Rhode Island Employees’ Retirement System

Founded in 1997 and currently managing $4.2 billion¹, Aristeia Capital seeks to produce absolute

returns through relative value investments, primarily in the corporate credit markets. Using extensive

hedges and single-name shorts, we seek to deliver alpha-heavy returns with minimal correlation to credit

or equity markets.

Investment Approach

Fuse deep fundamental research and trading expertise with extensive risk systems and technology.

Capture upside through aggressive pursuit of opportunities that exhibit attractive risk/reward.

Minimize downside through dynamic exposure adjustment and comprehensive risk control.

Integrate a robust ESG framework to assess and understand a broader spectrum of risks and opportunities.

•

●

Introduction to Aristeia Capital

Investment Strategies

Examples of historical investing success: debt restructuring opportunities, stressed/distressed high yield, junior

financial securities, convertible relative value, capital structure arbitrage, and equity relative value strategies.

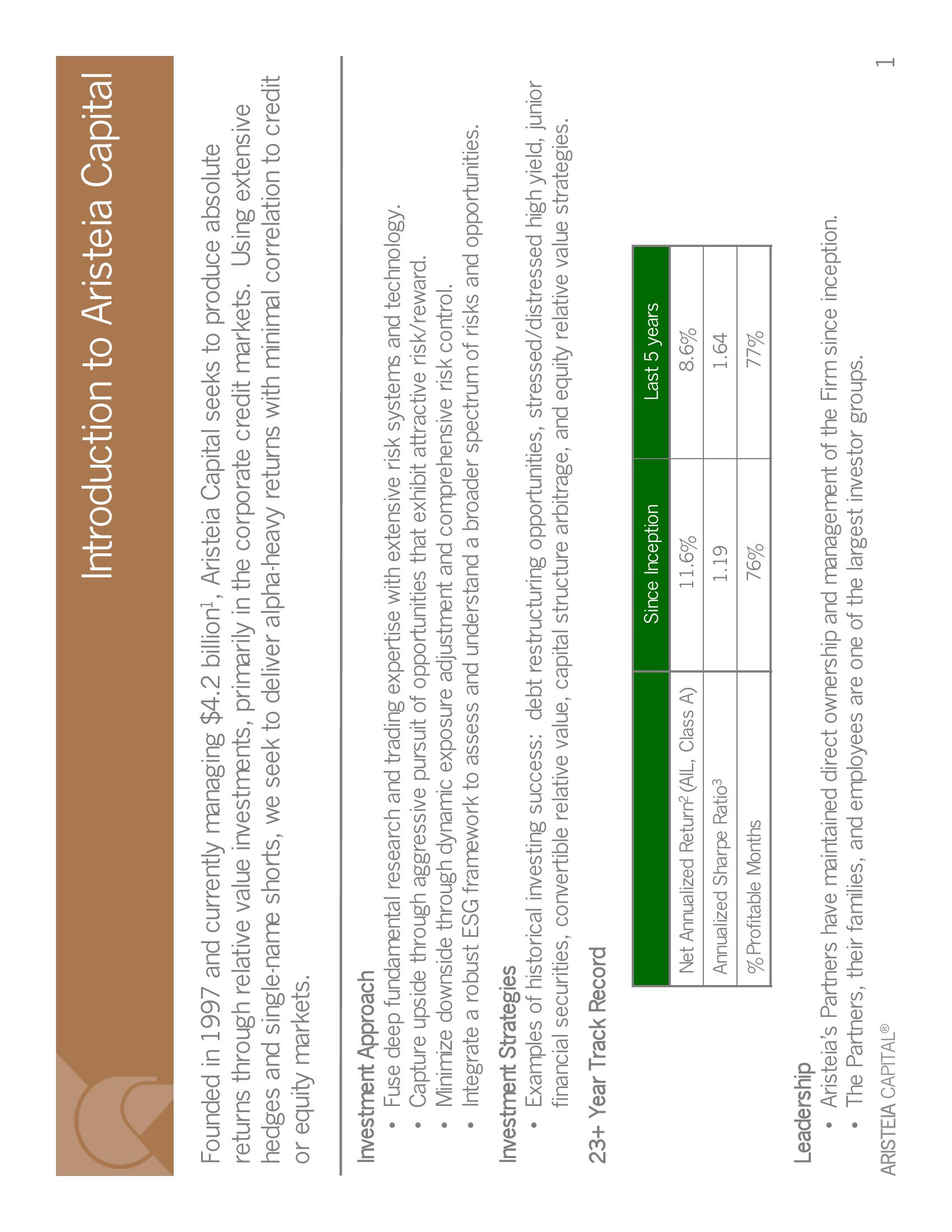

23+ Year Track Record

●

Net Annualized Return² (AIL, Class A)

Annualized Sharpe Ratio

% Profitable Months

●

Since Inception

11.6%

1.19

76%

Last 5 years

8.6%

1.64

77%

Leadership

• Aristeia's Partners have maintained direct ownership and management of the Firm since inception.

The Partners, their families, and employees are one of the largest investor groups.

ARISTEIA CAPITALⓇ

1View entire presentation