Bausch Health Companies Investor Conference Presentation Deck

Granite Trust Transaction

14

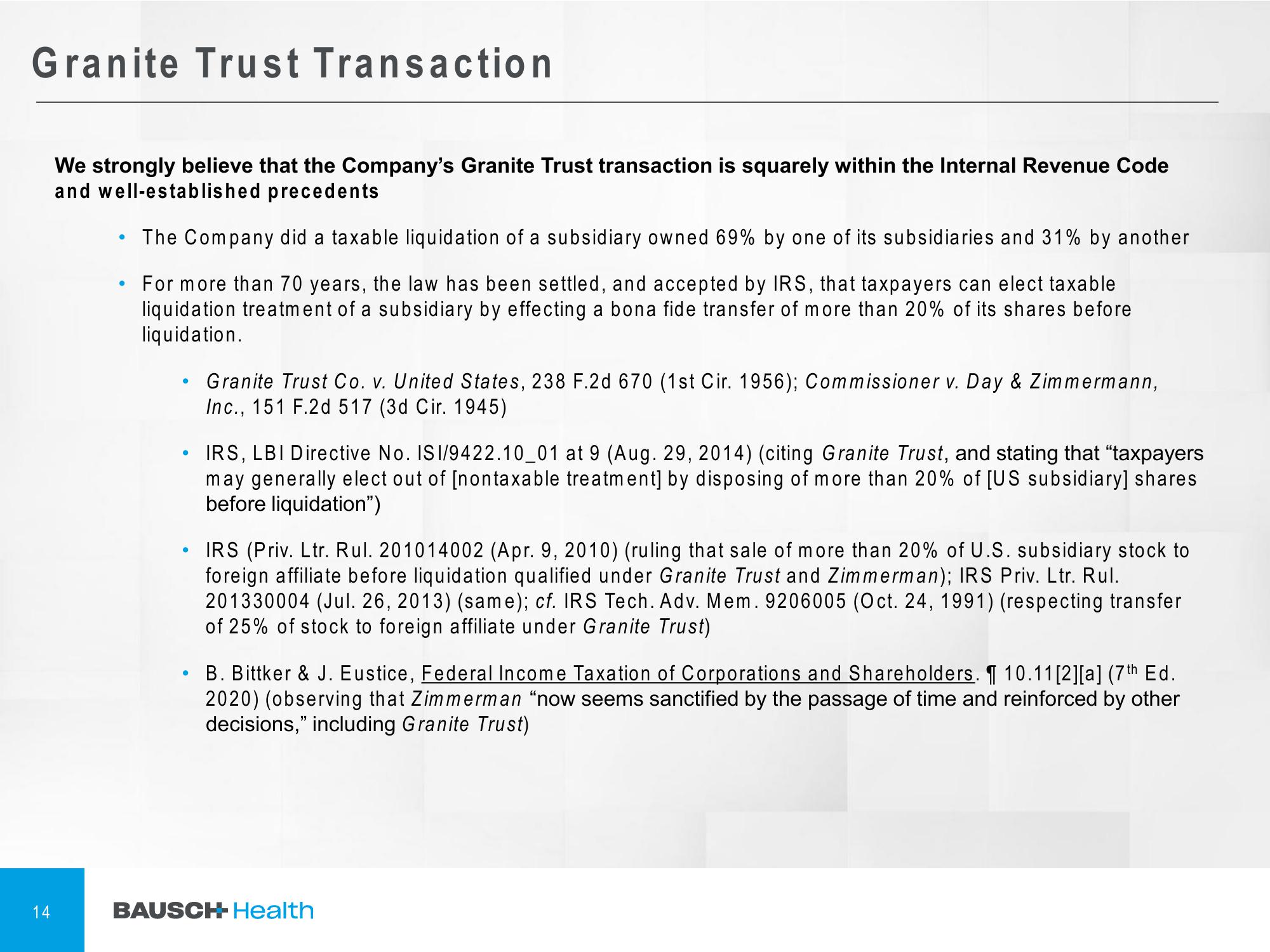

We strongly believe that the Company's Granite Trust transaction is squarely within the Internal Revenue Code

and well-established precedents

The Company did a taxable liquidation of a subsidiary owned 69% by one of its subsidiaries and 31% by another

For more than 70 years, the law has been settled, and accepted by IRS, that taxpayers can elect taxable

liquidation treatment of a subsidiary by effecting a bona fide transfer of more than 20% of its shares before

liquidation.

●

●

●

●

●

●

Granite Trust Co. v. United States, 238 F.2d 670 (1st Cir. 1956); Commissioner v. Day & Zimmermann,

Inc., 151 F.2d 517 (3d Cir. 1945)

IRS, LBI Directive No. ISI/9422.10_01 at 9 (Aug. 29, 2014) (citing Granite Trust, and stating that “taxpayers

may generally elect out of [nontaxable treatment] by disposing of more than 20% of [US subsidiary] shares

before liquidation")

IRS (Priv. Ltr. Rul. 201014002 (Apr. 9, 2010) (ruling that sale of more than 20% of U.S. subsidiary stock to

foreign affiliate before liquidation qualified under Granite Trust and Zimmerman); IRS Priv. Ltr. Rul.

201330004 (Jul. 26, 2013) (same); cf. IRS Tech. Adv. Mem. 9206005 (Oct. 24, 1991) (respecting transfer

of 25% of stock to foreign affiliate under Granite Trust)

B. Bittker & J. Eustice, Federal Income Taxation of Corporations and Shareholders. ¶ 10.11[2][a] (7th Ed.

2020) (observing that Zimmerman "now seems sanctified by the passage of time and reinforced by other

decisions," including Granite Trust)

BAUSCH- HealthView entire presentation