Sonos Results Presentation Deck

Q4 Financial Summary

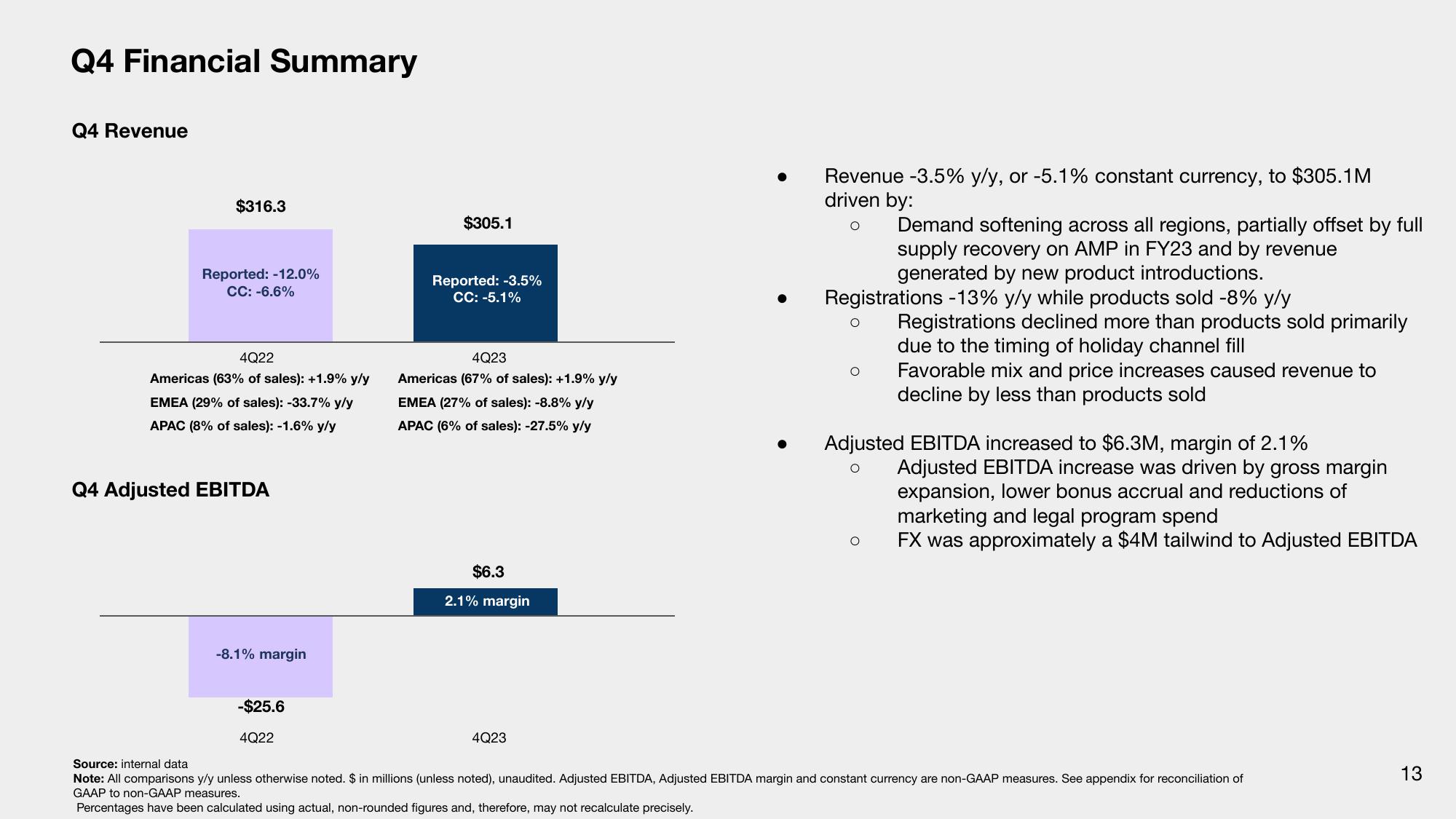

Q4 Revenue

$316.3

Reported: -12.0%

CC: -6.6%

4Q22

Americas (63% of sales): +1.9% y/y

EMEA (29% of sales): -33.7% y/y

APAC (8% of sales): -1.6% y/y

Q4 Adjusted EBITDA

-8.1% margin

-$25.6

4Q22

$305.1

Reported: -3.5%

CC: -5.1%

4Q23

Americas (67% of sales): +1.9% y/y

EMEA (27% of sales): -8.8% y/y

APAC (6% of sales): -27.5% y/y

$6.3

2.1% margin

4Q23

Revenue -3.5% y/y, or -5.1% constant currency, to $305.1M

driven by:

O

Registrations -13% y/y while products sold -8% y/y

O

O

Demand softening across all regions, partially offset by full

supply recovery on AMP in FY23 and by revenue

generated by new product introductions.

O

Registrations declined more than products sold primarily

due to the timing of holiday channel fill

Favorable mix and price increases caused revenue to

decline by less than products sold

Adjusted EBITDA increased to $6.3M, margin of 2.1%

O

Adjusted EBITDA increase was driven by gross margin

expansion, lower bonus accrual and reductions of

marketing and legal program spend

FX was approximately a $4M tailwind to Adjusted EBITDA

Source: internal data

Note: All comparisons y/y unless otherwise noted. $ in millions (unless noted), unaudited. Adjusted EBITDA, Adjusted EBITDA margin and constant currency are non-GAAP measures. See appendix for reconciliation of

GAAP to non-GAAP measures.

Percentages have been calculated using actual, non-rounded figures and, therefore, may not recalculate precisely.

13View entire presentation