Bank of America Results Presentation Deck

Asset Quality

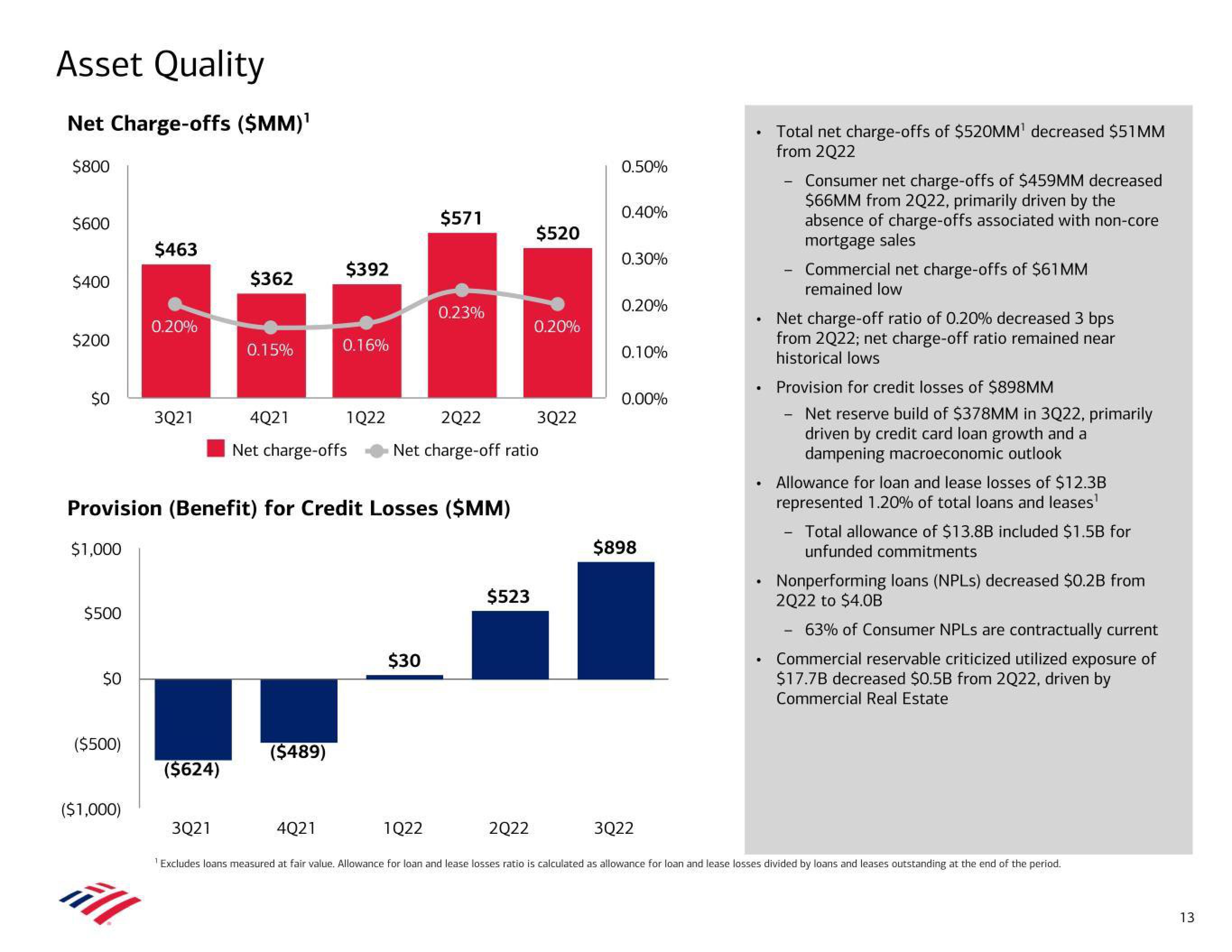

Net Charge-offs ($MM)¹

$800

$600

$400

$200

$0

$1,000

$500

$0

($500)

($1,000)

$463

ill

0.20%

3Q21

($624)

$362

Provision (Benefit) for Credit Losses ($MM)

3Q21

0.15%

$392

($489)

0.16%

4Q21

1Q22

4Q21

2Q22

Net charge-offs Net charge-off ratio

$571

$30

0.23%

1Q22

$523

$520

2Q22

0.20%

3Q22

0.50%

0.40%

0.30%

0.20%

0.10%

0.00%

$898

3Q22

.

Total net charge-offs of $520MM¹ decreased $51MM

from 2022

-

Consumer net charge-offs of $459MM decreased

$66MM from 2Q22, primarily driven by the

absence of charge-offs associated with non-core

mortgage sales

Net charge-off ratio of 0.20% decreased 3 bps

from 2022; net charge-off ratio remained near

historical lows

-

Commercial net charge-offs of $61MM

remained low

Provision for credit losses of $898MM

Net reserve build of $378MM in 3Q22, primarily

driven by credit card loan growth and a

dampening macroeconomic outlook

-

Allowance for loan and lease losses of $12.3B

represented 1.20% of total loans and leases¹

Total allowance of $13.8B included $1.5B for

unfunded commitments

Nonperforming loans (NPLs) decreased $0.2B from

2Q22 to $4.0B

- 63% of Consumer NPLs are contractually current

Commercial reservable criticized utilized exposure of

$17.7B decreased $0.5B from 2022, driven by

Commercial Real Estate

¹Excludes loans measured at fair value. Allowance for loan and lease losses ratio is calculated as allowance for loan and lease losses divided by loans and leases outstanding at the end of the period.

13View entire presentation