Credit Suisse Investor Event Presentation Deck

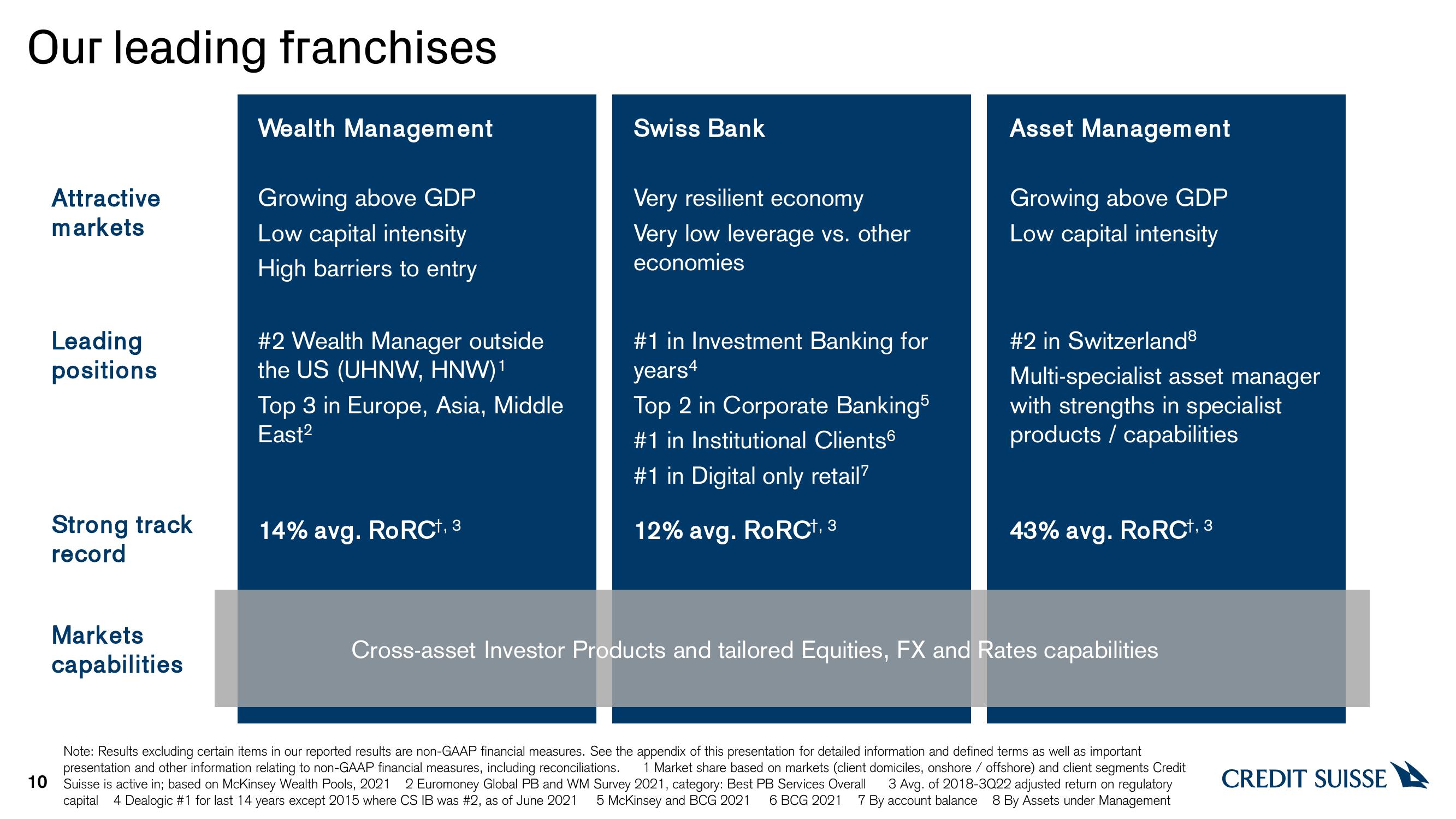

Our leading franchises

Attractive

markets

Leading

positions

Strong track

record

Markets

capabilities

Wealth Management

Growing above GDP

Low capital intensity

High barriers to entry

#2 Wealth Manager outside

the US (UHNW, HNW)¹

Top 3 in Europe, Asia, Middle

East²

14% avg. RoRC+, 3

Swiss Bank

Very resilient economy

Very low leverage vs. other

economies

#1 in Investment Banking for

years4

Top 2 in Corporate Banking5

#1 in Institutional Clients6

#1 in Digital only retail?

12% avg. RoRC+, 3

Asset Management

Growing above GDP

Low capital intensity

#2 in Switzerland8

Multi-specialist asset manager

with strengths in specialist

products / capabilities

43% avg. RoRCt, 3

Cross-asset Investor Products and tailored Equities, FX and Rates capabilities

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important

presentation and other information relating to non-GAAP financial measures, including reconciliations. 1 Market share based on markets (client domiciles, onshore / offshore) and client segments Credit

3 Avg. of 2018-3022 adjusted return on regulatory

10 Suisse is active in; based on McKinsey Wealth Pools, 2021 2 Euromoney Global PB and WM Survey 2021, category: Best PB Services Overall

capital 4 Dealogic #1 for last 14 years except 2015 where CS IB was #2, as of June 2021 5 McKinsey and BCG 2021

6 BCG 2021 7 By account balance 8 By Assets under Management

CREDIT SUISSEView entire presentation