Credit Suisse Investor Event Presentation Deck

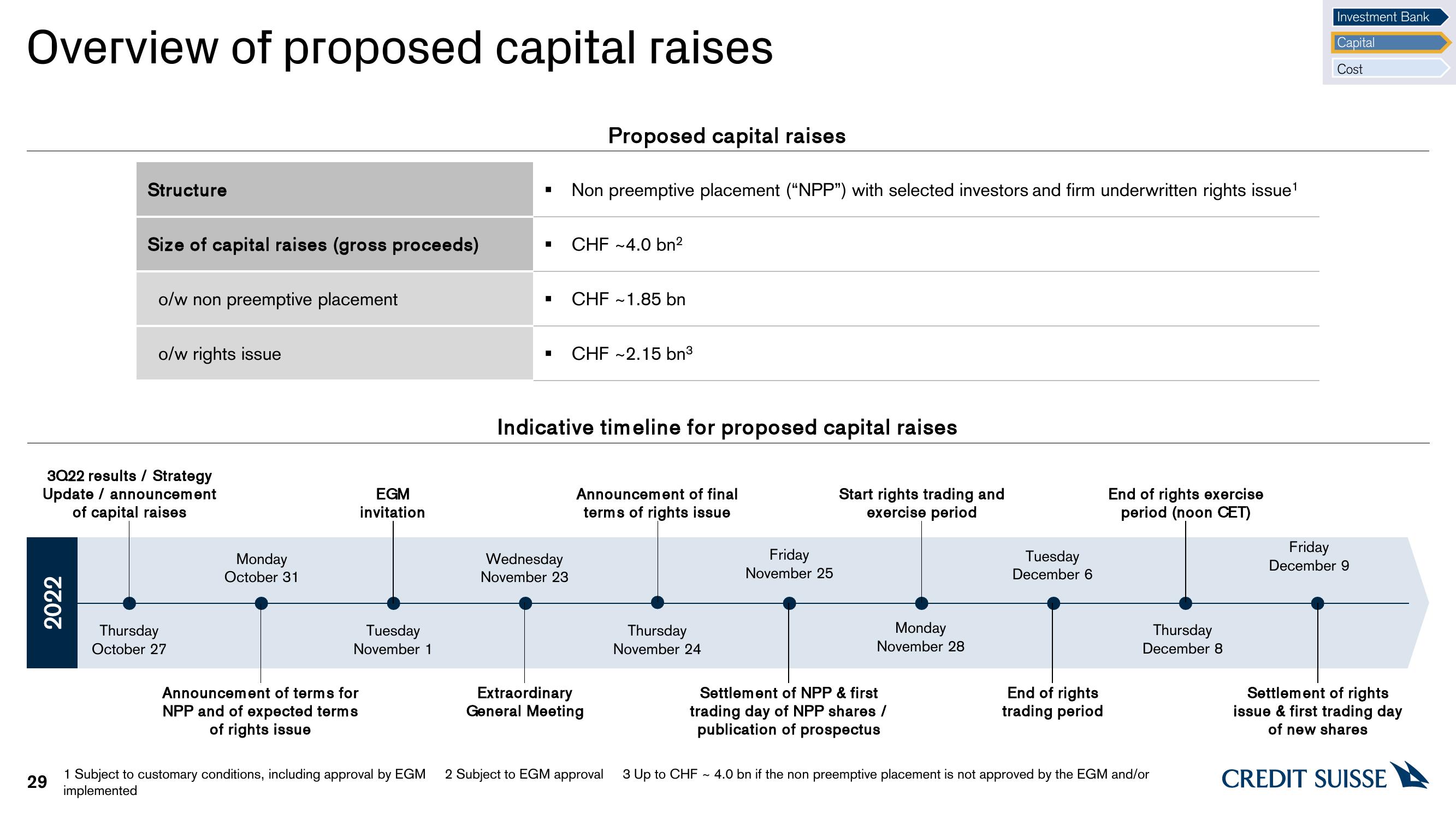

Overview of proposed capital raises

2022

Structure

29

Size of capital raises (gross proceeds)

o/w non preemptive placement

3Q22 results / Strategy

Update / announcement

of capital raises

o/w rights issue

Thursday

October 27

Monday

October 31

EGM

invitation

Tuesday

November 1

Announcement of terms for

NPP and of expected terms

of rights issue

1 Subject to customary conditions, including approval by EGM

implemented

■

Proposed capital raises

Non preemptive placement ("NPP") with selected investors and firm underwritten rights issue¹

■ CHF -4.0 bn²

CHF 1.85 bn

■ CHF 2.15 bn³

Wednesday

November 23

Indicative timeline for proposed capital raises

Announcement of final

terms of rights issue

Extraordinary

General Meeting

2 Subject to EGM approval

Thursday

November 24

Friday

November 25

Start rights trading and

exercise period

Monday

November 28

Settlement of NPP & first

trading day of NPP shares /

publication of prospectus

Tuesday

December 6

End of rights

trading period

End of rights exercise

period (noon CET)

Thursday

December 8

3 Up to CHF ~ 4.0 bn if the non preemptive placement is not approved by the EGM and/or

Investment Bank

Capital

Cost

Friday

December 9

Settlement of rights

issue & first trading day

of new shares

CREDIT SUISSEView entire presentation