Ares US Real Estate Opportunity Fund III

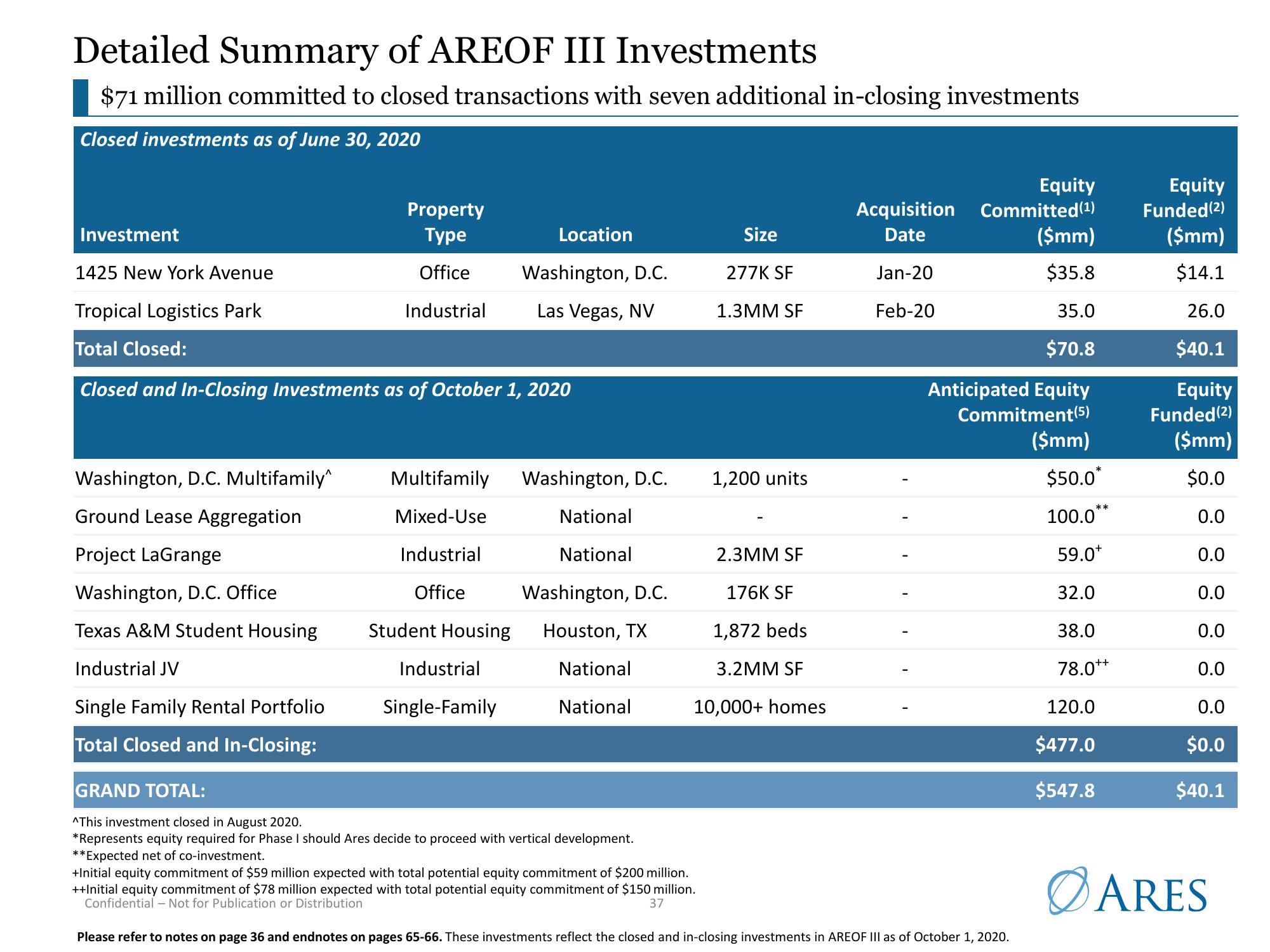

Detailed Summary of AREOF III Investments

$71 million committed to closed transactions with seven additional in-closing investments

Closed investments as of June 30, 2020

Washington, D.C. Multifamily^

Ground Lease Aggregation

Project LaGrange

Investment

1425 New York Avenue

Tropical Logistics Park

Total Closed:

Closed and In-Closing Investments as of October 1, 2020

Washington, D.C. Office

Texas A&M Student Housing

Industrial JV

Single Family Rental Portfolio

Total Closed and In-Closing:

Property

Type

Office

Industrial

GRAND TOTAL:

Multifamily

Mixed-Use

Industrial

Office

Student Housing

Location

Industrial

Single-Family

Washington, D.C.

Las Vegas, NV

Washington, D.C.

National

National

Washington, D.C.

Houston, TX

National

National

^This investment closed in August 2020.

*Represents equity required for Phase I should Ares decide to proceed with vertical development.

**Expected net of co-investment.

Size

+Initial equity commitment of $59 million expected with total potential equity commitment of $200 million.

++Initial equity commitment of $78 million expected with total potential equity commitment of $150 million.

Confidential - Not for Publication or Distribution

37

277K SF

1.3MM SF

1,200 units

2.3MM SF

176K SF

1,872 beds

3.2MM SF

10,000+ homes

Equity

Acquisition Committed (¹)

Date

($mm)

Jan-20

$35.8

Feb-20

35.0

$70.8

Anticipated Equity

Commitment (5)

($mm)

Please refer to notes on page 36 and endnotes on pages 65-66. These investments reflect the closed and in-closing investments in AREOF III as of October 1, 2020.

$50.0*

100.0**

59.0*

32.0

38.0

78.0++

120.0

$477.0

$547.8

Equity

Funded (2)

($mm)

$14.1

26.0

$40.1

Equity

Funded (2)

($mm)

$0.0

0.0

0.0

0.0

0.0

0.0

0.0

$0.0

$40.1

ARESView entire presentation