Marti SPAC Presentation Deck

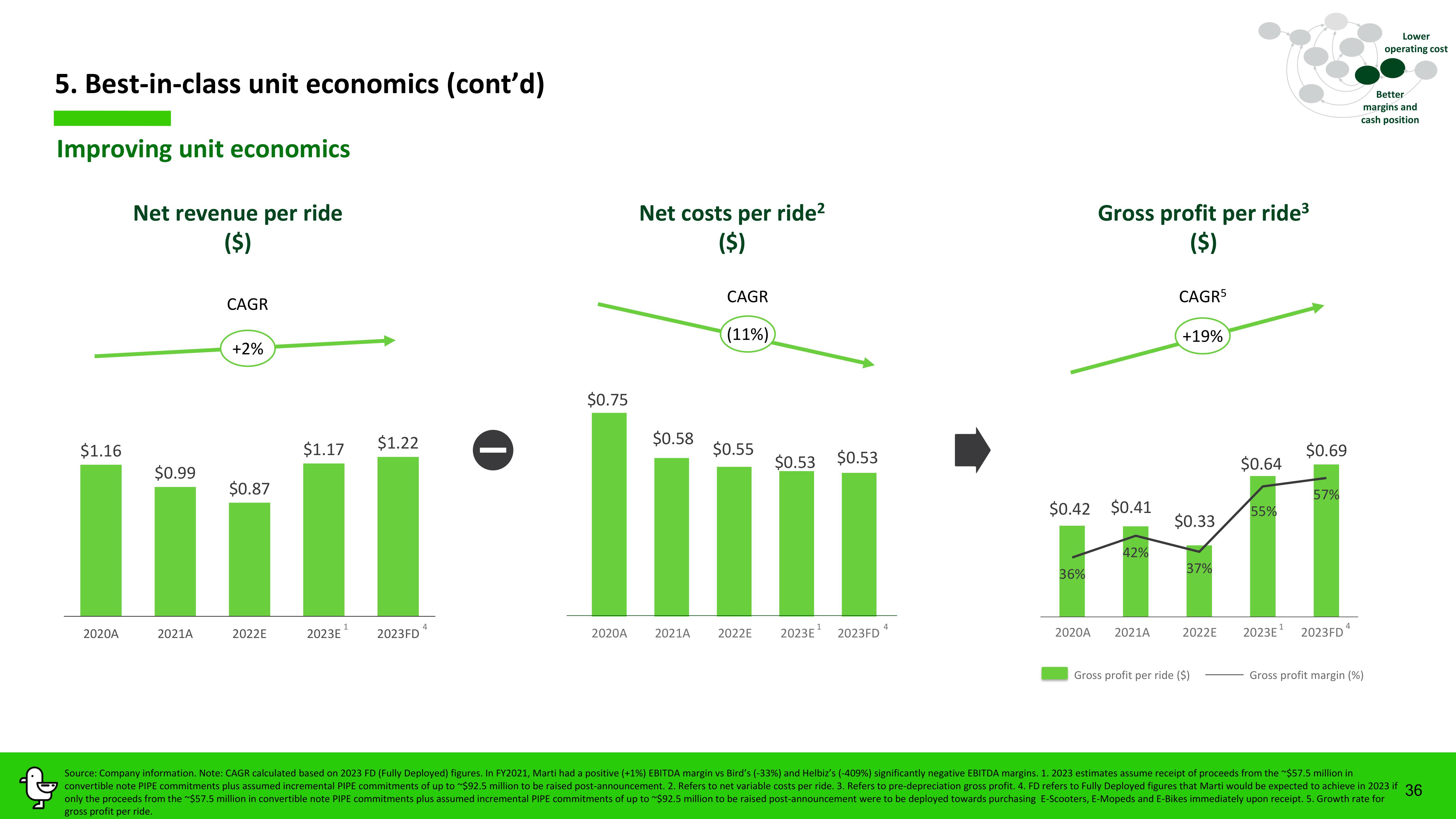

5. Best-in-class unit economics (cont'd)

Improving unit economics

$1.16

2020A

Net revenue per ride

($)

$0.99

2021A

CAGR

+2%

$0.87

2022E

$1.17

2023E

$1.22

2023FD

$0.75

Net costs per ride²

($)

$0.58

CAGR

(11%)

$0.55

$0.53 $0.53

2020A 2021A 2022E 2023E¹ 2023FD

$0.42 $0.41

36%

Gross profit per ride³

($)

2020A

42%

2021A

CAGR5

+19%

$0.33

37%

2022E

Gross profit per ride ($)

$0.64

55%

2023E¹

$0.69

57%

2023FD

Lower

operating cost

Better

margins and

cash position

Gross profit margin (%)

Source: Company information. Note: CAGR calculated based on 2023 FD (Fully Deployed) figures. In FY2021, Marti had a positive (+1%) EBITDA margin vs Bird's (-33%) and Helbiz's (-409 %) significantly negative EBITDA margins. 1. 2023 estimates assume receipt of proceeds from the ~$57.5 million in

convertible note PIPE commitments plus assumed incremental PIPE commitments of up to $92.5 million to be raised post-announcement. 2. Refers to net variable costs per ride. 3. Refers to pre-depreciation gross profit. 4. FD refers to Fully Deployed figures that Marti would be expected to achieve in 2023 if 36

only the proceeds from the ~$57.5 million in convertible note PIPE commitments plus assumed incremental PIPE commitments of up to $92.5 million to be raised post-announcement were to be deployed towards purchasing E-Scooters, E-Mopeds and E-Bikes immediately upon receipt. 5. Growth rate for

gross profit per ride.View entire presentation