First Busey Results Presentation Deck

2Q23 Earnings Investor Presentation

First Busey Corporation | Ticker: BUSE

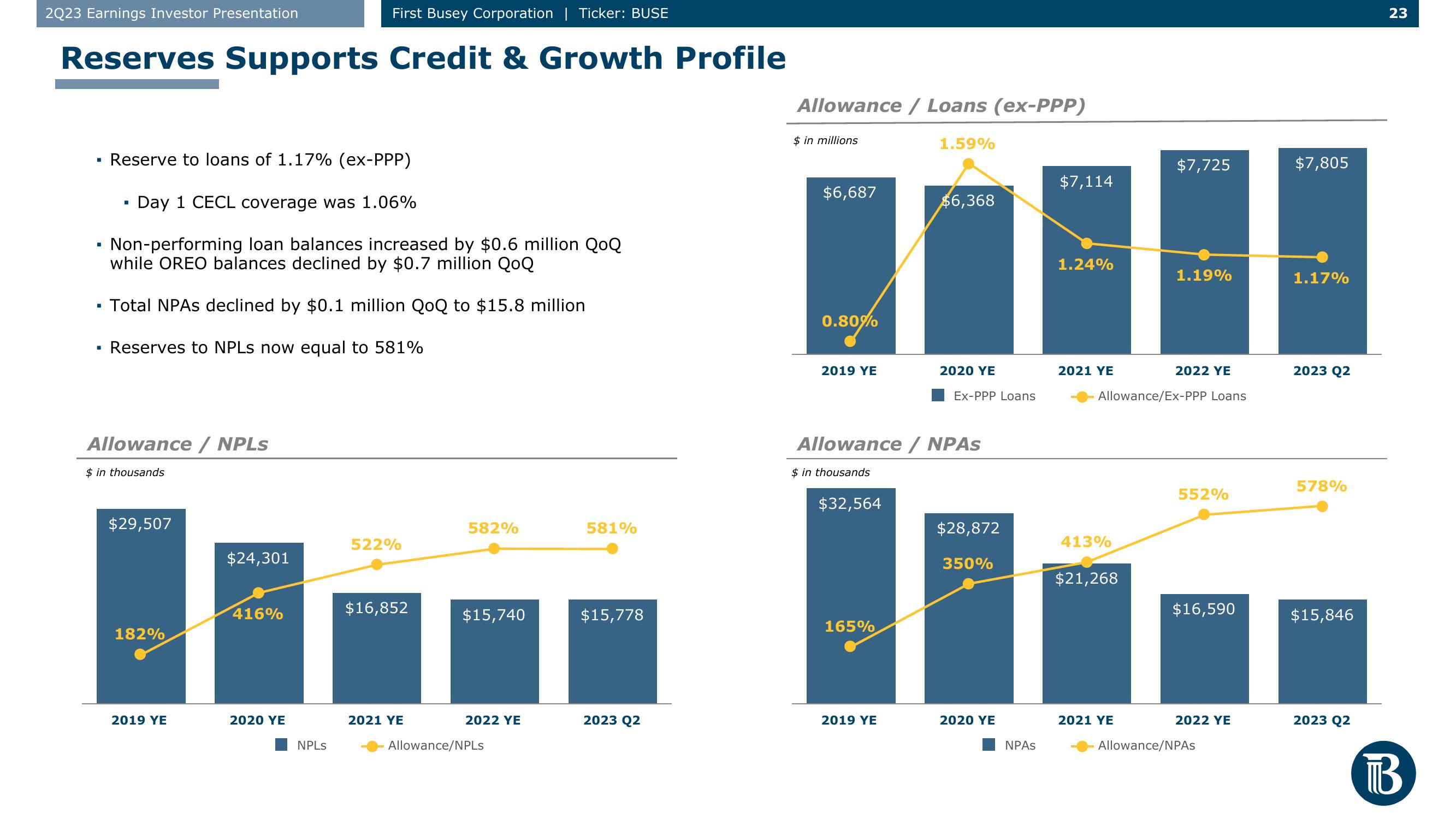

Reserves Supports Credit & Growth Profile

■

■

■

Reserve to loans of 1.17% (ex-PPP)

■

Day 1 CECL coverage was 1.06%

Non-performing loan balances increased by $0.6 million QoQ

while OREO balances declined by $0.7 million QoQ

Total NPAs declined by $0.1 million QoQ to $15.8 million

Reserves to NPLs now equal to 581%

Allowance / NPLs

$ in thousands

$29,507

182%

2019 YE

$24,301

416%

2020 YE

NPLs

522%

$16,852

2021 YE

582%

$15,740

2022 YE

Allowance/NPLs

581%

$15,778

2023 Q2

Allowance / Loans (ex-PPP)

$ in millions

$6,687

0.80%

2019 YE

$32,564

165%

1.59%

2019 YE

$6,368

Allowance / NPAS

$ in thousands

2020 YE

Ex-PPP Loans

$28,872

350%

2020 YE

NPAS

$7,114

1.24%

2021 YE

413%

2022 YE

Allowance/Ex-PPP Loans

$21,268

$7,725

2021 YE

1.19%

552%

$16,590

2022 YE

Allowance/NPAS

$7,805

1.17%

2023 Q2

578%

$15,846

2023 Q2

23

BView entire presentation