Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

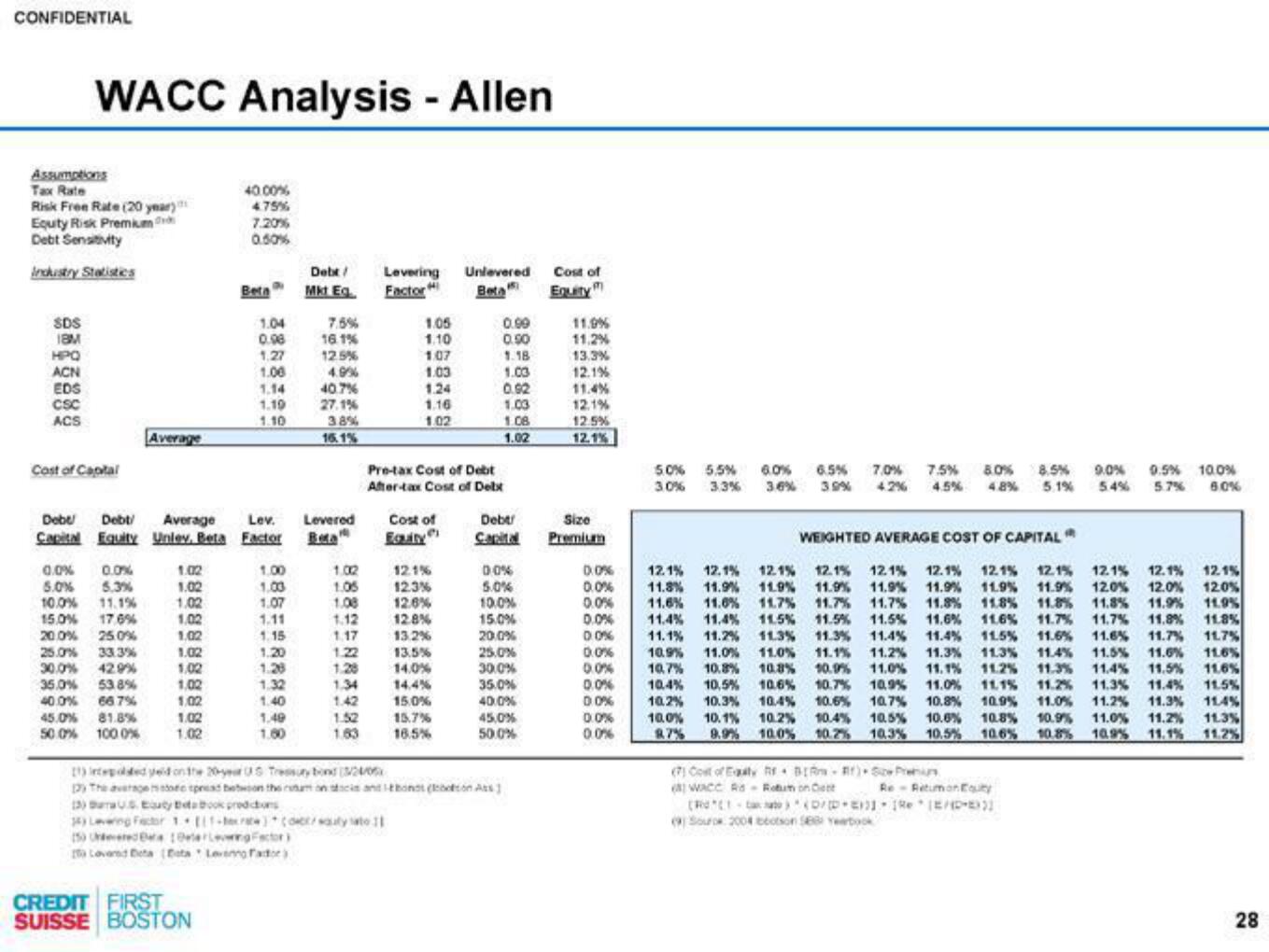

Assumptions

Tax Rate

WACC Analysis - Allen

Risk Free Rate (20 year)

Equity Risk Premium

Debt Sensitivity

Industry Statistics

SDS

18M

HPQ

ACN

EDS

CSC

ACS

Cost of Capital

0.0% 0.0%

5.0% 5.3%

10.0% 11.1%

15.0% 17.6%

20.0%

25.0%

25.0% 33.3%

30.0% 42.9%

35.0% 53.8%

40.0%

66.7%

Average

45.0% 81.8%

50.0% 100.0%

1.02

1.02

1.02

1.02

1.02

1.02

1,02

1,02

1.02

1.02

1.02

40.00%

4.75%

7.20%

0.50%

Debu Debt/ Average Lev.

Capital Equity Unlev, Beta Factor

CREDIT FIRST

SUISSE BOSTON

Beta

a

1.04

0.98

1.27

1.00

1.14

1.19

1.10

1.00

1.00

1.07

1.11

1.15

1.20

1.28

1.32

1.40

1.49

1.00

Debt/

Mkt Eg

16.1%

12.5%

4.9%

40.7%

27.1%

3.8%

16.1%

Levered

Beta

1.02

1.05

1.08

1.12

1.17

1.22

Levering

Factor H

1.28

1.34

1.42

1.05

1.10

1.07

1.03

1.24

1.16

1.02

Cost of

Equity

Pre-tax Cost of Debt

After-tax Cost of Debt

12.1%

12.3%

12.6%

12.8%

13.2%

13.5%

14.0%

14.4%

15.0%

1.52 15.7%

1.63

16.5%

Unlevered Cost of

Beta

Equity

0.99

0.50

1.18

1.03

0.92

1.03

1.08

1.02

Debt!

Capital

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

40.0%

(1) intepolded yeld on the 20-year 05 Tressury bond (3/24/0

3) The averagere tprest bewoon the ruum on stocks and bonos (on Ass

13) Bara US Eutybetabook predictions

34) Levering Factor 1 (11-rate)(owcwaty at 11

(5) de 10elereng Factor)

Lovered Beta (Ests Levenno Fador)

45,0%

50.0%

11.9%

11.2%

13.3%

12.1%

11.4%

12.1%

12.5%

12.1%

Size

Premium

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

5.0% 5,5 %

3.0% 3.3 %

6.0%

3.6 %

6.5% 7.0%

39% 4.2 %

7.5 %

4.5 %

80%

4.8 %

WEIGHTED AVERAGE COST OF CAPITAL

(7) Cost of Eaty RE BIR-R)

(8) WACCRS- Rotunon Cent

8.5% 9.0% 0.5% 100%

5.1% 54% 5.7% 6.0%

12.1% 12.1% 12.1% 12.1% 12.1% 12.1% 12.1% 12.1% 12.1% 12.1% 12.1%

11.8% 11.9% 11.9% 11.9% 11.9% 11.9% 11.9% 11.9% 12.0% 12.0% 12.0%

11.6% 11.0% 11.7% 11.7% 11.7% 11.8% 11.8% 11.8% 11.8%

11.8% 11.9% 11.9%

11.4% 11.4% 11.5% 11.5% 11.5% 11.6% 11.6% 11.7% 11.7% 11.8% 11.8%

11.1% 11.2% 11.3%

11.3% 11.3%

11.3% 11.4% 11.4% 11.5% 11.6% 11.6% 11.7% 11.7%

10.9% 11.0% 11.0% 11.1% 11.2% 11.3% 11.3% 11.4% 11.5% 11.6% 11.6%

10.7% 10.8% 10.8% 10.9% 11.0% 11.1% 11.2% 11.3% 11.4% 11.5% 11.6%

10.4% 10,5% 10.6% 10.7% 10.9% 11.0% 11.1% 11.2% 11.3% 11.4% 11.5%

10,2% 10.3% 10.4% 10.6% 10.7% 10.8% 10.9% 11.0% 11.2% 11.3% 11.4%

10.0% 10.1% 10.2% 10.4% 10.5% 10.6 % 10.8% 10.9% 11.0% 11.2% 11.3%

87% 9.9% 10.0% 10.2% 10.3% 10.5% 10.6 % 10.8% 10.9% 11.1% 11.2%

Sow Premiums

Re-Retumonauty

[Rd1) (D/D] [Re [E/DE) }]

(9) Sour 2004 bbotson SEB Yearbook

28View entire presentation