Matterport 2Q23 Results

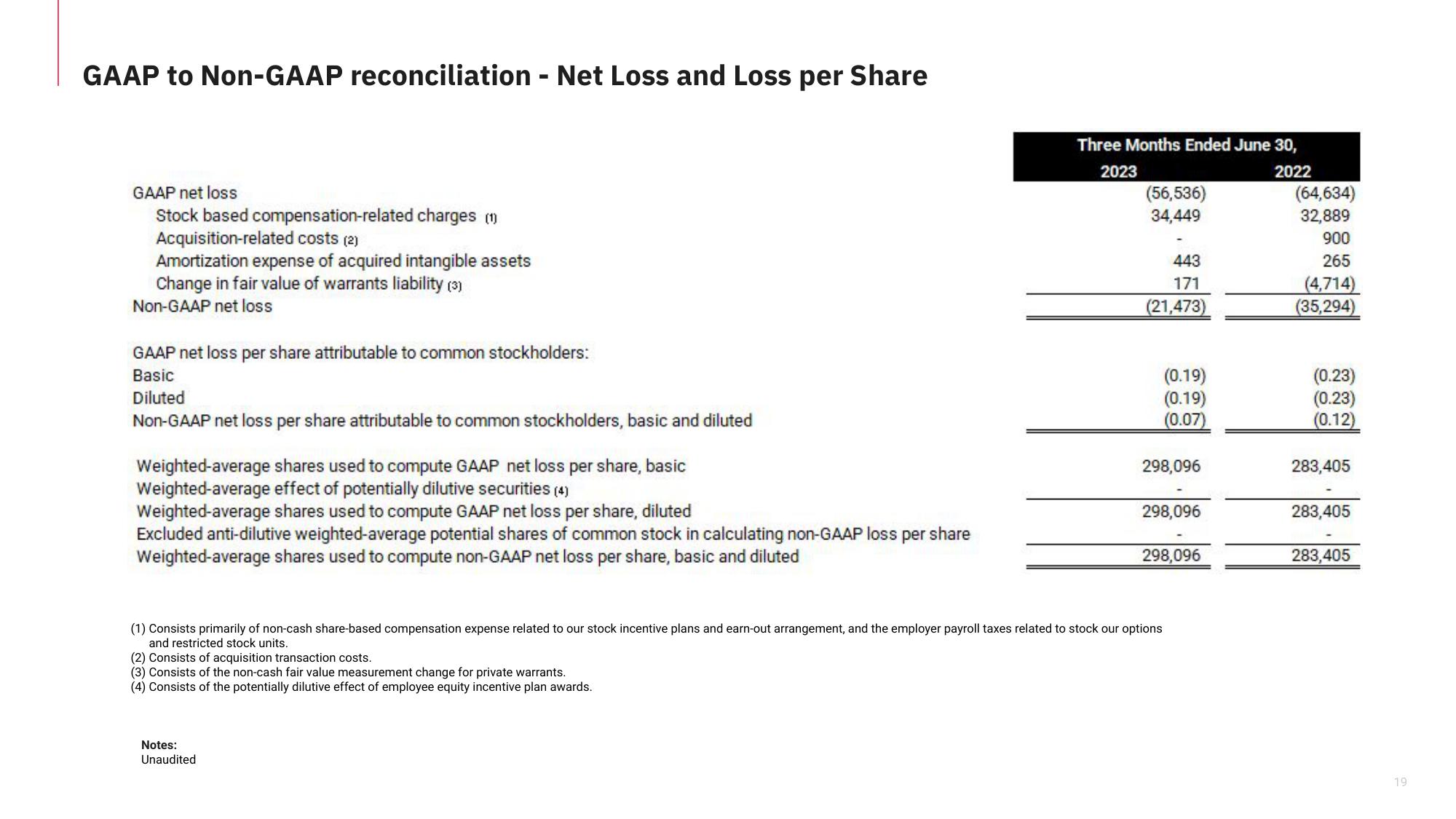

GAAP to Non-GAAP reconciliation - Net Loss and Loss per Share

GAAP net loss

Stock based compensation-related charges (1)

Acquisition-related costs (2)

Amortization expense of acquired intangible assets

Change in fair value of warrants liability (3)

Non-GAAP net loss

GAAP net loss per share attributable to common stockholders:

Basic

Diluted

Non-GAAP net loss per share attributable to common stockholders, basic and diluted

Weighted-average shares used to compute GAAP net loss per share, basic

Weighted-average effect of potentially dilutive securities (4)

Weighted-average shares used to compute GAAP net loss per share, diluted

Excluded anti-dilutive weighted-average potential shares of common stock in calculating non-GAAP loss per share

Weighted-average shares used to compute non-GAAP net loss per share, basic and diluted

Three Months Ended June 30,

2023

2022

Notes:

Unaudited

(56,536)

34,449

443

171

(21,473)

(0.19)

(0.19)

(0.07)

298,096

298,096

(1) Consists primarily of non-cash share-based compensation expense related to our stock incentive plans and earn-out arrangement, and the employer payroll taxes related to stock our options

and restricted stock units.

(2) Consists of acquisition transaction costs.

(3) Consists of the non-cash fair value measurement change for private warrants.

(4) Consists of the potentially dilutive effect of employee equity incentive plan awards.

298,096

(64,634)

32,889

900

265

(4,714)

(35,294)

(0.23)

(0.23)

(0.12)

283,405

283,405

283,405

19View entire presentation