Ares U.S. Real Estate Opportunity Fund IV, L.P. (“AREOF IV”)

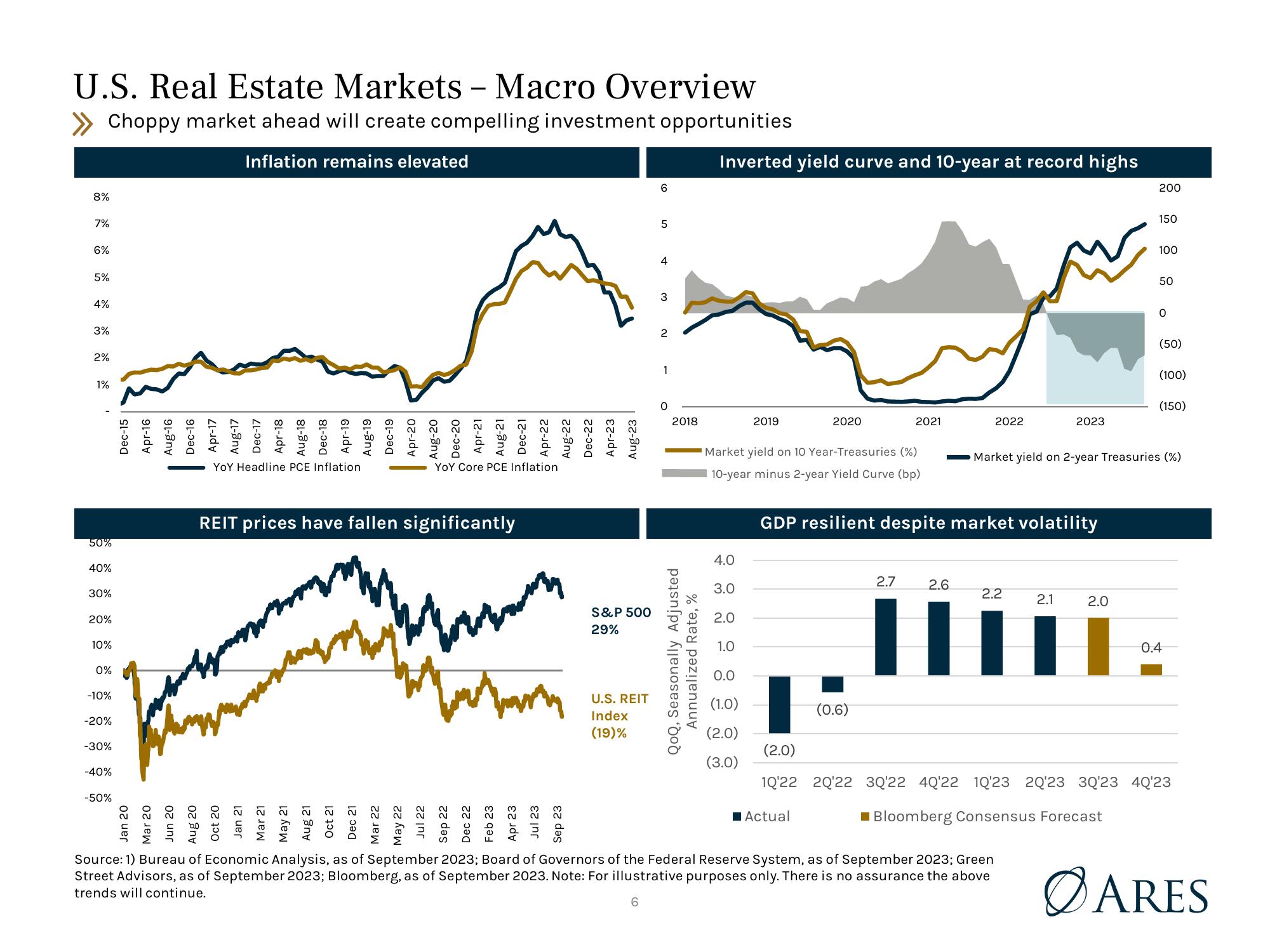

U.S. Real Estate Markets - Macro Overview

» Choppy market ahead will create compelling investment opportunities

Inflation

remains

8%

7%

6%

5%

4%

3%

2%

1%

50%

40%

30%

20%

10%

0%

-10%

-20%

-30%

-40%

-50%

Dec-15

Apr-16

Aug-16

Dec-16

Apr-17

Aug-17

Dec-17

Jan 20

Mar 20

Jun 20

Apr-18

Aug-18

Dec-18

Apr-19

Aug-19

Dec-19

YOY Headline PCE Inflation

elevated

Apr-20

Aug-20

Dec-20

Apr-21

Aug-21

Dec-21

Apr-22

Aug-22

Dec-22

YOY Core PCE Inflation

REIT prices have fallen significantly

Bramy

Watan

21

Aug 20

Oct 20

Jan 21

Mar 21

May 21

Aug 21

Oct

Dec 21

Mar 22

May 22

Jul 22

Sep 22

Dec 22

Feb 23

Apr 23

Jul 23

Sep 23

Apr-23

Aug-23

S&P 500

29%

U.S. REIT

Index

(19)%

6

5

4

2

0

2018

QoQ, Seasonally Adjusted

Annualized Rate, %

Inverted yield curve and 10-year at record highs

4.0

3.0

2019

2.0

1.0

0.0

(1.0)

(2.0)

(3.0)

Market yield on 10 Year-Treasuries (%)

10-year minus 2-year Yield Curve (bp)

2020

2021

Actual

(0.6)

2022

GDP resilient despite market volatility

2.7

2.6

11

2.2

2023

Source: 1) Bureau of Economic Analysis, as of September 2023; Board of Governors of the Federal Reserve System, as of September 2023; Green

Street Advisors, as of September 2023; Bloomberg, as of September 2023. Note: For illustrative purposes only. There is no assurance the above

trends will continue.

200

w

150

100

50

0

➡Market yield on 2-year Treasuries (%)

(50)

(100)

(150)

(2.0)

1Q'22 20'22 3Q'22 4Q'22 10'23 20'23 3Q'23 40'23

Bloomberg Consensus Forecast

2.1

2.0

ii:

0.4

ARESView entire presentation