Deutsche Bank Investment Banking Pitch Book

sood sugegobeu

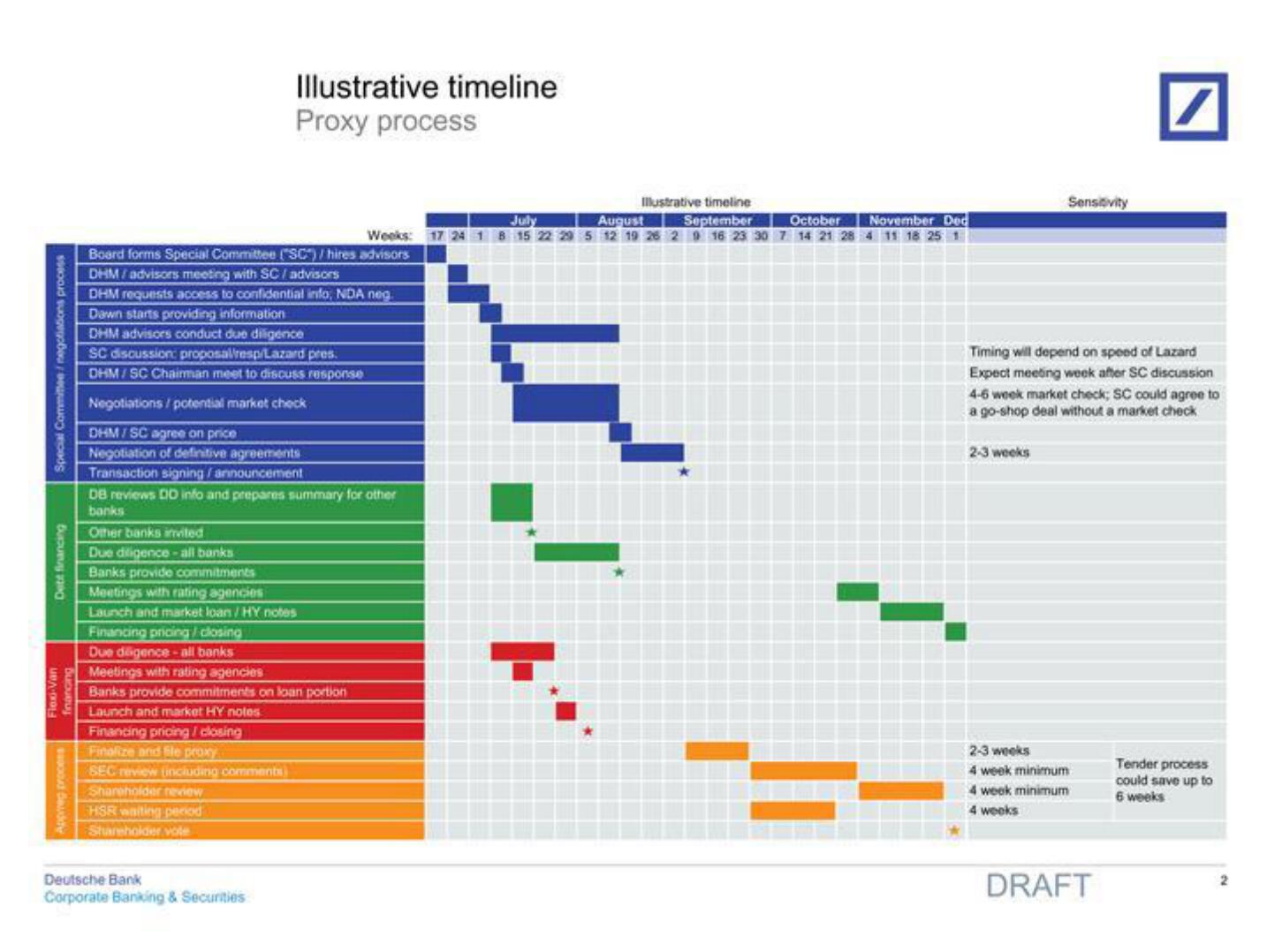

Debt financing

Weeks:

Board forms Special Committee (SC) /hires advisors

DHM/advisors meeting with SC / advisors

DHM requests access to confidential info, NDA neg

Dawn starts providing information

DHM advisors conduct due diligence

SC discussion: proposal/resp/Lazard pres.

DHM/SC Chairman meet to discuss response

Negotiations/potential market check

DHM/SC agree on price

Negotiation of definitive agreements

Transaction signing/announcement

DB reviews DD info and prepares summary for other

banks

Illustrative timeline

Proxy process

Other banks invited

Due diligence-all banks

Banks provide commitments

Meetings with rating agencies

Launch and market loan/HY notes

Financing pricing/closing

Due digence-all banks

Meetings with rating agencies

Banks provide commitments on loan portion

Launch and market HY notes

Financing pricing / closing

Finalize and le proxy

SEC

(including comments)

Shareholder review

HSR waiting period

Shareholder vole

Deutsche Bank

Corporate Banking & Securities

Illustrative timeline

September

July

August

October

17 24 18 15 22 29 5 12 19 26 2 9 16 23 30 7 14 21 28

November Dec

4 11 18 25 1

2-3 weeks

Sensitivity

Timing will depend on speed of Lazard

Expect meeting week after SC discussion

4-6 week market check; SC could agree to

a go-shop deal without a market check

2-3 weeks

4 week minimum

4 week minimum

4 weeks

7

DRAFT

Tender process

could save up to

6 weeks

2View entire presentation