HSBC Results Presentation Deck

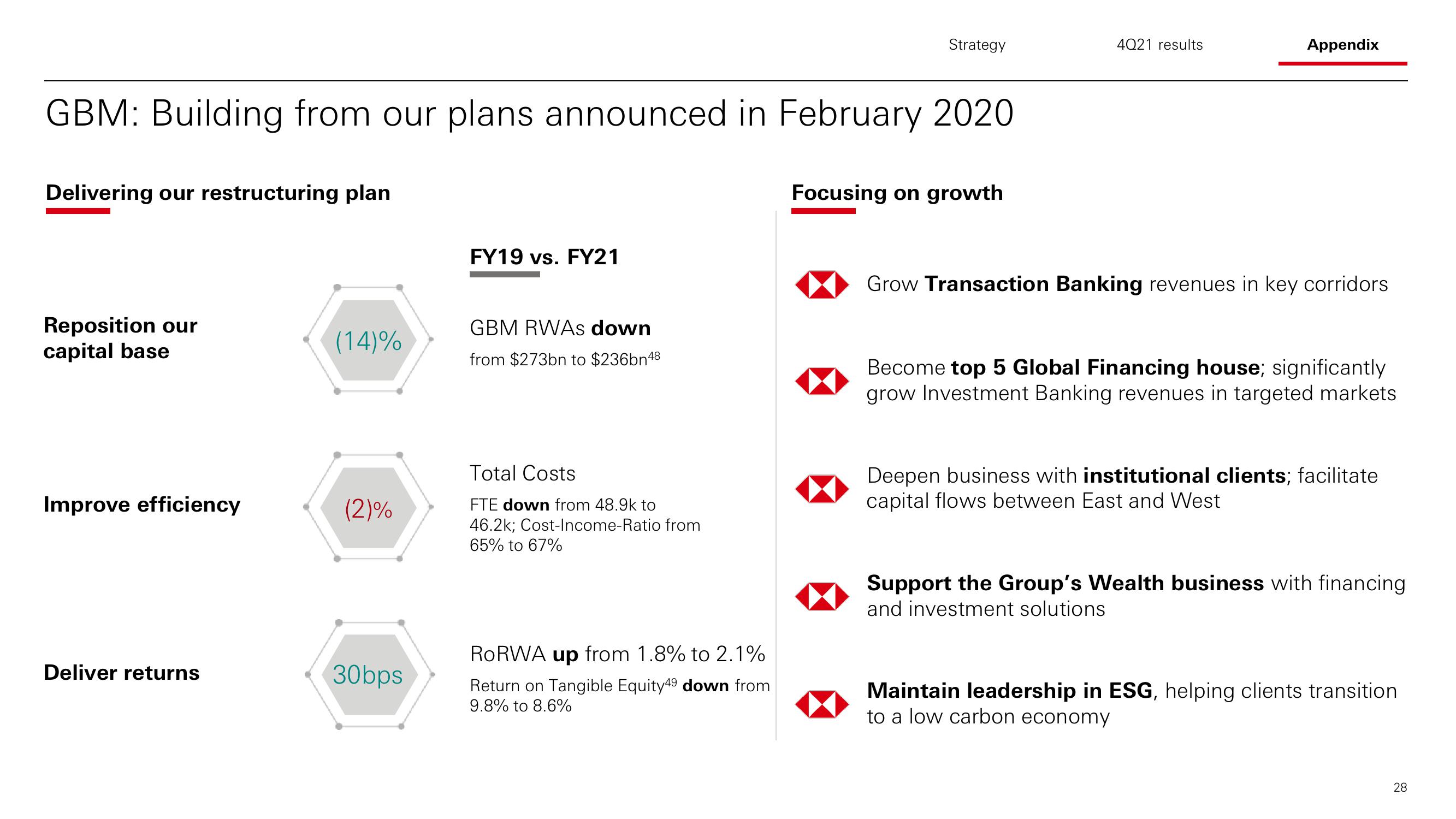

GBM: Building from our plans announced in February 2020

Delivering our restructuring plan

Reposition our

capital base

Improve efficiency

Deliver returns

(14)%

(2)%

30bps

FY19 vs. FY21

GBM RWAs down

from $273bn to $236bn48

Total Costs

FTE down from 48.9k to

46.2k; Cost-Income-Ratio from

65% to 67%

Strategy

RoRWA up from 1.8% to 2.1%

Return on Tangible Equity 49 down from

9.8% to 8.6%

Focusing on growth

4021 results

Appendix

Grow Transaction Banking revenues in key corridors

Become top 5 Global Financing house; significantly

grow Investment Banking revenues in targeted markets

Deepen business with institutional clients; facilitate

capital flows between East and West

Support the Group's Wealth business with financing

and investment solutions

Maintain leadership in ESG, helping clients transition

to a low carbon economy

28View entire presentation