Blackwells Capital Activist Presentation Deck

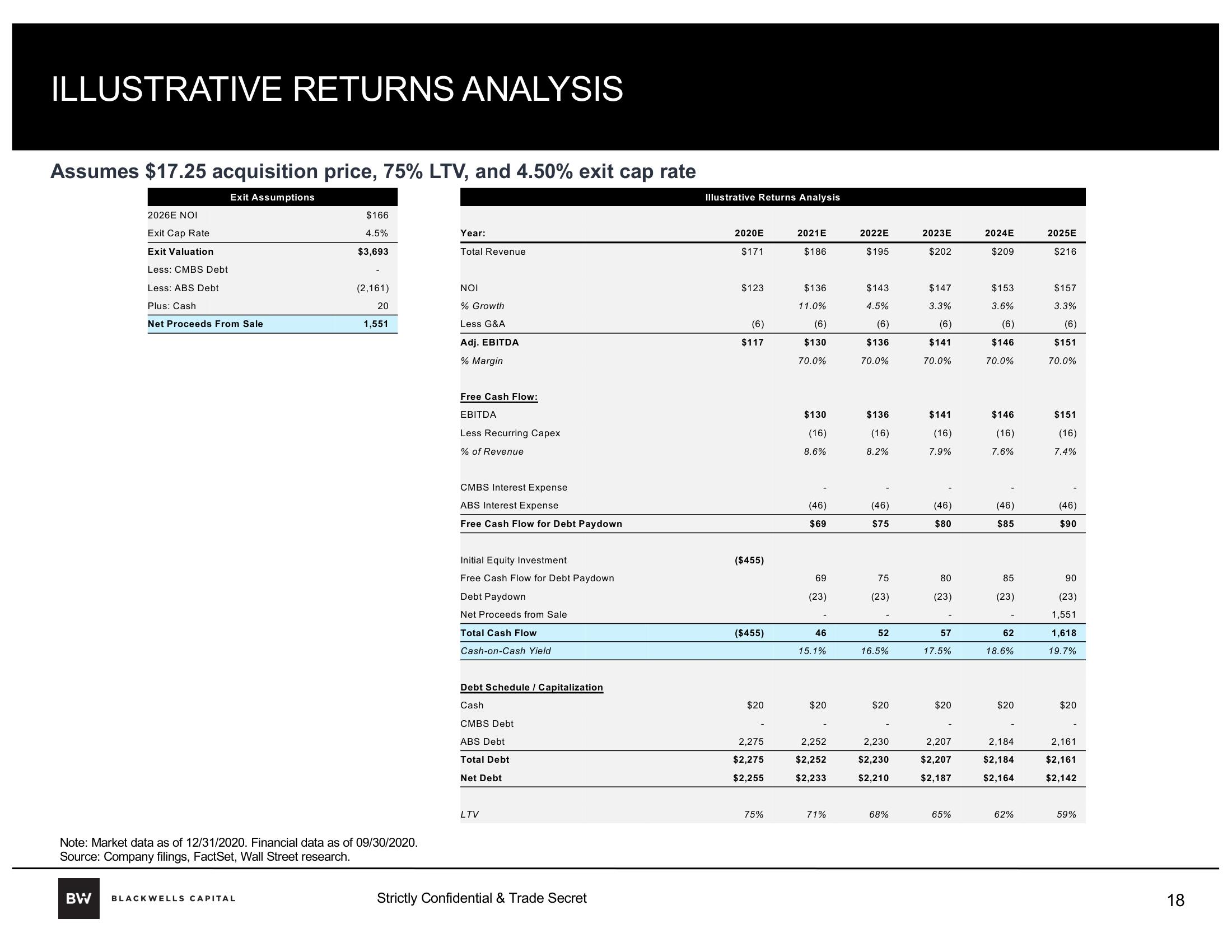

ILLUSTRATIVE RETURNS ANALYSIS

Assumes $17.25 acquisition price, 75% LTV, and 4.50% exit cap rate

Exit Assumptions

2026E NOI

Exit Cap Rate

Exit Valuation

Less: CMBS Debt

Less: ABS Debt

Plus: Cash

Net Proceeds From Sale

$166

4.5%

$3,693

BW BLACKWELLS CAPITAL

(2,161)

20

1,551

Note: Market data as of 12/31/2020. Financial data as of 09/30/2020.

Source: Company filings, FactSet, Wall Street research.

Year:

Total Revenue

NOI

% Growth

Less G&A

Adj. EBITDA

% Margin

Free Cash Flow:

EBITDA

Less Recurring Capex

% of Revenue

CMBS Interest Expense

ABS Interest Expense

Free Cash Flow for Debt Paydown

Initial Equity Investment

Free Cash Flow for Debt Paydown

Debt Paydown

Net Proceeds from Sale

Total Cash Flow

Cash-on-Cash Yield

Debt Schedule / Capitalization

Cash

CMBS Debt

ABS Debt

Total Debt

Net Debt

LTV

Strictly Confidential & Trade Secret

Illustrative Returns Analysis

2020E

$171

$123

(6)

$117

($455)

($455)

$20

2,275

$2,275

$2,255

75%

2021E

$186

$136

11.0%

(6)

$130

70.0%

$130

(16)

8.6%

(46)

$69

69

(23)

46

15.1%

$20

2,252

$2,252

$2,233

71%

2022E

$195

$143

4.5%

(6)

$136

70.0%

$136

(16)

8.2%

(46)

$75

75

(23)

52

16.5%

$20

2,230

$2,230

$2,210

68%

2023E

$202

$147

3.3%

(6)

$141

70.0%

$141

(16)

7.9%

(46)

$80

80

(23)

57

17.5%

$20

2,207

$2,207

$2,187

65%

2024E

$209

$153

3.6%

(6)

$146

70.0%

$146

(16)

7.6%

(46)

$85

85

(23)

62

18.6%

$20

2,184

$2,184

$2,164

62%

2025E

$216

$157

3.3%

(6)

$151

70.0%

$151

(16)

7.4%

(46)

$90

90

(23)

1,551

1,618

19.7%

$20

2,161

$2,161

$2,142

59%

18View entire presentation