Snap Inc Results Presentation Deck

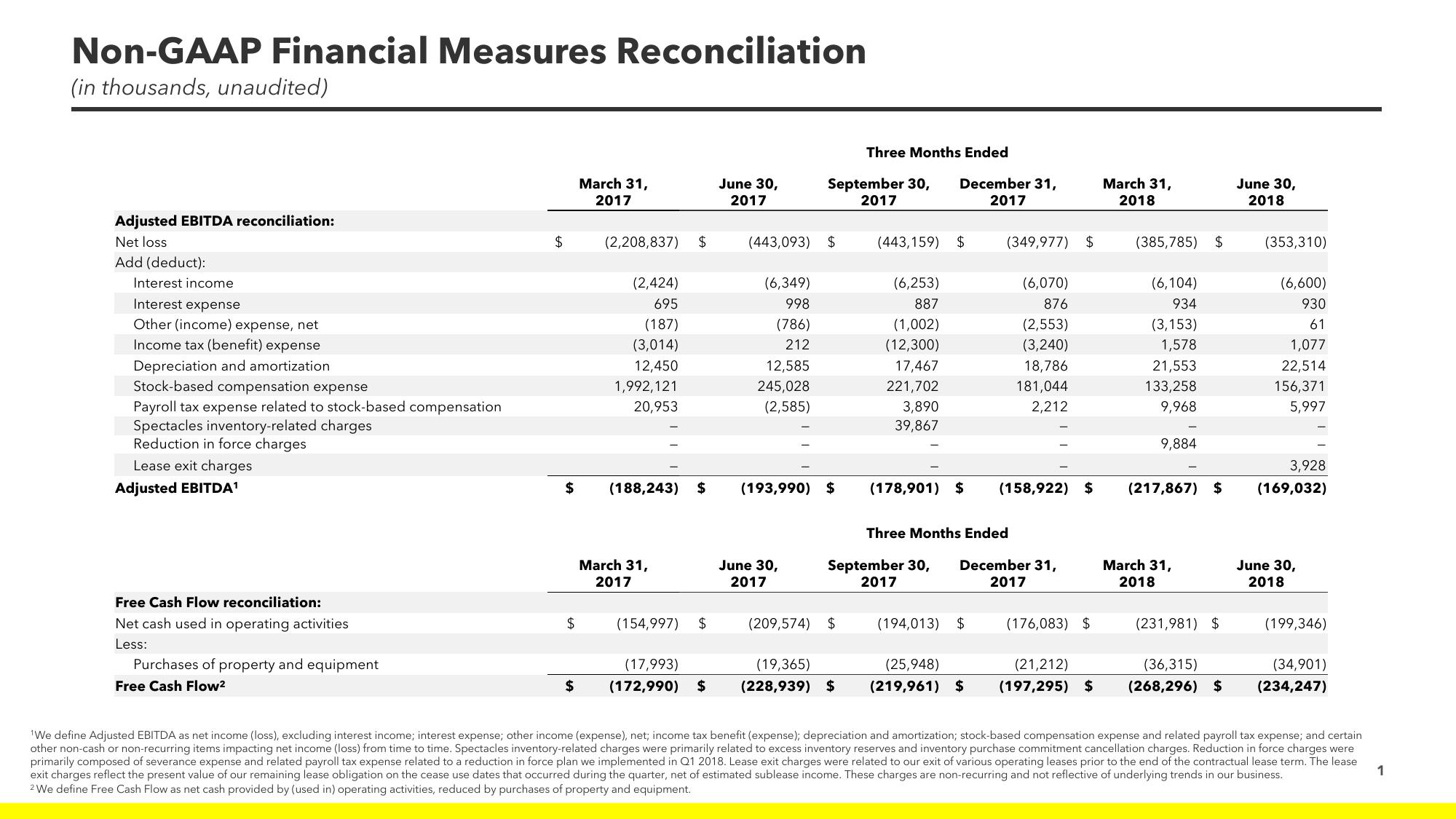

Non-GAAP Financial Measures Reconciliation

(in thousands, unaudited)

Adjusted EBITDA reconciliation:

Net loss

Add (deduct):

Interest income

Interest expense

Other (income) expense, net

Income tax (benefit) expense

Depreciation and amortization

Stock-based compensation expense

Payroll tax expense related to stock-based compensation

Spectacles inventory-related charges

Reduction in force charges

Lease exit charges

Adjusted EBITDA¹

Free Cash Flow reconciliation:

Net cash used in operating activities

Less:

Purchases of property and equipment

Free Cash Flow²

$

$

March 31,

2017

$

(2,208,837) $

$ (188,243)

(2,424)

695

(187)

(3,014)

12,450

1,992,121

20,953

March 31,

2017

$

(154,997) $

(17,993)

(172,990) $

June 30,

2017

(443,093) $

(6,349)

998

(786)

212

12,585

245,028

(2,585)

Three Months Ended

September 30, December 31,

2017

2017

(193,990) $

June 30,

2017

(209,574) $

(443,159)

(19,365)

(228,939) $

(6,253)

887

(1,002)

(12,300)

17,467

221,702

3,890

39,867

September 30,

2017

$

Three Months Ended

(349,977)

(178,901) $ (158,922) $

(194,013) $

(6,070)

876

(2,553)

(3,240)

18,786

181,044

2,212

December 31,

2017

(25,948)

(219,961) $

$

(176,083) $

(21,212)

(197,295) $

March 31,

2018

(385,785) $

(6,104)

934

(3,153)

1,578

21,553

133,258

9,968

9,884

(217,867) $

March 31,

2018

(231,981) $

(36,315)

(268,296) $

June 30,

2018

(353,310)

(6,600)

930

61

1,077

22,514

156,371

5,997

3,928

(169,032)

June 30,

2018

(199,346)

(34,901)

(234,247)

'We define Adjusted EBITDA as net income (loss), excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense and related payroll tax expense; and certain

other non-cash or non-recurring items impacting net income (loss) from time to time. Spectacles inventory-related charges were primarily related to excess inventory reserves and inventory purchase commitment cancellation charges. Reduction in force charges were

primarily composed of severance expense and related payroll tax expense related to a reduction in force plan we implemented in Q1 2018. Lease exit charges were related to our exit of various operating leases prior to the end of the contractual lease term. The lease

exit charges reflect the present value of our remaining lease obligation on the cease use dates that occurred during the quarter, net of estimated sublease income. These charges are non-recurring and not reflective of underlying trends in our business.

2 We define Free Cash Flow as net cash provided by (used in) operating activities, reduced by purchases of property and equipment.

1View entire presentation