Bausch+Lomb Results Presentation Deck

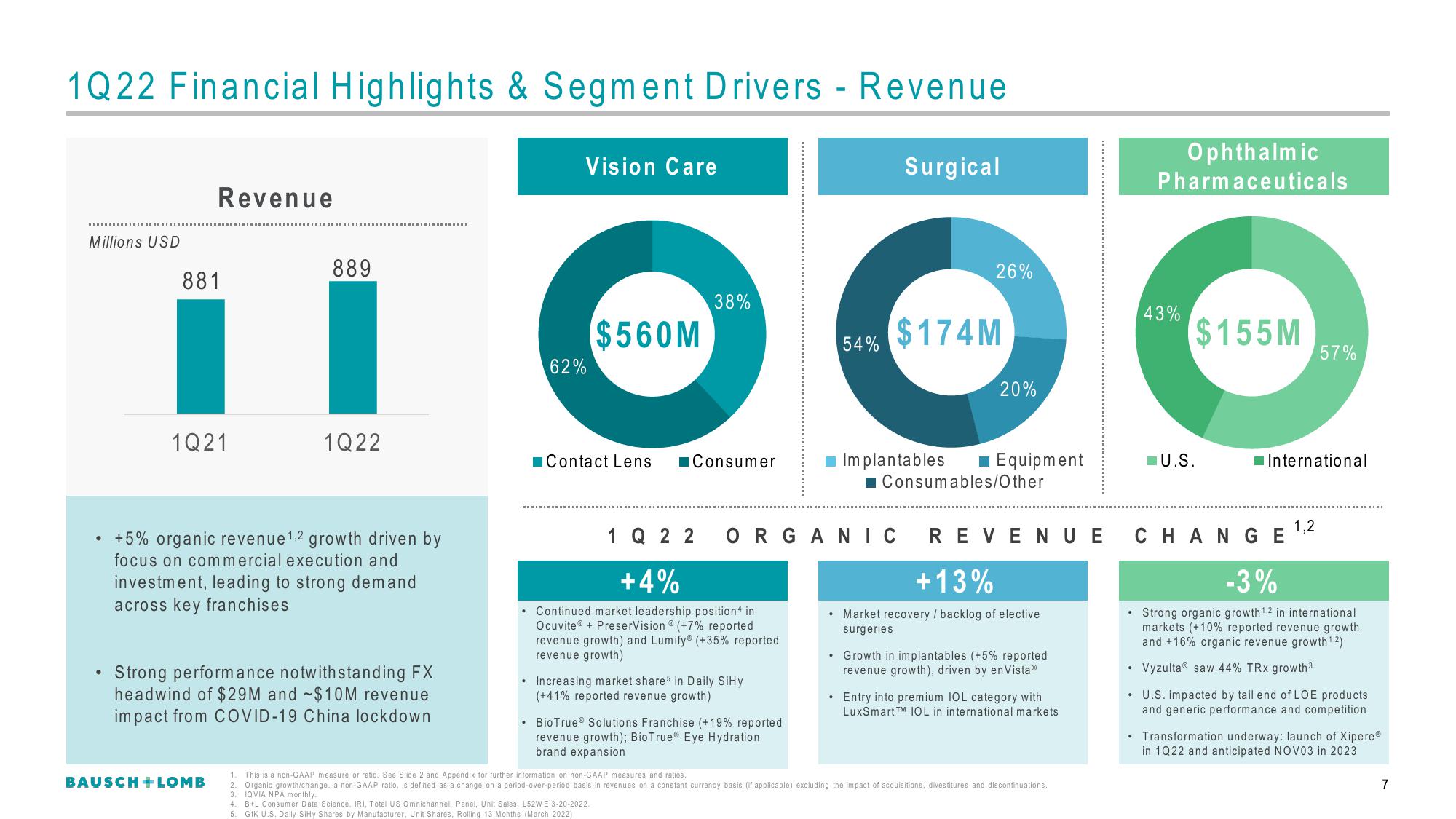

1Q22 Financial Highlights & Segment Drivers - Revenue

Millions USD

Revenue

881

1Q21

889

1Q22

+5% organic revenue ¹,2 growth driven by

focus on commercial execution and

BAUSCH + LOMB

investment, leading to strong demand

across key franchises

Strong performance notwithstanding FX

headwind of $29M and -$10M revenue

impact from COVID-19 China lockdown

.

Vision Care

62%

$560M

38%

Contact Lens ■Consumer

1 Q 22

+4%

Continued market leadership position in

Ocuvite® + PreserVision (+7% reported

revenue growth) and Lumify® (+35% reported

revenue growth)

ORGANIC

Increasing market share5 in Daily SiHy

(+41% reported revenue growth)

• BioTrue® Solutions Franchise (+19% reported

revenue growth); BioTrue® Eye Hydration

brand expansion

Surgical

26%

54% $174M

.

■ Implantables ■ Equipment

■ Consumables/Other

20%

REVENUE

+13%

• Market recovery / backlog of elective

surgeries

Growth in implantables (+5% reported

revenue growth), driven by en Vista®

Entry into premium IOL category with

LuxSmartTM IOL in international markets

1. This is a non-GAAP measure or ratio. See Slide 2 and Appendix for further information on non-GAAP measures and ratios.

2. Organic growth/change, a non-GAAP ratio, is defined as a change on a period-over-period basis in revenues on a constant currency basis (if applicable) excluding the impact of acquisitions, divestitures and discontinuations.

IQVIA NPA monthly..

3

4 B+L Consumer Data Science, IRI, Total US Omnichannel, Panel, Unit Sales, L52WE 3-20-2022.

5. GfK U.S. Daily SiHy Shares by Manufacturer. Unit Shares, Rolling 13 Months (March 2022)

.

.

.

.

Ophthalmic

Pharmaceuticals

43%

$155M

U.S.

International

CHANGE

57%

1,2

-3%

Strong organic growth ¹.2 in international

markets (+10% reported revenue growth

and +16% organic revenue growth ¹.2)

Vyzulta® saw 44% TRX growth³

U.S. impacted by tail end of LOE products

and generic performance and competition

Transformation underway: launch of XipereⓇ

in 1Q22 and anticipated NOV03 in 2023

7View entire presentation