Experian ESG Presentation Deck

Executive Summary Improving Financial Health

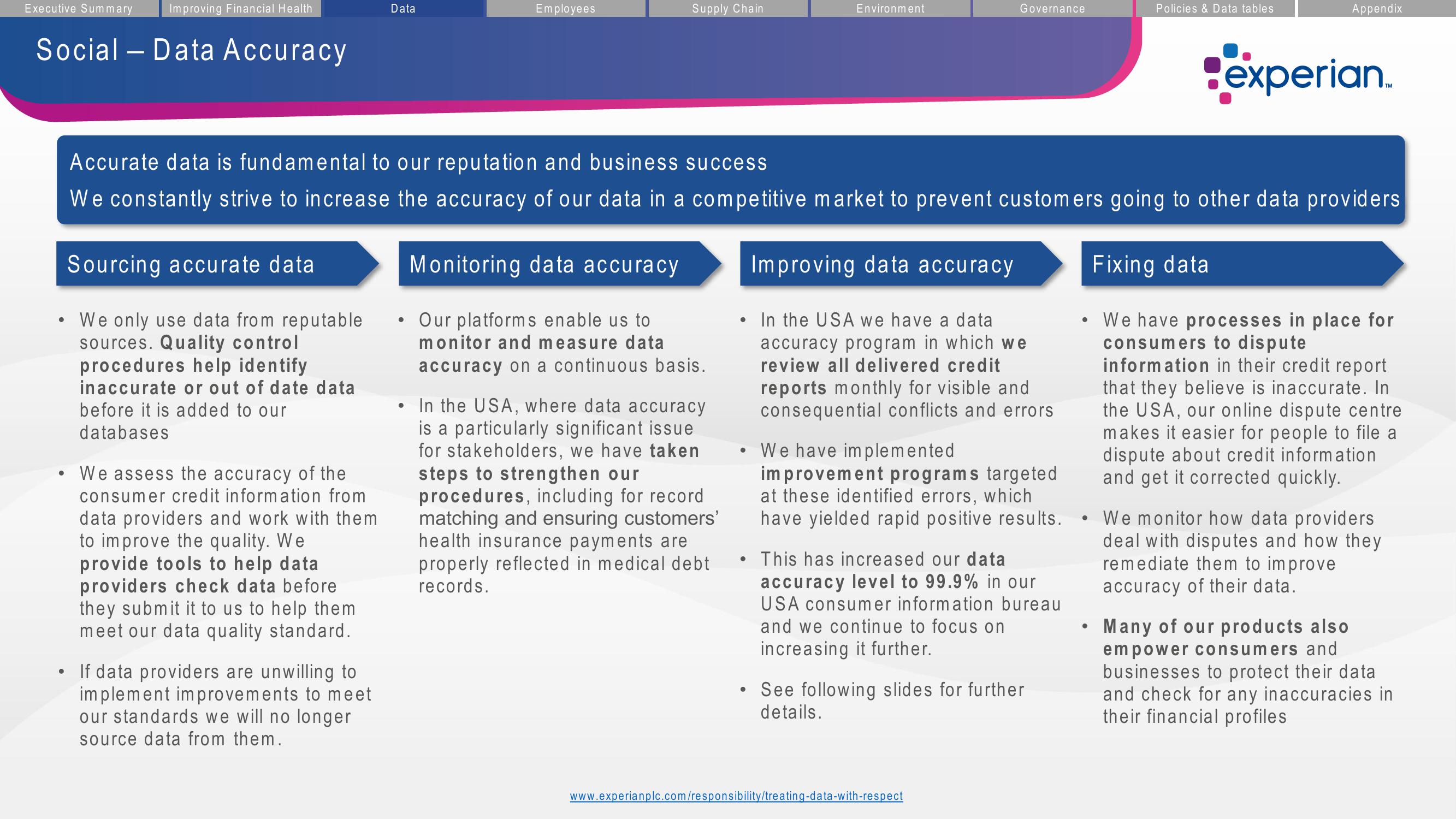

Social - Data Accuracy

●

Sourcing accurate data

We only use data from reputable

sources. Quality control

procedures help identify

inaccurate or out of date data

before it is added to our

databases

We assess the accuracy of the

consumer credit information from

data providers and work with them

to improve the quality. We

provide tools to help data.

providers check data before

they submit it to us to help them

meet our data quality standard.

Data

If data providers are unwilling to

implement improvements to meet

our standards we will no longer

source data from them.

Employees

Supply Chain

●

Monitoring data accuracy

• Our platforms enable us to

monitor and measure data

accuracy on a continuous basis.

Accurate data is fundamental to our reputation and business success

We constantly strive to increase the accuracy of our data in a competitive market to prevent customers going to other data providers

In the USA, where data accuracy

is a particularly significant issue

for stakeholders, we have taken

steps to strengthen our

procedures, including for record

matching and ensuring customers'

health insurance payments are

properly reflected in medical debt

records.

●

●

Environment

●

Governance

Improving data accuracy

In the USA we have a data

accuracy program in which we

review all delivered credit

reports monthly for visible and

consequential conflicts and errors

We have implemented

improvement programs targeted

at these identified errors, which

have yielded rapid positive results.

This has increased our data

accuracy level to 99.9% in our

USA consumer information bureau

and we continue to focus on

increasing it further.

• See following slides for further

details.

www.experianplc.com/responsibility/treating-data-with-respect

Policies & Data tables

●

Appendix

experian.

Fixing data

We have processes in place for

consumers to dispute

information in their credit report

that they believe is inaccurate. In

the USA, our online dispute centre

makes it easier for people to file a

dispute about credit information

and get it corrected quickly.

We monitor how data providers

deal with disputes and how they

remediate them to improve

accuracy of their data.

Many of our products also

empower consumers and

businesses to protect their data

and check for any inaccuracies in

their financial profilesView entire presentation