Building a Leading P&C Insurer

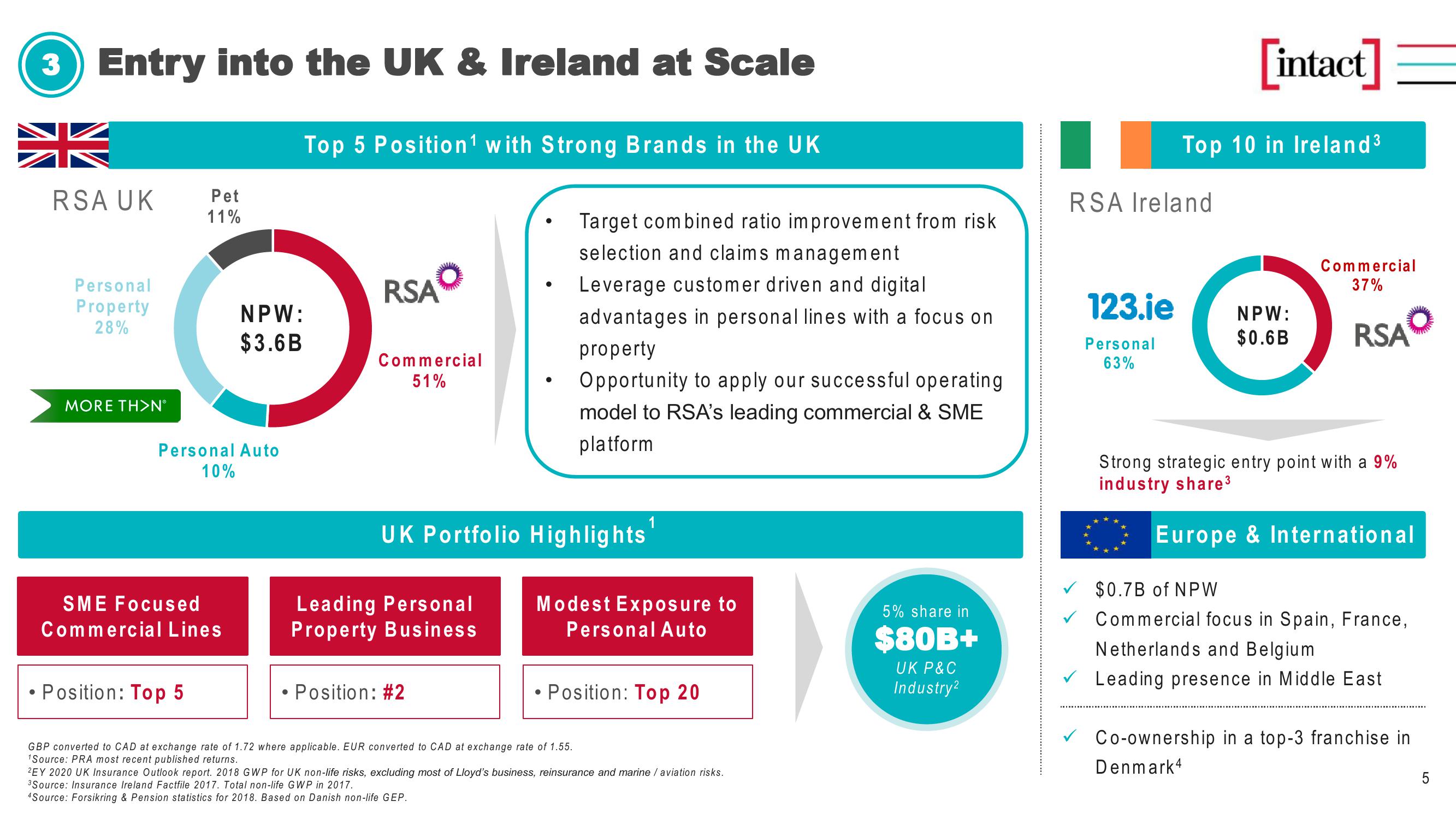

3) Entry into the UK & Ireland at Scale

RSA UK

Personal

Property

28%

MORE TH>N°

Pet

11%

Personal Auto

10%

SME Focused

Commercial Lines

• Position: Top 5

Top 5 Position¹ with Strong Brands in the UK

NPW:

$3.6B

RSAⓇ

Commercial

51%

Leading Personal

Property Business

UK Portfolio Highlights

• Position: #2

Target combined ratio improvement from risk

selection and claims management

●

Leverage customer driven and digital

advantages in personal lines with a focus on

property

Opportunity to apply our successful operating

model to RSA's leading commercial & SME

platform

Modest Exposure to

Personal Auto

GBP converted to CAD at exchange rate of 1.72 where applicable. EUR converted to CAD at exchange rate of 1.55.

Source: PRA most recent published returns.

1

Position: Top 20

2EY 2020 UK Insurance Outlook report. 2018 GWP for UK non-life risks, excluding most of Lloyd's business, reinsurance and marine / aviation risks.

3Source: Insurance Ireland Factfile 2017. Total non-life GWP in 2017.

4Source: Forsikring & Pension statistics for 2018. Based on Danish non-life GEP.

5% share in

$80B+

UK P&C

Industry²

RSA Ireland

123.ie

Personal

63%

[intact]

Top 10 in Ireland ³

NPW:

$0.6B

Commercial

37%

RSAⓇ

Strong strategic entry point with a 9%

industry share³

Europe & International

$0.7B of NPW

Commercial focus in Spain, France,

Netherlands and Belgium

✓ Leading presence in Middle East

✓ Co-ownership in a top-3 franchise in

Denmark 4

LO

5View entire presentation