Accelerating Value Creation for Shareholders

Proposal for integration with UFJ Group

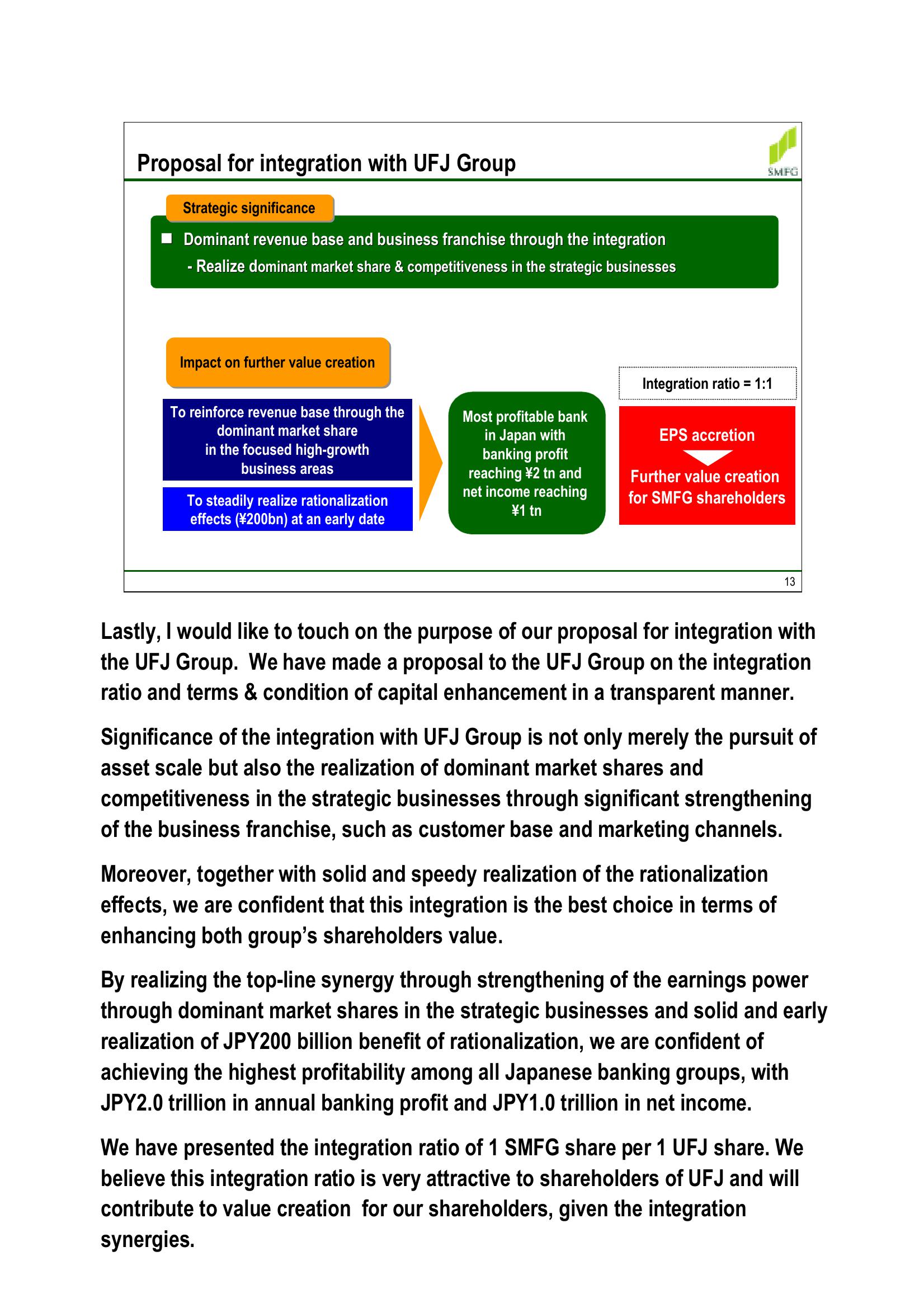

Strategic significance

Dominant revenue base and business franchise through the integration

- Realize dominant market share & competitiveness in the strategic businesses

SMFG

Impact on further value creation

To reinforce revenue base through the

dominant market share

in the focused high-growth

business areas

To steadily realize rationalization

effects (¥200bn) at an early date

Most profitable bank

in Japan with

banking profit

reaching ¥2 tn and

net income reaching

¥1 tn

Integration ratio = 1:1

EPS accretion

Further value creation

for SMFG shareholders

13

Lastly, I would like to touch on the purpose of our proposal for integration with

the UFJ Group. We have made a proposal to the UFJ Group on the integration

ratio and terms & condition of capital enhancement in a transparent manner.

Significance of the integration with UFJ Group is not only merely the pursuit of

asset scale but also the realization of dominant market shares and

competitiveness in the strategic businesses through significant strengthening

of the business franchise, such as customer base and marketing channels.

Moreover, together with solid and speedy realization of the rationalization

effects, we are confident that this integration is the best choice in terms of

enhancing both group's shareholders value.

By realizing the top-line synergy through strengthening of the earnings power

through dominant market shares in the strategic businesses and solid and early

realization of JPY200 billion benefit of rationalization, we are confident of

achieving the highest profitability among all Japanese banking groups, with

JPY2.0 trillion in annual banking profit and JPY1.0 trillion in net income.

We have presented the integration ratio of 1 SMFG share per 1 UFJ share. We

believe this integration ratio is very attractive to shareholders of UFJ and will

contribute to value creation for our shareholders, given the integration

synergies.View entire presentation