Fort Capital Investment Banking Pitch Book

Precedent Transactions

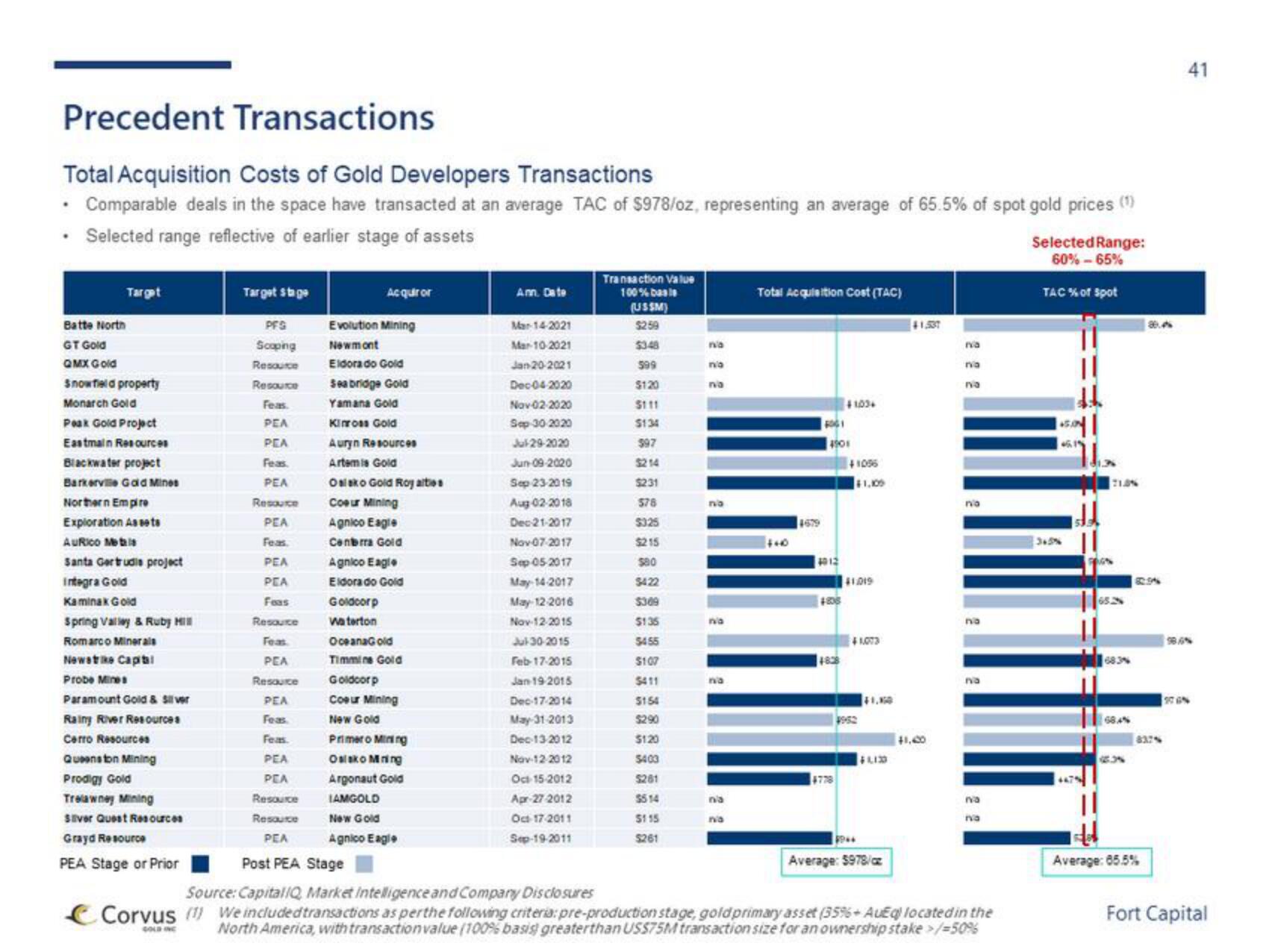

Total Acquisition Costs of Gold Developers Transactions

• Comparable deals in the space have transacted at an average TAC of $978/oz, representing an average of 65.5% of spot gold prices (¹)

• Selected range reflective of earlier stage of assets

Selected Range:

60%-65%

TAC % of Spot

Batte North

GT Gold

QMX Gold

Target

Snowfield property

Monarch Gold

Peak Gold Project

Eastmain Resources

Blackwater project

Barkerville Gold Mines

Northern Empire

Exploration Assets

AuRico Metis

Santa Gertrudis project

Integra Gold

Kaminak Gold

Spring Valley & Ruby Hill

Romarco Minerals

Newstrike Capital

Probe Mines

Paramount Gold & Sill ver

Rainy River Resources

Cerro Resources

Queenston Mining

Prodigy Gold

Trelawney Mining

Siver Quest Resources

Grayd Resource

PEA Stage or Prior

Target stage

PFS

Scoping

Resource

Resource

Feas.

PEA

PEA

Feas.

PEA

Resource

PEA

Feas.

PEA

PEA

Feas

Resource

Feas

PEA

Resource

PEA

Feas

Feas.

PEA

PEA

Resource

Resource

PEA

Acquir or

Evolution Mining

Newmont

Eldorado Gold

Sea bridge Gold

Yamana Gold

Kinross Gold

Auryn Resources

Artemis Gold

Osiako Gold Royalties

Coeur Mining

Agnico Eagle

Conterra Gold

Agnico Eagle

Eldorado Gold

Goldcorp

Waterton

OceanaGold

Timmine Gold

Goldcorp

Coeur Mining

New Gold

Primero Mining

Osiako Mring

Argonaut Gold

IAMGOLD

New Gold

Agnico Eagle

Ann. Date

Mar 14-2021

Mar 10-2021

Jan 20-2021

Dec-04-2020

Nav-02-2020

Sep-30-2020

Jul-29-2020

Jun-09-2020

Sep 23-2019

Aug-02-2018

Dec-21-2017

Nov-07-2017

Sep-05-2017

May-14-2017

May-12-2016

Nov-12-2015

Jul 30-2015

Feb-17-2015

Jan 19/2015

Dec-17-2014

May-31-2013

Dec-13-2012

Nov-12-2012

Oct-15-2012

Apr-27-2012

Oct 17-2011

Sep-19-2011

Transaction Value

100% basis

(USSM)

$259

$34

599

$120

$1.11

$134

397

$214

$231

578

$325

$215

$80

$422

$369

$135

$455

$107

$411

$154

$290

$120

5403

$281

$514

$115

$261

na

n'o

na

no

no

na

na

n'a

Total Acquisition Cost (TAC)

440

4901

4012

41034

4838

41055

41.019

41073

Average: 5978/cz

41,537

na

no

na

no

na

na

na

na

Post PEA Stage

Source: Capital iQ Market Intelligence and Company Disclosures

Corvus (1) We included transactions as per the following criteria: pre-production stage, gold primary asset (35%+ AuEq) located in the

North America, with transaction value (100% basis greater than US$75M transaction size for an ownership stake >/-50%

GOLD INC

21.3%

68.4%

837%

Average: 85.5%

41

100%

Fort CapitalView entire presentation