Ginkgo Results Presentation Deck

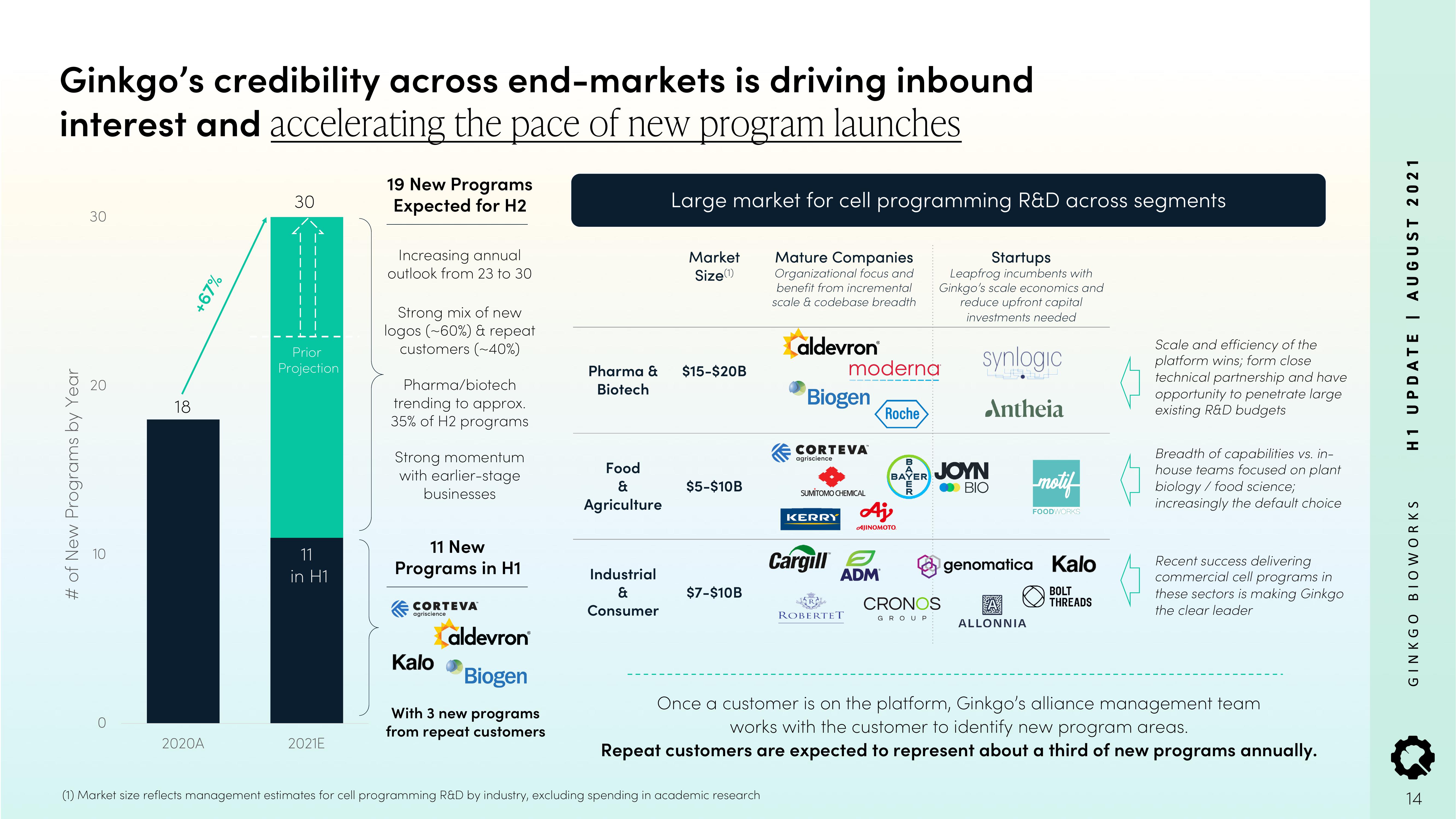

Ginkgo's credibility across end-markets is driving inbound

interest and accelerating the pace of new program launches

# of New Programs by Year

30

10

0

18

2020A

%49+

30

Prior

Projection

11

in H1

2021E

19 New Programs

Expected for H2

Increasing annual

outlook from 23 to 30

Strong mix of new

logos (-60%) & repeat

customers (-40%)

Pharma/biotech

trending to approx.

35% of H2 programs

Strong momentum

with earlier-stage

businesses

11 New

Programs in H1

CORTEVA

agriscience

aldevron

Biogen

With 3 new programs

from repeat customers

Kalo

Pharma &

Biotech

Food

&

Agriculture

Industrial

&

Consumer

Large market for cell programming R&D across segments

Market

Size (1)

$15-$20B

$5-$10B

$7-$10B

Mature Companies

Organizational focus and

benefit from incremental

scale & codebase breadth

Caldevron

Biogen

(1) Market size reflects management estimates for cell programming R&D by industry, excluding spending in academic research

CORTEVA

agriscience

SUMITOMO CHEMICAL

KERRY

Cargill

moderna

ROBERTET

ADM

Roche

Startups

Leapfrog incumbents with

Ginkgo's scale economics and

reduce upfront capital

investments needed

synlogic

Antheia

Aj,

AJINOMOTO

B

BAYER JOYN

R

BIO

CRONOS

GROUP

motif

FOODWORKS

genomatica Kalo

BOLT

THREADS

A

ALLONNIA

(

A

(

Scale and efficiency of the

platform wins; form close

technical partnership and have

opportunity to penetrate large

existing R&D budgets

Breadth of capabilities vs. in-

house teams focused on plant

biology/ food science;

increasingly the default choice

Recent success delivering

commercial cell programs in

these sectors is making Ginkgo

the clear leader

Once a customer is on the platform, Ginkgo's alliance management team

works with the customer to identify new program areas.

Repeat customers are expected to represent about a third of new programs annually.

H 1 UPDATE | AUGUST 2021

GINKGO BIOWORKS

14View entire presentation