Deutsche Bank Results Presentation Deck

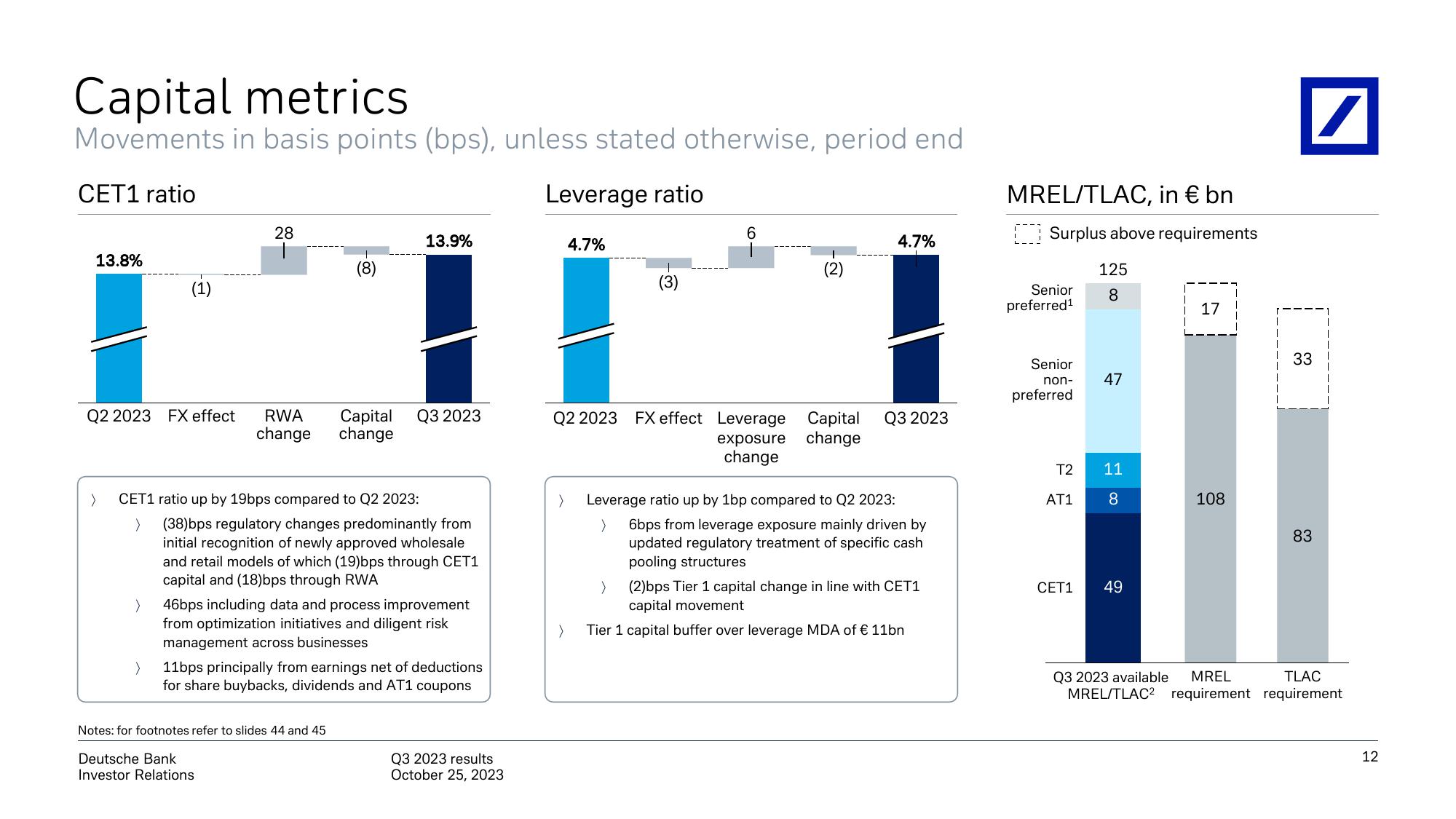

Capital metrics

Movements in basis points (bps), unless stated otherwise, period end

CET1 ratio

13.8%

Q2 2023 FX effect

(1)

>

>

28

RWA

change

(8)

CET1 ratio up by 19bps compared to Q2 2023:

>

Capital

change

13.9%

Q3 2023

Notes: for footnotes refer to slides 44 and 45

Deutsche Bank

Investor Relations

(38)bps regulatory changes predominantly from

initial recognition of newly approved wholesale

and retail models of which (19)bps through CET1

capital and (18)bps through RWA

46bps including data and process improvement

from optimization initiatives and diligent risk

management across businesses

11bps principally from earnings net of deductions

for share buybacks, dividends and AT1 coupons

Q3 2023 results

October 25, 2023

Leverage ratio

4.7%

(3)

6

(2)

Q2 2023 FX effect Leverage Capital

exposure change

change

>

4.7%

Q3 2023

> Leverage ratio up by 1bp compared to Q2 2023:

6bps from leverage exposure mainly driven by

updated regulatory treatment of specific cash

pooling structures

>

(2)bps Tier 1 capital change in line with CET1

capital movement

> Tier 1 capital buffer over leverage MDA of € 11bn

MREL/TLAC, in € bn

Surplus above requirements

Senior

preferred¹

Senior

non-

preferred

125

8

47

11

T2

AT1 8

CET1 49

17

108

33

83

TLAC

Q3 2023 available MREL

MREL/TLAC² requirement requirement

12View entire presentation