Pershing Square Activist Presentation Deck

Lowe's ("LOW")

LOWE'S

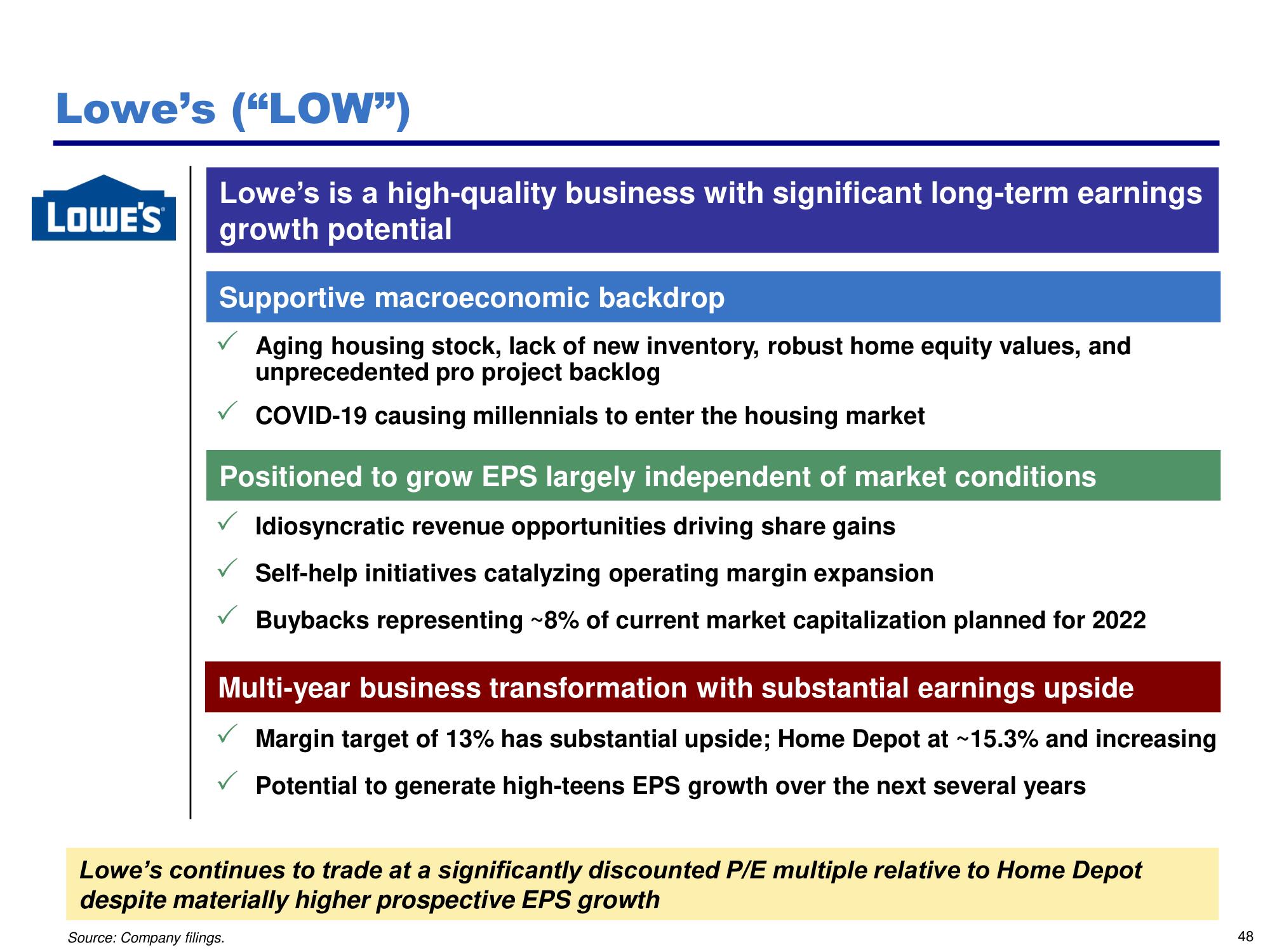

Lowe's is a high-quality business with significant long-term earnings

growth potential

Supportive macroeconomic backdrop

Aging housing stock, lack of new inventory, robust home equity values, and

unprecedented pro project backlog

✓ COVID-19 causing millennials to enter the housing market

Positioned to grow EPS largely independent of market conditions

Idiosyncratic revenue opportunities driving share gains

Self-help initiatives catalyzing operating margin expansion

Buybacks representing ~8% of current market capitalization planned for 2022

Multi-year business transformation with substantial earnings upside

Margin target of 13% has substantial upside; Home Depot at ~15.3% and increasing

Potential to generate high-teens EPS growth over the next several years

Lowe's continues to trade at a significantly discounted P/E multiple relative to Home Depot

despite materially higher prospective EPS growth

Source: Company filings.

48View entire presentation