MSR Value Growth & Market Trends

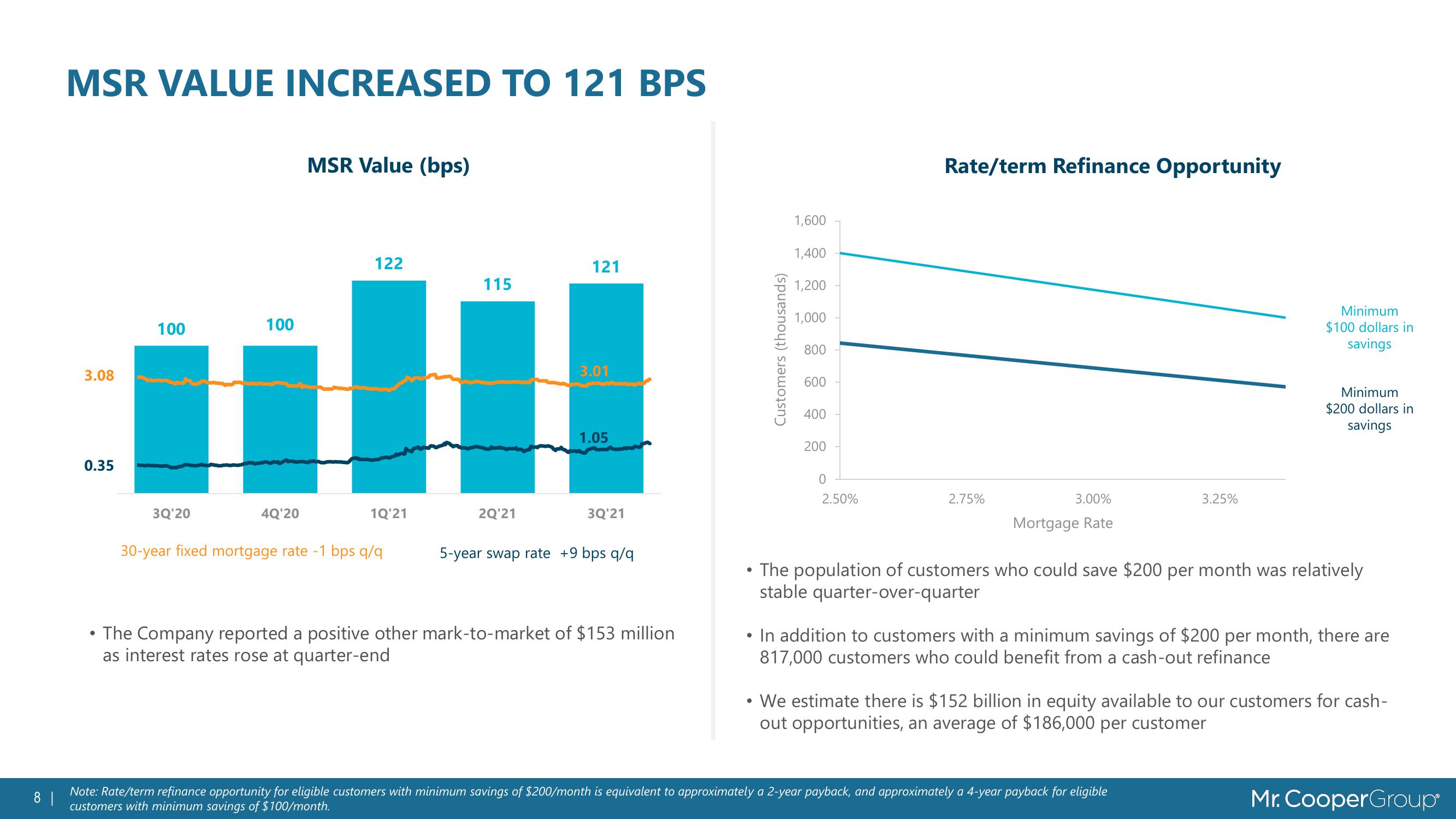

MSR VALUE INCREASED TO 121 BPS

3.08

0.35

●

100

3Q'20

100

4Q'20

MSR Value (bps)

122

1Q'21

30-year fixed mortgage rate -1 bps q/q

115

2Q'21

121

3.01

1.05

3Q'21

5-year swap rate +9 bps q/q

The Company reported a positive other mark-to-market of $153 million

as interest rates rose at quarter-end

Customers (thousands)

1,600

1,400

1,200

1,000

800

600

400

200

0

2.50%

Rate/term Refinance Opportunity

2.75%

3.00%

Mortgage Rate

3.25%

Minimum

$100 dollars in

savings

Minimum

$200 dollars in

savings

• The population of customers who could save $200 per month was relatively

stable quarter-over-quarter

8 |

Note: Rate/term refinance opportunity for eligible customers with minimum savings of $200/month is equivalent to approximately a 2-year payback, and approximately a 4-year payback for eligible

customers with minimum savings of $100/month.

●

In addition to customers with a minimum savings of $200 per month, there are

817,000 customers who could benefit from a cash-out refinance

We estimate there is $152 billion in equity available to our customers for cash-

out opportunities, an average of $186,000 per customer

Mr. CooperGroupView entire presentation