Paysafe Results Presentation Deck

Summary

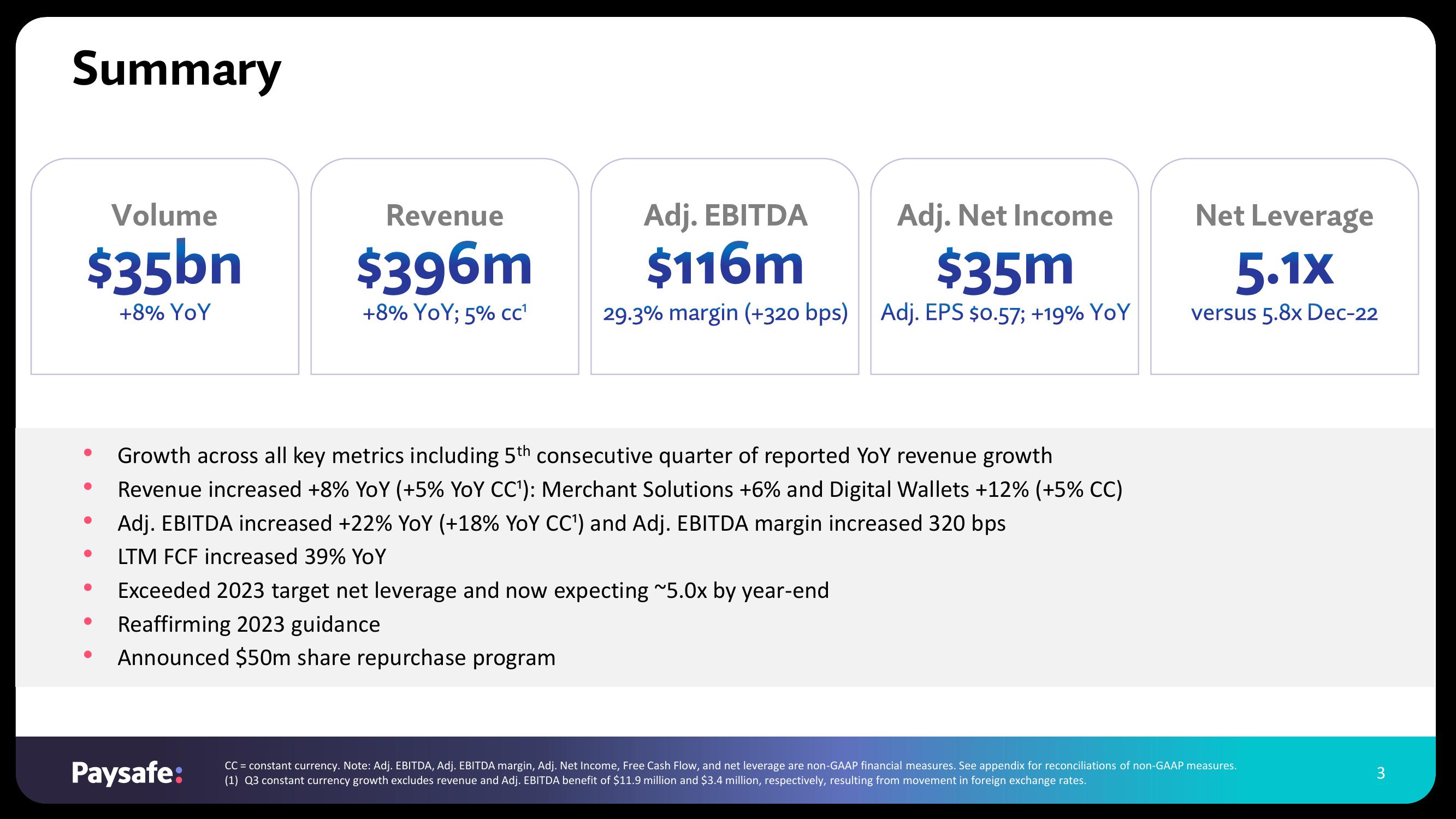

Volume

$35bn

+8% YoY

●

Revenue

$396m

+8% YoY; 5% CC¹

Adj. EBITDA

Adj. Net Income

$116m

$35m

29.3% margin (+320 bps) Adj. EPS $0.57; +19% YoY

Growth across all key metrics including 5th consecutive quarter of reported YoY revenue growth

Revenue increased +8% YoY (+5% YoY CC¹): Merchant Solutions +6% and Digital Wallets +12% (+5% CC)

Adj. EBITDA increased +22% YoY (+18% YoY CC¹) and Adj. EBITDA margin increased 320 bps

LTM FCF increased 39% YoY

Paysafe:

Exceeded 2023 target net leverage and now expecting ~5.0x by year-end

Reaffirming 2023 guidance

Announced $50m share repurchase program

Net Leverage

5.1x

versus 5.8x Dec-22

CC = constant currency. Note: Adj. EBITDA, Adj. EBITDA margin, Adj. Net Income, Free Cash Flow, and net leverage are non-GAAP financial measures. See appendix for reconciliations of non-GAAP measures.

(1) Q3 constant currency growth excludes revenue and Adj. EBITDA benefit of $11.9 million and $3.4 million, respectively, resulting from movement in foreign exchange rates.

3View entire presentation