Bank of America Investment Banking Pitch Book

Illustrative Levered Returns Sensitivity

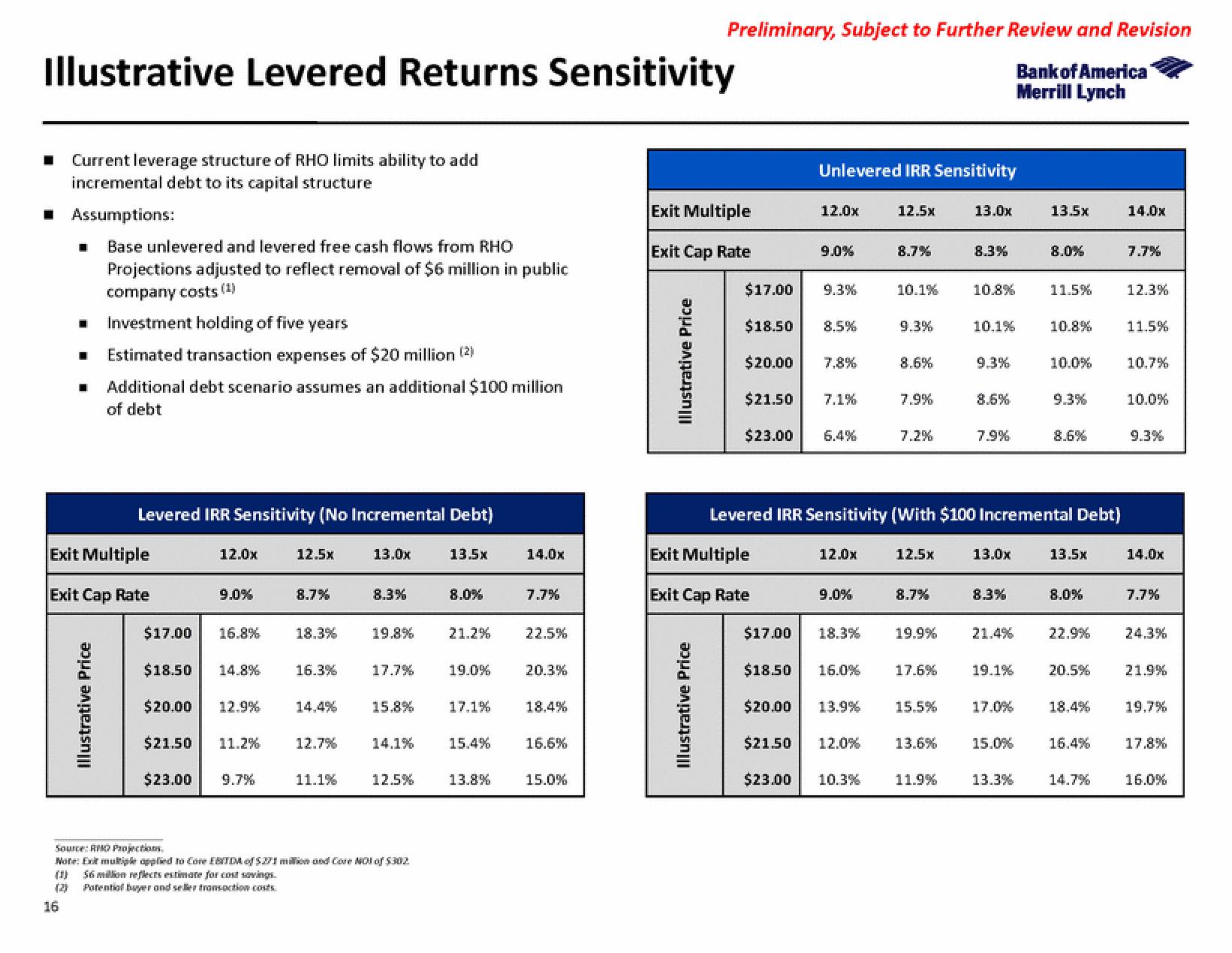

■ Current leverage structure of RHO limits ability to add

incremental debt to its capital structure

■ Assumptions:

■

(1)

(2)

■

16

Base unlevered and levered free cash flows from RHO

Projections adjusted to reflect removal of $6 million in public

company costs (1)

Investment holding of five years

Estimated transaction expenses of $20 million (2)

Exit Multiple

Exit Cap Rate

Illustrative Price

Additional debt scenario assumes an additional $100 million

of debt

Levered IRR Sensitivity (No Incremental Debt)

135

12.0x

9.0%

$17.00 16.8%

$18.50 14.8%

$20.00 12.9%

$21.50 11.2%

$23.00 9.7%

125x

8.7%

18.3%

16.3%

14.4%

12.7%

11.1%

13.0x

8.3%

19.8%

17.7%

15.8%

14.1%

Source: RHO Projectio

Note: Exit multiple applied to Core EBITDA of $271 million and Core NOT of $302

56 million reflects estimate for cost savings.

Potential buyer and seller transaction costs

12.5%

8.0%

21.2%

19.0%

17.1%

15.4%

13.8%

14.0x

7.7%

22.5%

20.3%

18.4%

16.6%

15.0%

Preliminary, Subject to Further Review and Revision

Bank of America

Merrill Lynch

Exit Multiple

Exit Cap Rate

Illustrative Price

Illustrative Price

$17.00

$18.50

$20.00

$21.50

$23.00

Exit Multiple

Exit Cap Rate

$17.00

Unlevered IRR Sensitivity

12.0x

$23.00

9.0%

9.3%

8.5%

7,8%

7.1%

6.4%

12.0x

9.0%

18.3%

$18.50 16.0%

$20.00 13.9%

$21.50 12.0%

12.5x

10.3%

8.7%

10.1%

9.3%

8.6%

7.9%

7.2%

125x

8.7%

19.9%

17.6%

15.5%

Levered IRR Sensitivity (With $100 Incremental Debt)

13.6%

13.0x

11.9%

8.3%

10.8%

10.1%

9.3%

8.6%

7.9%

13.0x

8.3%

21.4%

19.1%

17.0%

15.0%

135x

13.3%

8.0%

11.5%

10.8%

10.0%

9.3%

8.6%

135x

8.0%

22.9%

20.5%

18.4%

16.4%

14.7%

14.0x

7.7%

12.3%

11.5%

10.7%

10.0%

9.3%

14.0x

7.7%

24.3%

21.9%

19.7%

17.8%

16.0%View entire presentation