Main Street Capital Investor Day Presentation Deck

A Differentiated Approach

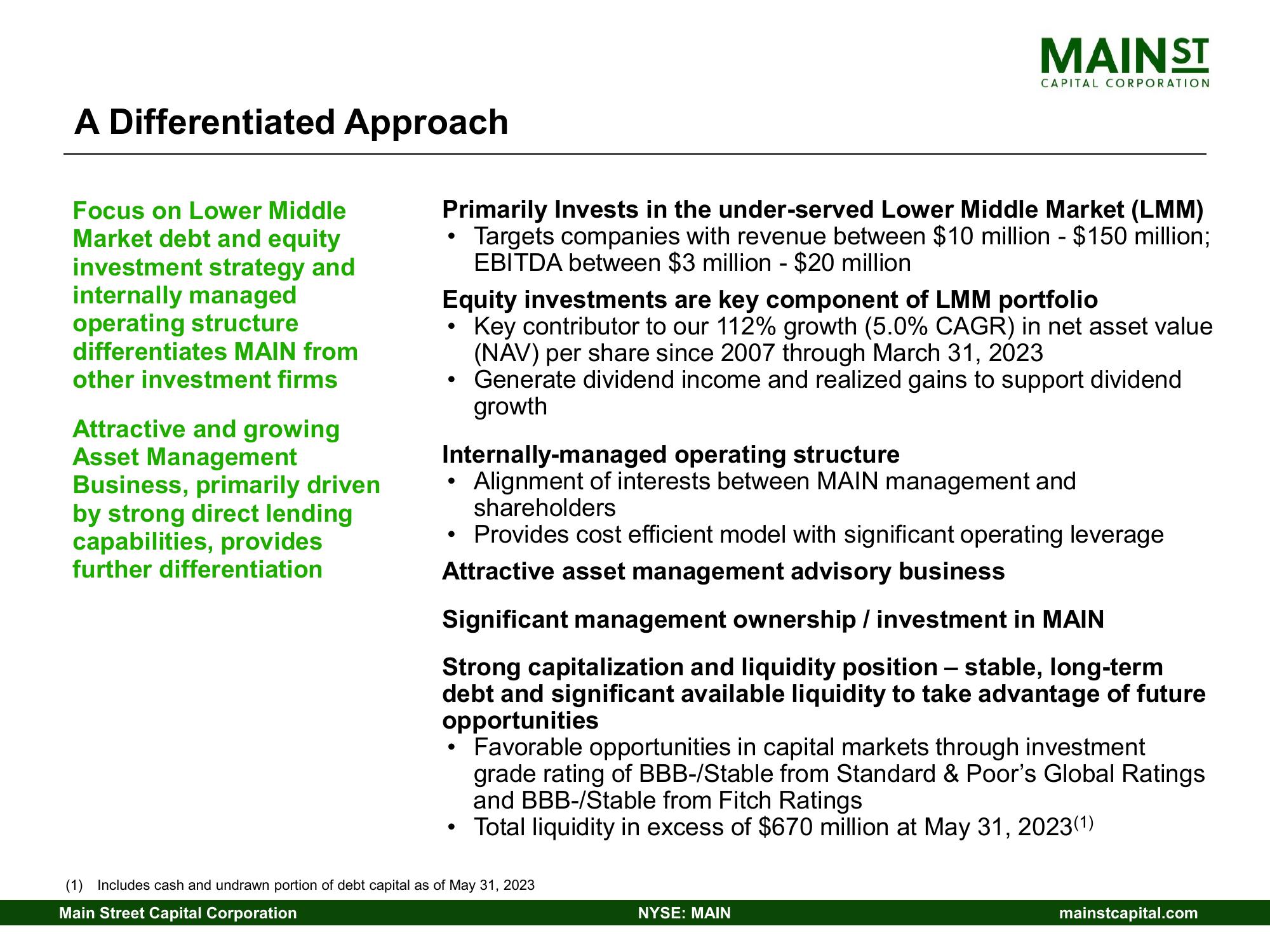

Focus on Lower Middle

Market debt and equity

investment strategy and

internally managed

operating structure

differentiates MAIN from

other investment firms

Attractive and growing

Asset Management

Business, primarily driven

by strong direct lending

capabilities, provides

further differentiation

●

Primarily Invests in the under-served Lower Middle Market (LMM)

Targets companies with revenue between $10 million - $150 million;

EBITDA between $3 million - $20 million

●

Equity investments are key component of LMM portfolio

Key contributor to our 112% growth (5.0% CAGR) in net asset value

(NAV) per share since 2007 through March 31, 2023

Generate dividend income and realized gains to support dividend

growth

●

Internally-managed operating structure

Alignment of interests between MAIN management and

shareholders

Provides cost efficient model with significant operating leverage

Attractive asset management advisory business

Significant management ownership / investment in MAIN

Strong capitalization and liquidity position - stable, long-term

debt and significant available liquidity to take advantage of future

opportunities

●

●

MAINST

●

CAPITAL CORPORATION

(1) Includes cash and undrawn portion of debt capital as of May 31, 2023

Main Street Capital Corporation

Favorable opportunities in capital markets through investment

grade rating of BBB-/Stable from Standard & Poor's Global Ratings

and BBB-/Stable from Fitch Ratings

Total liquidity in excess of $670 million at May 31, 2023(¹)

NYSE: MAIN

mainstcapital.comView entire presentation