Deutsche Bank Results Presentation Deck

Sound liquidity and funding base

In € bn, unless stated otherwise

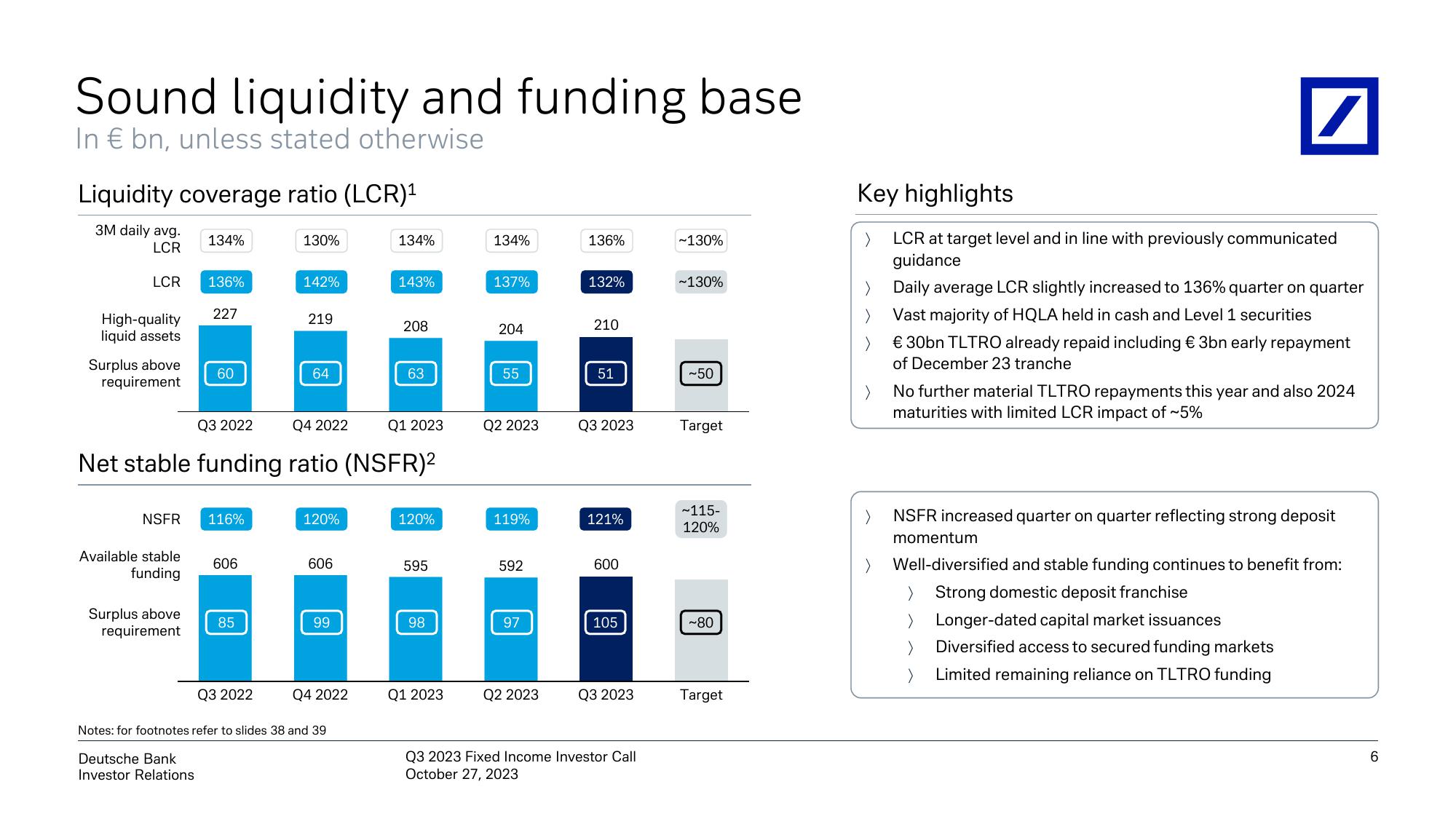

Liquidity coverage ratio (LCR)¹

3M daily avg.

LCR

LCR

High-quality

liquid sets

Surplus above

requirement

NSFR

Available stable

funding

134%

Surplus above

requirement

136%

227

60

116%

606

85

130%

Q3 2022

142%

Q3 2022

Q4 2022

Q1 2023

Net stable funding ratio (NSFR)²

219

64

120%

606

99

Q4 2022

134%

Notes: for footnotes refer to slides 38 and 39

Deutsche Bank

Investor Relations

143%

208

63

120%

595

98

Q1 2023

134%

137%

204

55

Q2 2023

119%

592

97

Q2 2023

136%

132%

210

51

Q3 2023

121%

600

105

Q3 2023

Q3 2023 Fixed Income Investor Call

October 27, 2023

~130%

~130%

~50

Target

~115-

120%

~80

Target

Key highlights

LCR at target level and in line with previously communicated

guidance

>

/

Daily average LCR slightly increased to 136% quarter on quarter

Vast majority of HQLA held in cash and Level 1 securities

€ 30bn TLTRO already repaid including € 3bn early repayment

of December 23 tranche

No further material TLTRO repayments this year and also 2024

maturities with limited LCR impact of ~5%

NSFR increased quarter on quarter reflecting strong deposit

momentum

Well-diversified and stable funding continues to benefit from:

Strong domestic deposit franchise

>

Longer-dated capital market issuances

> Diversified access to secured funding markets

> Limited remaining reliance on TLTRO funding

6View entire presentation