Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

Sin million)

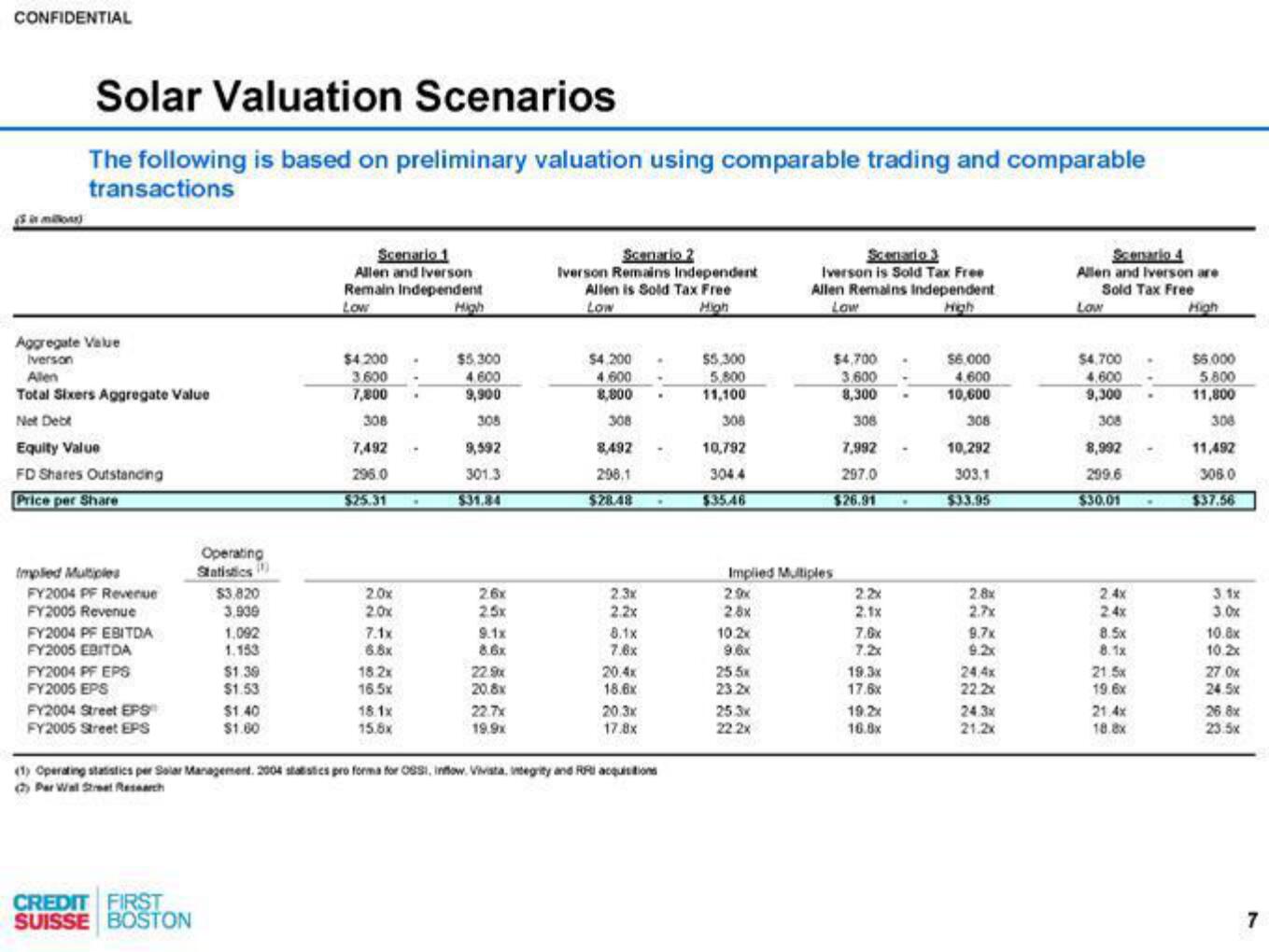

Solar Valuation Scenarios

The following is based on preliminary valuation using comparable trading and comparable

transactions

Aggregate Value

Iverson

Allen

Total Sixers Aggregate Value

Net Debt

Equity Value

FD Shares Outstanding

Price per Share

Implied Multiples

FY2004 PF Revenue

FY2005 Revenue

FY2004 PF EBITDA

FY2005 EBITDA

FY2004 PF EPS

FY2005 EPS

FY2004 Street EPS

FY2005 Street EPS

Operating

Statistics

CREDIT FIRST

SUISSE BOSTON

$3,820

3,939

1,092

1.153

$1.39

$1.53

$1.40

$1.00

Scenario 1

Allen and Iverson

Remain Independent

Low

$4,200 .

3.600

7,800

308

7,492

296.0

$25.31

2.0x

2.0x

7.1x

6.8x

18.2x

1652

18.1x

15.8x

-

.

$5,300

4.600

9,900

308

9,592

301.3

$31.84

2.6x

2.5x

9.1x

8.6x

22.9x

20.8x

22.7x

19.9x

Scenario 2

Iverson Remains Independent

Allen is Sold Tax Free

Low

High

$4,200

4.600

8,800

308

8,492

298,1

$28.48

2.3x

2.2x

8.1x

7.6x

20.4x

18.6x

20.3x

17.8x

(1) Operating statistics per Solar Management, 2004 statistics pro forma for OSSI, inflow. Vivista, Integrity and acquisitions

(2) Per Wall Street Research

$5,300

5,800

11,100

308

10,792

304.4

$35.46

10.2x

9.6x

Implied Multiples

2.9x

2.8x

BÁN

23.2x

Scenario 3

Iverson is Sold Tax Free

Allen Remains Independent

Low

25.3x

22.2x

$4,700

3.600

8,300

308

7,992

297.0

$26.91

2.2x

2.1x

7.6x

7.2x

19.3x

17.6x

19.2x

16.8x

$6.000

4.600

10,600

308

10,292

303.1

$33.95

2.8x

2.7x

9.7x

9.2x

24,4x

22.2x

24.3x

21.2x

Scenario 4

Allen and Iverson are

Sold Tax Free

Low

$4,700

4.600

9,300

308

8,992

299.6

$30.01

2.4x

2.4x

8.5x

8.1x

215

19.6x

21.4x

18.8x

$6.000

5.800

11,800

308

11,492

306.0

$37.56

3.1x

3.0x

10.8x

10.2x

27.0x

2.5

26.8x

23.5

7View entire presentation