Q2 Quarter 2023

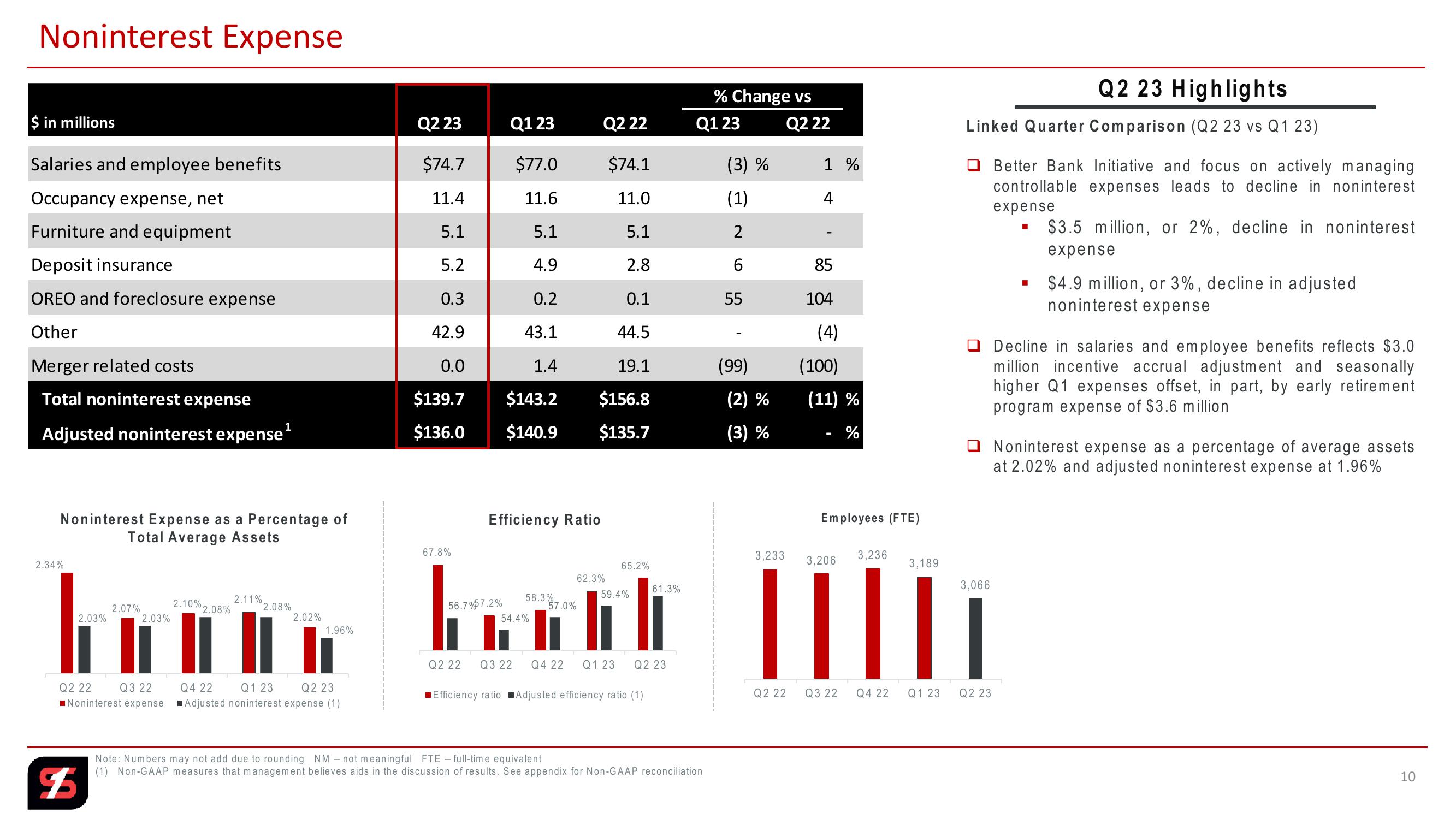

Noninterest Expense

% Change vs

$ in millions

Q2 23

Q123

Q2 22

Q1 23

Q222

Salaries and employee benefits

$74.7

$77.0

$74.1

(3) %

1 %

Occupancy expense, net

11.4

11.6

11.0

(1)

4

Furniture and equipment

5.1

5.1

5.1

2

Deposit insurance

5.2

4.9

2.8

6

85

OREO and foreclosure expense

0.3

0.2

0.1

55

104

Other

42.9

43.1

44.5

(4)

Merger related costs

0.0

1.4

19.1

(99)

(100)

Total noninterest expense

$139.7

$143.2

$156.8

(2) %

(11) %

Adjusted noninterest expense¹

$136.0

$140.9

$135.7

(3) %

-

%

Noninterest Expense as a Percentage of

Total Average Assets

2.34%

Efficiency Ratio

67.8%

Employees (FTE)

Q2 23 Highlights

Linked Quarter Comparison (Q2 23 vs Q1 23)

Better Bank Initiative and focus on actively managing

controllable expenses leads to decline in noninterest

expense

$3.5 million, or 2%, decline in noninterest

expense

$4.9 million, or 3%, decline in adjusted

noninterest expense

Decline in salaries and employee benefits reflects $3.0

million incentive accrual adjustment and seasonally

higher Q1 expenses offset, in part, by early retirement

program expense of $3.6 million

Noninterest expense as a percentage of average assets

at 2.02% and adjusted noninterest expense at 1.96%

3,233

3,236

3,206

3,189

65.2%

62.3%

61.3%

2.10%

2.11%

2.07%

°2.08%

2.08%

2.03%

2.03%

2.02%

1.96%

56.7% 57.2%

58.3% 7.0%

59.4%

54.4%

Q2 22

Q3 22

Noninterest expense

Q2 22 Q3 22

Q4 22 Q1 23 Q2 23

Q4 22

Q1 23

Q2 23

■Efficiency ratio Adjusted efficiency ratio (1)

Q2 22

Q3 22

■Adjusted noninterest expense (1)

3.066

IIIII

Q4 22 Q1 23

Q2 23

Note: Numbers may not add due to rounding NM - not meaningful FTE -full-time equivalent

$5

(1) Non-GAAP measures that management believes aids in the discussion of results. See appendix for Non-GAAP reconciliation

10

10View entire presentation