Trian Partners Activist Presentation Deck

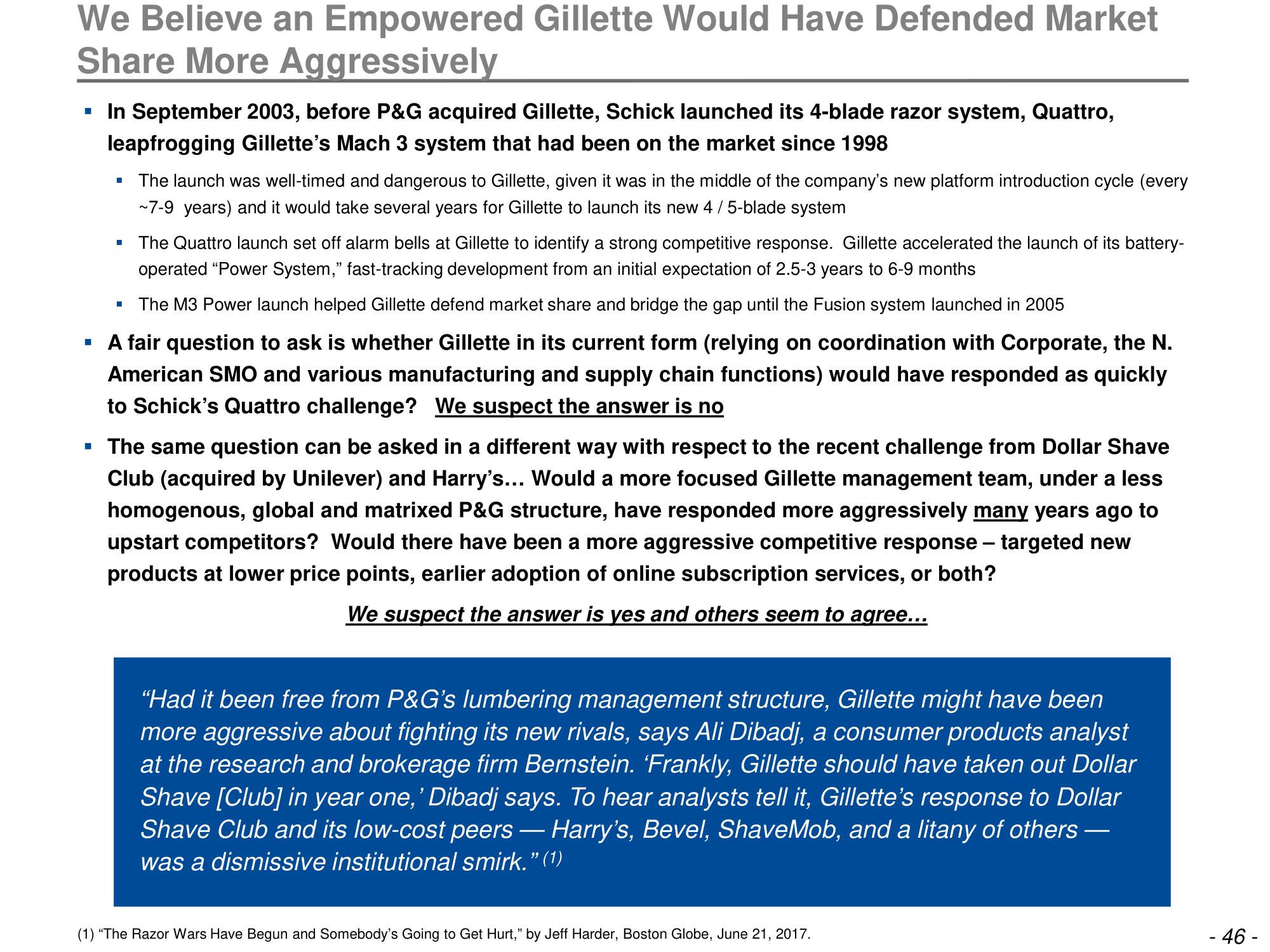

We Believe an Empowered Gillette Would Have Defended Market

Share More Aggressively

▪ In September 2003, before P&G acquired Gillette, Schick launched its 4-blade razor system, Quattro,

leapfrogging Gillette's Mach 3 system that had been on the market since 1998

■

The launch was well-timed and dangerous to Gillette, given it was in the middle of the company's new platform introduction cycle (every

~7-9 years) and it would take several years for Gillette to launch its new 4/5-blade system

The Quattro launch set off alarm bells at Gillette to identify a strong competitive response. Gillette accelerated the launch of its battery-

operated "Power System," fast-tracking development from an initial expectation of 2.5-3 years to 6-9 months

The M3 Power launch helped Gillette defend market share and bridge the gap until the Fusion system launched in 2005

▪ A fair question to ask is whether Gillette in its current form (relying on coordination with Corporate, the N.

American SMO and various manufacturing and supply chain functions) would have responded as quickly

to Schick's Quattro challenge? We suspect the answer is no

■

▪ The same question can be asked in a different way with respect to the recent challenge from Dollar Shave

Club (acquired by Unilever) and Harry's... Would a more focused Gillette management team, under a less

homogenous, global and matrixed P&G structure, have responded more aggressively many years ago to

upstart competitors? Would there have been a more aggressive competitive response - targeted new

products at lower price points, earlier adoption of online subscription services, or both?

We suspect the answer is yes and others seem to agree...

"Had it been free from P&G's lumbering management structure, Gillette might have been

more aggressive about fighting its new rivals, says Ali Dibadj, a consumer products analyst

at the research and brokerage firm Bernstein. 'Frankly, Gillette should have taken out Dollar

Shave [Club] in year one," Dibadj says. To hear analysts tell it, Gillette's response to Dollar

Shave Club and its low-cost peers — Harry's, Bevel, ShaveMob, and a litany of others —

was a dismissive institutional smirk." (1)

(1) "The Razor Wars Have Begun and Somebody's Going to Get Hurt," by Jeff Harder, Boston Globe, June 21, 2017.

- 46 -View entire presentation