Kore Investor Presentation Deck

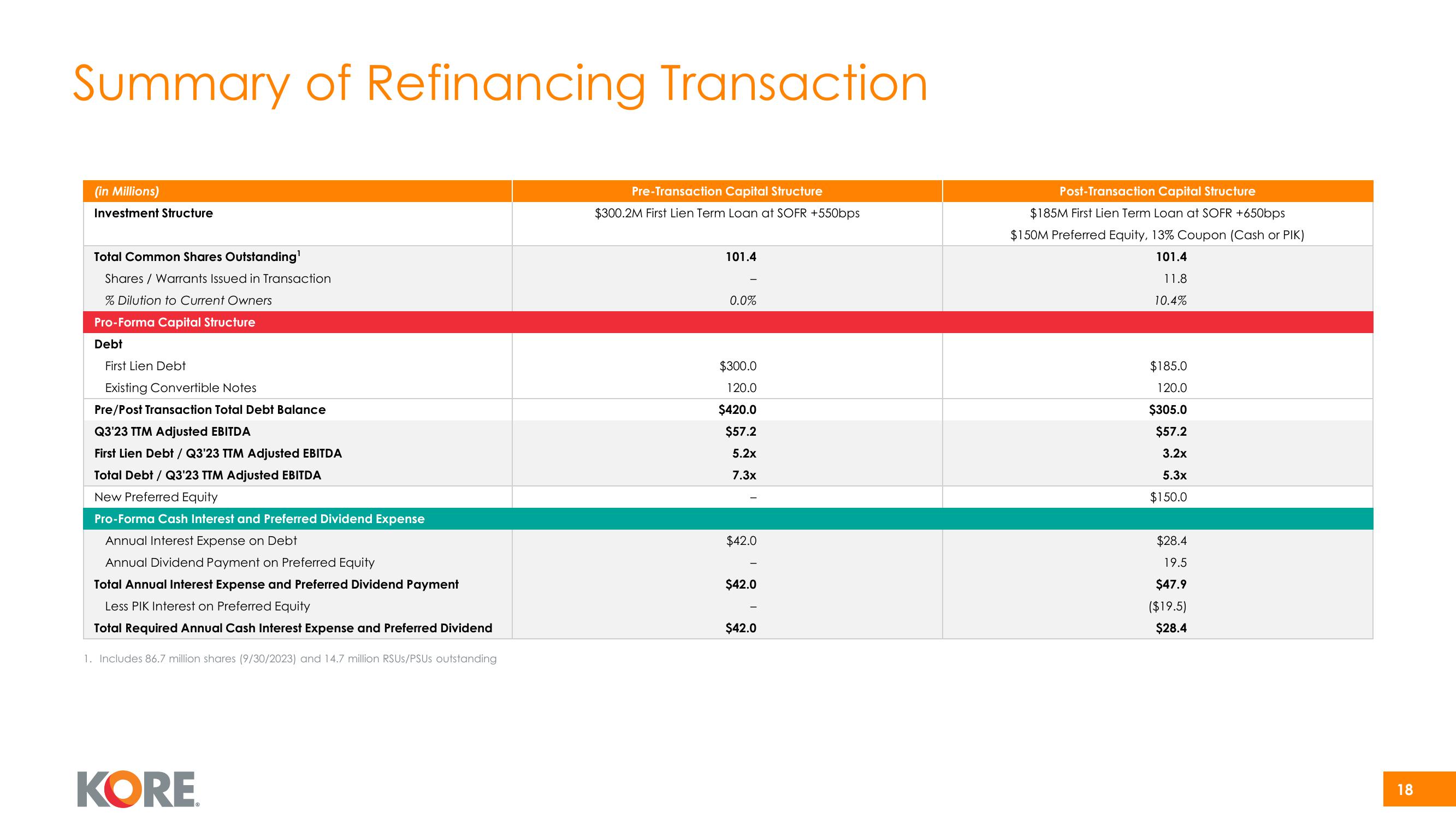

Summary of Refinancing Transaction

(in Millions)

Investment Structure

Total Common Shares Outstanding¹

Shares / Warrants Issued in Transaction

% Dilution to Current Owners

Pro-Forma Capital Structure

Debt

First Lien Debt

Existing Convertible Notes

Pre/Post Transaction Total Debt Balance

Q3'23 TTM Adjusted EBITDA

First Lien Debt / Q3'23 TTM Adjusted EBITDA

Total Debt / Q3'23 TTM Adjusted EBITDA

New Preferred Equity

Pro-Forma Cash Interest and Preferred Dividend Expense

Annual Interest Expense on Debt

Annual Dividend Payment on Preferred Equity

Total Annual Interest Expense and Preferred Dividend Payment

Less PIK Interest on Preferred Equity

Total Required Annual Cash Interest Expense and Preferred Dividend

1. Includes 86.7 million shares (9/30/2023) and 14.7 million RSUS/PSUs outstanding

KORE

Pre-Transaction Capital Structure

$300.2M First Lien Term Loan at SOFR +550bps

101.4

0.0%

$300.0

120.0

$420.0

$57.2

5.2x

7.3x

$42.0

$42.0

$42.0

Post-Transaction Capital Structure

$185M First Lien Term Loan at SOFR +650bps

$150M Preferred Equity, 13% Coupon (Cash or PIK)

101.4

11.8

10.4%

$185.0

120.0

$305.0

$57.2

3.2x

5.3x

$150.0

$28.4

19.5

$47.9

($19.5)

$28.4

18View entire presentation