Sonder Results Presentation Deck

Appendix

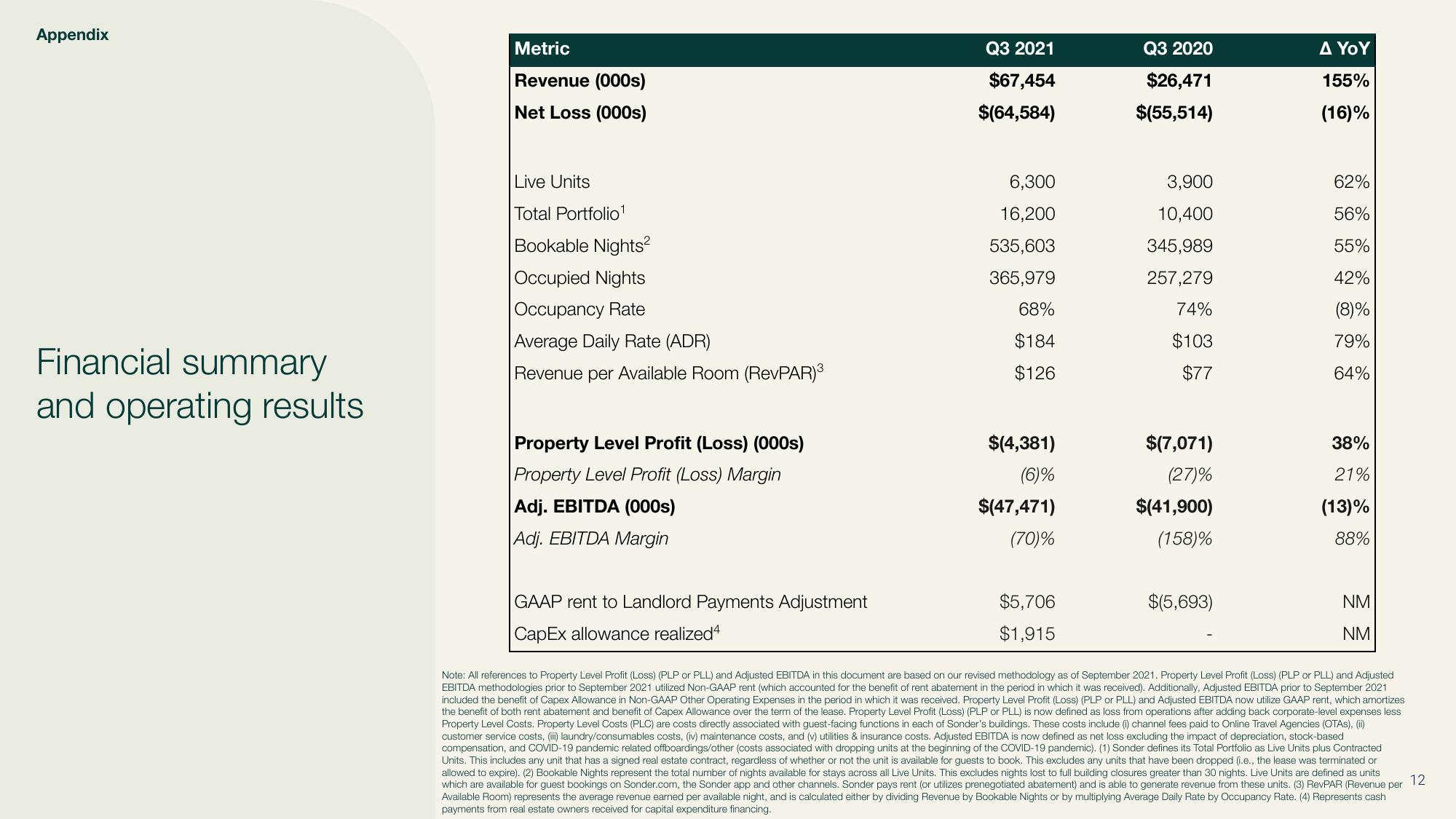

Financial summary

and operating results

Metric

Revenue (000s)

Net Loss (000s)

Live Units

Total Portfolio¹

Bookable Nights2

Occupied Nights

Occupancy Rate

Average Daily Rate (ADR)

Revenue per Available Room (RevPAR)³

Property Level Profit (Loss) (000s)

Property Level Profit (Loss) Margin

Adj. EBITDA (000s)

Adj. EBITDA Margin

GAAP rent to Landlord Payments Adjustment

CapEx allowance realized4

Q3 2021

$67,454

$(64,584)

6,300

16,200

535,603

365,979

68%

$184

$126

$(4,381)

(6)%

$(47,471)

(70)%

$5,706

$1,915

Q3 2020

$26,471

$(55,514)

3,900

10,400

345,989

257,279

74%

$103

$77

$(7,071)

(27)%

$(41,900)

(158)%

$(5,693)

ΔΥΟΥ

155%

(16)%

62%

56%

55%

42%

(8)%

79%

64%

38%

21%

(13)%

88%

NM

NM

Note: All references to Property Level Profit (Loss) (PLP or PLL) and Adjusted EBITDA in this document are based on our revised methodology as of September 2021. Property Level Profit (Loss) (PLP or PLL) and Adjusted

EBITDA methodologies prior to September 2021 utilized Non-GAAP rent (which accounted for the benefit of rent abatement in the period in which it was received). Additionally, Adjusted EBITDA prior to September 2021

included the benefit of Capex Allowance in Non-GAAP Other Operating Expenses in the period in which it was received. Property Level Profit (Loss) (PLP or PLL) and Adjusted EBITDA now utilize GAAP rent, which amortizes

the benefit of both rent abatement and benefit of Capex Allowance over the term of the lease. Property Level Profit (Loss) (PLP or PLL) is now defined as loss from operations after adding back corporate-level expenses less

Property Level Costs. Property Level Costs (PLC) are costs directly associated with guest-facing functions in each of Sonder's buildings. These costs include (i) channel fees paid to Online Travel Agencies (OTAS), (ii)

customer service costs, (iii) laundry/consumables costs, (iv) maintenance costs, and (v) utilities & insurance costs. Adjusted EBITDA is now defined as net loss excluding the impact of depreciation, stock-based

compensation, and COVID-19 pandemic related offboardings/other (costs associated with dropping units at the beginning of the COVID-19 pandemic). (1) Sonder defines its Total Portfolio as Live Units plus Contracted

Units. This includes any unit that has a signed real estate contract, regardless of whether or not the unit is available for guests to book. This excludes any units that have been dropped (i.e., the lease was terminated or

allowed to expire). (2) Bookable Nights represent the total number of nights available for stays across all Live Units. This excludes nights lost to full building closures greater than 30 nights. Live Units are defined as units

12

which are available for guest bookings on Sonder.com, the Sonder app and other channels. Sonder pays rent (or utilizes prenegotiated abatement) and is able to generate revenue from these units. (3) RevPAR (Revenue per

Available Room) represents the average revenue earned per available night, and is calculated either by dividing Revenue by Bookable Nights or by multiplying Average Daily Rate by Occupancy Rate. (4) Represents cash

payments from real estate owners received for capital expenditure financing.View entire presentation