Barclays Investment Banking Pitch Book

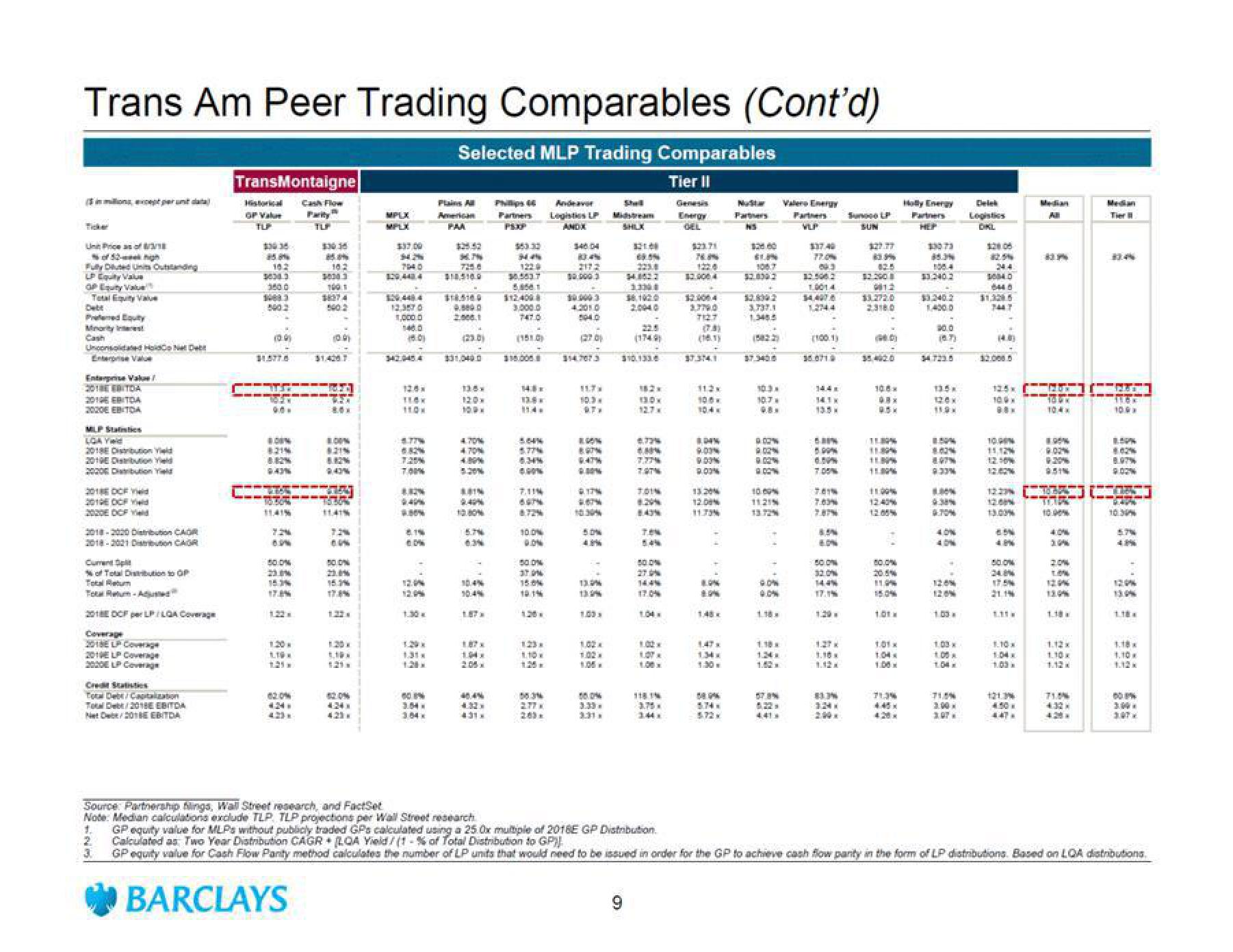

Trans Am Peer Trading Comparables (Cont'd)

Selected MLP Trading Comparables

Tier II

Ticker

of 52-weigh

Fully Duted Uni Outstanding

LP Equity Value

OP Equity Valu

Total Equity Valu

Debt

Preferred Equity

Mority

Uncond Hote

Enterprise Value

Enterprise Value

201 EBITDA

2016 EBITDA

ORDE EBITDA

MLP Static

LGA Yild

2019 Distribution d

3000 Cabution Tield

2016 DOF Yd

2019 DCF d

2018-2020 Distribution CAR

2018-2021 Distribution CAR

Cument Opt

% of Total Distribution to OF

Totaltu

Tour Reum-Austed?

2018 DCF UPLOA Coverage

Coverage

2018ELP Coverage

2010ELP Coverage

CreStatistics

Total Debt Capitalization

T/2018E EBITDA

NO 201 EBITDA

TransMontaigne

Historical Cash Flow

1.

2

3

C

$3934

85.8%

18.2

9438.3

14083

BON

8214

943%

CE

11.41%

7:24

50.0%

17.2%

LIP

1.25 M

130.35

BARCLAYS

18.2

1001

16274

1314

T

50.0%

21.0%

15.3%

17.3%

4:24*

MPLX

MPLX

$37.00

129,443,4

159.4414

12.357 0

1,000.0

18.01

128x

110x

11:00

6.82%

7.00%

80%

80%

P

12.04

12.99

50%

304x

Plains All

PAA

$24.42

725.8

$10.510.0

$14

9.8800

2008.1

4

115

100

4.70%

4.70%

63%

Source: Partnership Slings, Wall Street research, and FactSet

Note: Median calculations exclude TLP TLP projections per Wall Street research

10.4%

10.4%

40.4%

400

431*

Phillips 44

Partners

$53.30

2445

1228

30.583 7

58541

$12.400

3,000.0

747.0

(151.0)

14

13.8.

5.64%

AUTH

8.72%

100%

ON

150 0%

15:0

12:1

1.50

123.

1.10

58.3%

Andeavor

Logistics LP Midstream

ANDA

30.4%

2172

0.0003

10.000 3

504.0

(270)

4

117.

10.3.

BUSTN

10.30%

AN

13.994

1.02.

5.M

2238

34.882 2

13

20040

(1749)

$10.133.8

9

13.0x

**

7.T

TEN

84%

50 0%

14.4%

17.0%

118 T

3.75

3441

Energy

GEL

$23.71

12.0064

3.776.0

7127

(3)

112x

105.

9.OOM

9.00%

13.20

12.0

11.73%

BON

TON

5.72

Partners

NS

$28.00

$2.830.2

12.09.2

3.737.1

1.3485

10.3.

10.7.

CON

1121N

GON

0.0%

124

52,

4.41

Valero Energy

Partners

$37.40

843

1.0014

14.407

1.2744

(1001)

14.4

7.05%

BON

SOLON

32.0%

14.4%

17.1%

1.10

BUN

IN

$27.77

82.5

$3.390

13.272.0

35,402.0

10.8.

48.

11.30%

TUNN

11.00%

11:00

12:40%

11.99

15.0%

104

7139

4.45 K

Holly Energy

100.4

$32402

1.400.0

(8.7)

11.9.

897

8.33%

0.38%

0.70%

1204

1.05

1.03 M

11.00

Delek

$2008

244

10040

$1.325

7447

1400

10.90%

13.00%

BEN

125 GLI

10:0

80.0%

175

21.14

1.10

All

1.03

83%

121.3%

50

447.

122) (4)

-

10:4

10

20%

13.0%

1.18

Median

Tier

1.124

13:44

71.5%

TICK

8.97%

2424

10:30%

5.7%

1.10

1:32 M

GP equity value for MLPs without publicly traded GPs calculated using a 25.0x multiple of 2016E GP Distribution.

Calculated as Two Year Distribution CAGR + LOA Yield/(1-% of Total Distribution to GP

GP equity value for Cash Flow Panty method calculates the number of LP units that would need to be issued in order for the GP to achieve cash flow party in the form of LP distributions. Based on LQA distributions.

50 PMView entire presentation