BlackRock Results Presentation Deck

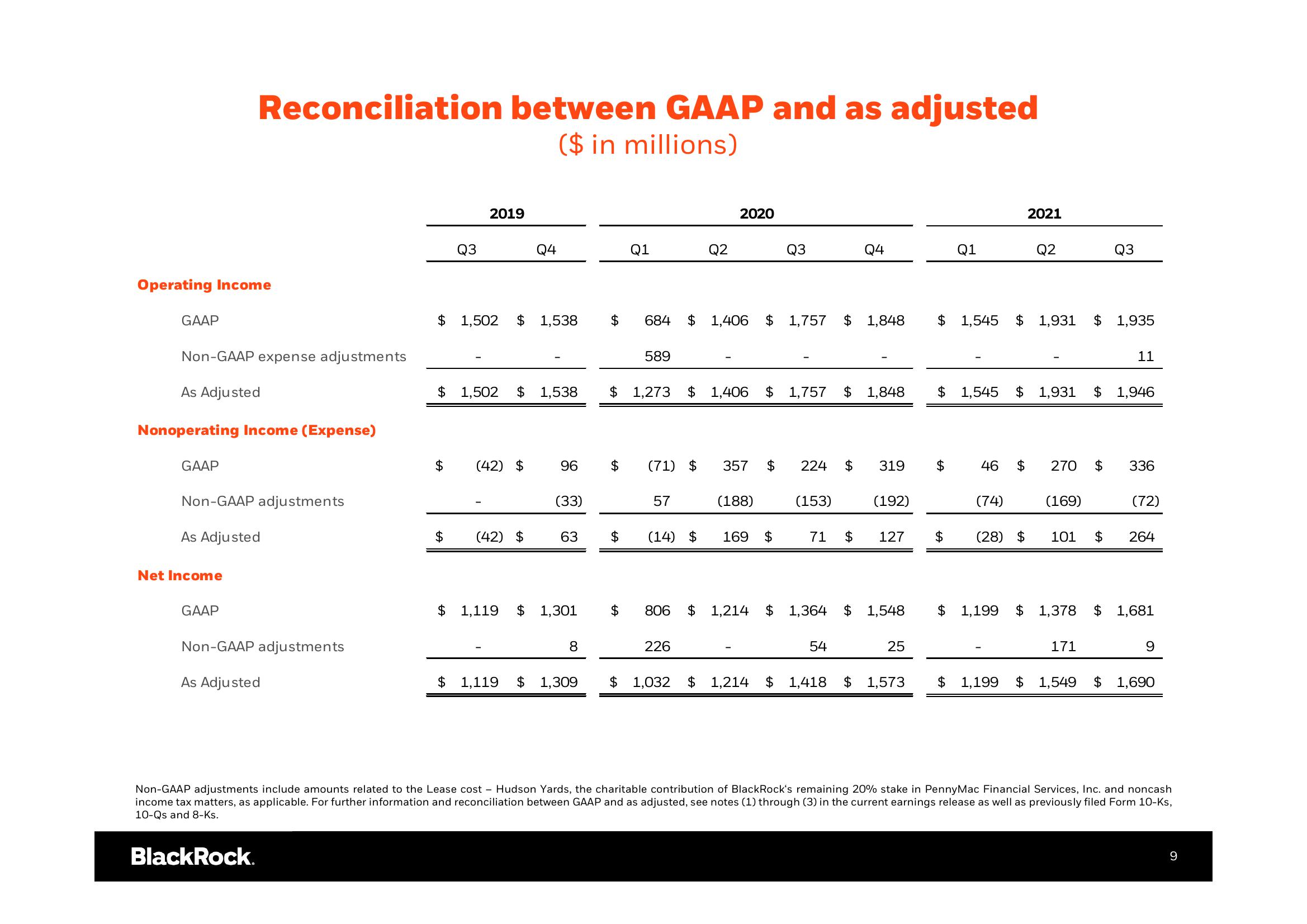

Operating Income

GAAP

Non-GAAP expense adjustments

Reconciliation between GAAP and as adjusted

($ in millions)

As Adjusted

Nonoperating Income (Expense)

GAAP

Non-GAAP adjustments

As Adjusted

Net Income

GAAP

Non-GAAP adjustments

As Adjusted

Q3

2019

$ 1,502 $ 1,538 $

Q4

$ 1,502 $ 1,538

$ (42) $

$ (42) $

96

(33)

63

$ 1,119 $ 1,301

8

$ 1,119 $ 1,309

$

$

Q1

$

684

$ 1,273 $

589

(71) $

57

(14) $

Q2

226

2020

$ 1,406 $ 1,757 $ 1,848 $ 1,545

1,406 $ 1,757 $

Q3

357 $ 224 $

(188)

169 $

806 $ 1,214 $

(153)

71 $

Q4

54

1,848

319

(192)

127

1,364 $ 1,548

25

$ 1,032 $ 1,214 $ 1,418 $ 1,573

Q1

$ 1,545

$

$

46

(74)

$

(28) $

2021

Q2

1,931 $ 1,935

Q3

1,931 $ 1,946

(169)

270 $ 336

101 $

11

171

(72)

264

$ 1,199 $ 1,378 $ 1,681

9

$ 1,199 $ 1,549 $ 1,690

Non-GAAP adjustments include amounts related to the Lease cost - Hudson Yards, the charitable contribution of BlackRock's remaining 20% stake in PennyMac Financial Services, Inc. and noncash

income tax matters, as applicable. For further information and reconciliation between GAAP and as adjusted, see notes (1) through (3) in the current earnings release as well as previously filed Form 10-Ks,

10-Qs and 8-Ks.

BlackRock.

9View entire presentation