Bumble Results Presentation Deck

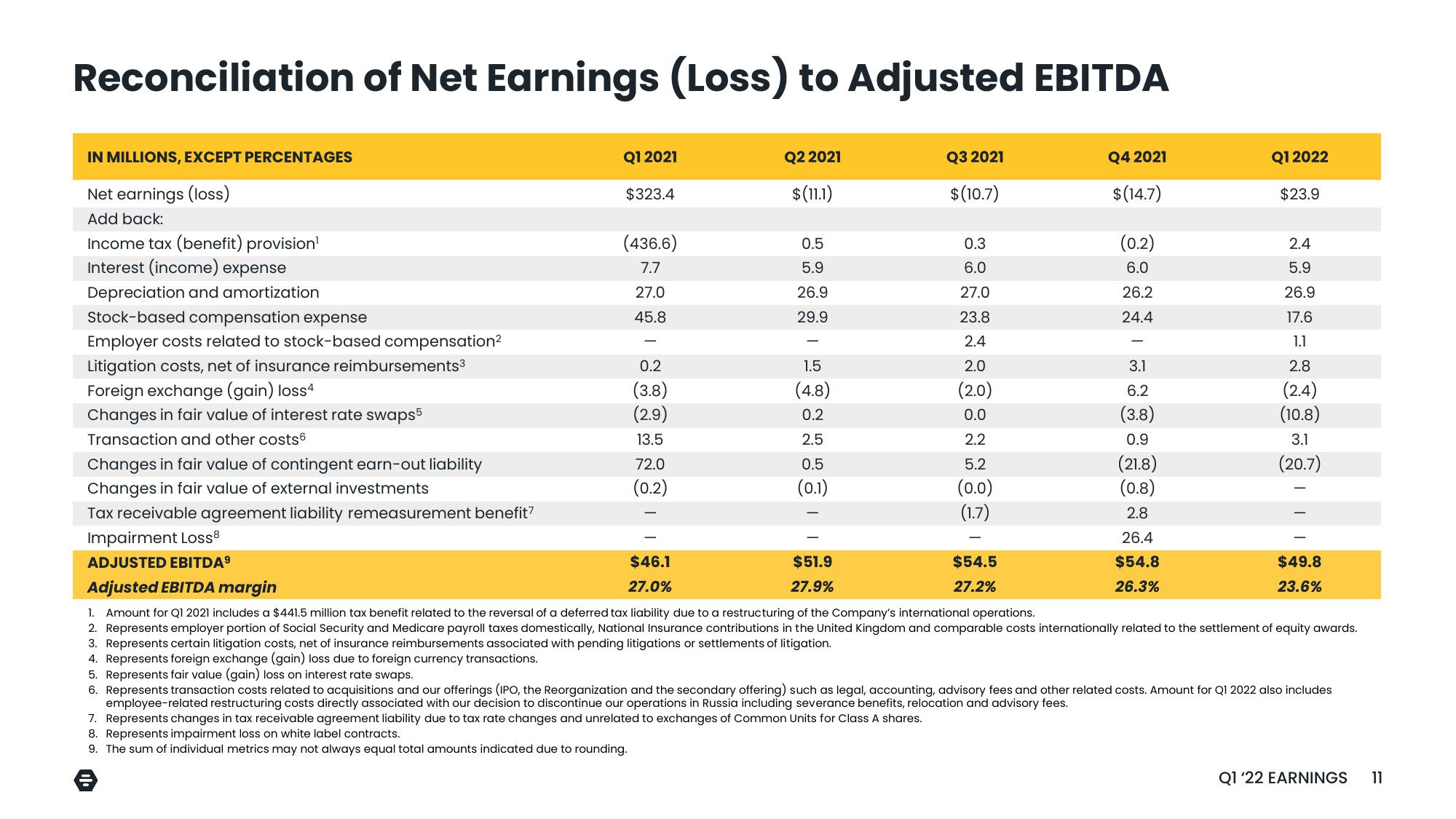

Reconciliation of Net Earnings (Loss) to Adjusted EBITDA

IN MILLIONS, EXCEPT PERCENTAGES

Net earnings (loss)

Add back:

Income tax (benefit) provision¹

Interest (income) expense

Depreciation and amortization

Stock-based compensation expense

Employer costs related to stock-based compensation²

Litigation costs, net of insurance reimbursements³

Foreign exchange (gain) loss4

Changes in fair value of interest rate swaps5

Transaction and other costs6

Changes in fair value of contingent earn-out liability

Changes in fair value of external investments

Tax receivable agreement liability remeasurement benefit7

Q1 2021

$323.4

(436.6)

7.7

27.0

45.8

0.2

(3.8)

(2.9)

13.5

72.0

(0.2)

$46.1

27.0%

8. Represents impairment loss on white label contracts.

9. The sum of individual metrics may not always equal total amounts indicated due to rounding.

Q2 2021

$(11.1)

0.5

5.9

26.9

29.9

1.5

(4.8)

0.2

2.5

0.5

(0.1)

Q3 2021

$(10.7)

$51.9

27.9%

0.3

6.0

27.0

23.8

2.4

2.0

(2.0)

0.0

2.2

5.2

(0.0)

(1.7)

Q4 2021

$(14.7)

$54.5

27.2%

(0.2)

6.0

26.2

24.4

3.1

6.2

(3.8)

0.9

(21.8)

(0.8)

2.8

Impairment Loss8

ADJUSTED EBITDA⁹

Adjusted EBITDA margin

1. Amount for Q1 2021 includes a $441.5 million tax benefit related to the reversal of a deferred tax liability due to a restructuring of the Company's international operations.

2. Represents employer portion of Social Security and Medicare payroll taxes domestically, National Insurance contributions in the United Kingdom and comparable costs internationally related to the settlement of equity awards.

3. Represents certain litigation costs, net of insurance reimbursements associated with pending litigations or settlements of litigation.

4. Represents foreign exchange (gain) loss due to foreign currency transactions.

Q1 2022

26.4

$54.8

26.3%

$23.9

2.4

5.9

26.9

17.6

1.1

2.8

(2.4)

(10.8)

3.1

(20.7)

$49.8

23.6%

5. Represents fair value (gain) loss on interest rate swaps.

6. Represents transaction costs related to acquisitions and our offerings (IPO, the Reorganization and the secondary offering) such as legal, accounting, advisory fees and other related costs. Amount for Q1 2022 also includes

employee-related restructuring costs directly associated with our decision to discontinue our operations in Russia including severance benefits, relocation and advisory fees.

7. Represents changes in tax receivable agreement liability due to tax rate changes and unrelated to exchanges of Common Units for Class A shares.

Q1'22 EARNINGS

11View entire presentation