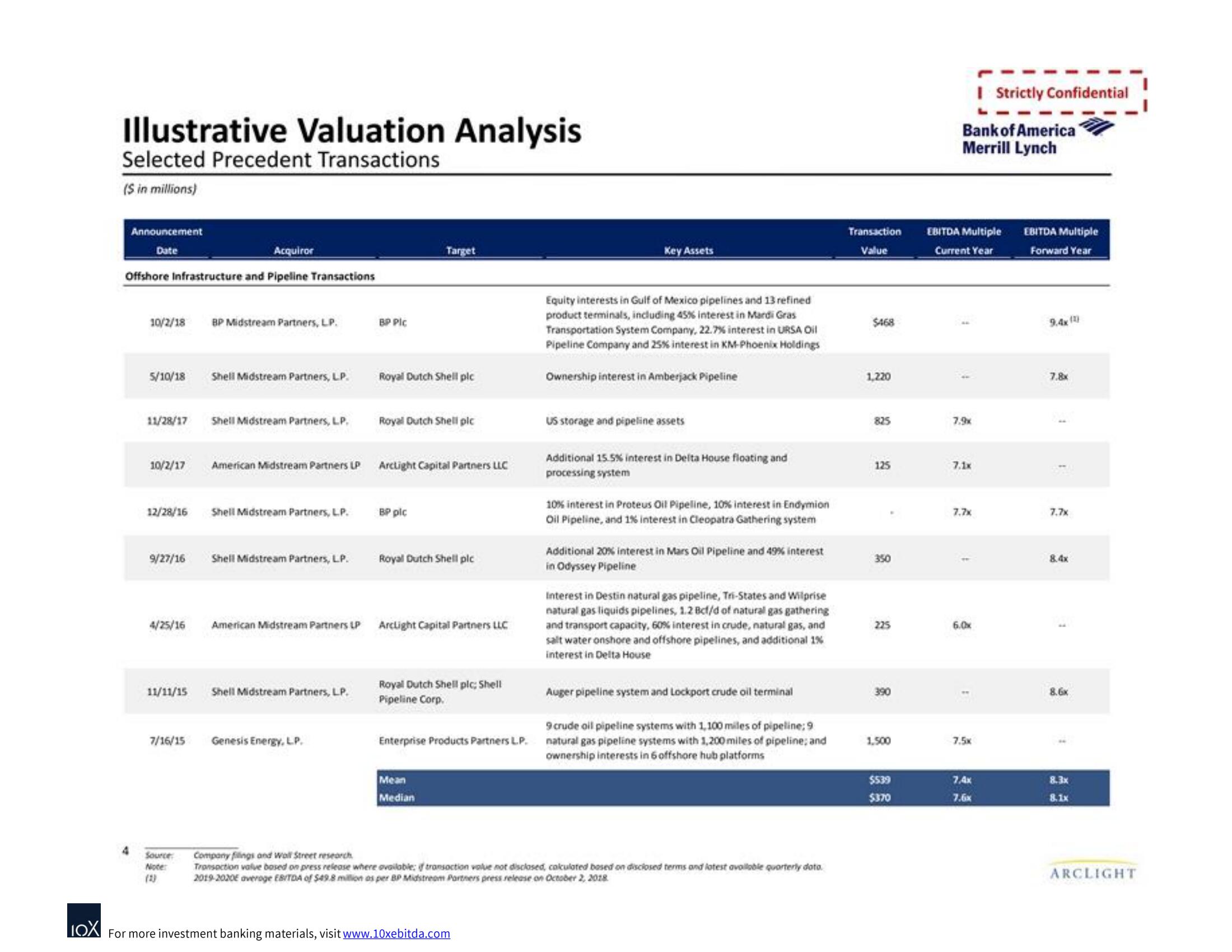

Illustrative Valuation Analysis

Selected Precedent Transactions

(S in millions)

Announcement

Date

Acquiror

Offshore Infrastructure and Pipeline Transactions

4

10/2/18 BP Midstream Partners, LP.

5/10/18

11/28/17 Shell Midstream Partners, LP,

10/2/17

12/28/16

9/27/16

11/11/15

Shell Midstream Partners, LP.

7/16/15

Source:

Note:

(2)

Shell Midstream Partners, L.P.

Shell Midstream Partners, LP.

BP Plc

American Midstream Partners LP Arclight Capital Partners LLC

Shell Midstream Partners, LP.

Genesis Energy. LP.

Royal Dutch Shell plc

4/25/16 American Midstream Partners LP Arclight Capital Partners LLC

Target

Royal Dutch Shell pic

BP pic

Royal Dutch Shell plc

Royal Dutch Shell plc; Shell

Pipeline Corp.

Mean

Median

Key Assets

Equity interests in Gulf of Mexico pipelines and 13 refined

product terminals, including 45% interest in Mardi Gras

Transportation System Company, 22.7% interest in URSA Oil

Pipeline Company and 25% interest in KM-Phoenix Holdings

LOX For more investment banking materials, visit www.10xebitda.com

Ownership interest in Amberjack Pipeline

US storage and pipeline assets

Additional 15.5% interest in Delta House floating and

processing system

10% interest in Proteus Oil Pipeline, 10% interest in Endymion

Oil Pipeline, and 1% interest in Cleopatra Gathering system

Additional 20% interest in Mars Oil Pipeline and 49% interest

in Odyssey Pipeline

Auger pipeline system and Lockport crude oil terminal

9 crude oil pipeline systems with 1,100 miles of pipeline; 9

Enterprise Products Partners LP. natural gas pipeline systems with 1,200 miles of pipeline; and

ownership interests in 6 offshore hub platforms

Interest in Destin natural gas pipeline, Tri-States and Wilprise

natural gas liquids pipelines, 1.2 Bcf/d of natural gas gathering

and transport capacity, 60% interest in crude, natural gas, and

salt water onshore and offshore pipelines, and additional 1%

interest in Delta House

Company filings and Wall Street research

Transaction value based on press release where available: if transaction value not disclosed, calculated based on disclosed terms and latest available quarterly dato

2019-2020E average EBITDA of $49.8 million as per BP Midstreom Partners press release on October 2, 2018

Transaction

Value

$468

1,220

825

125

350

225

390

1,500

$539

$370

Bank of America

Merrill Lynch

EBITDA Multiple

Current Year

7.9x

7.1x

7.7x

t

6.0x

I Strictly Confidential

7.5x

7,4x

7.6x

EBITDA Multiple

Forward Year

7.8x

7,7x

8.4x

1

8.6x

8.3x

8.1x

ARCLIGHTView entire presentation