MP Materials Investor Conference Presentation Deck

1.

2.

Continued

operational

execution

■

2021

2022

Stage II Related

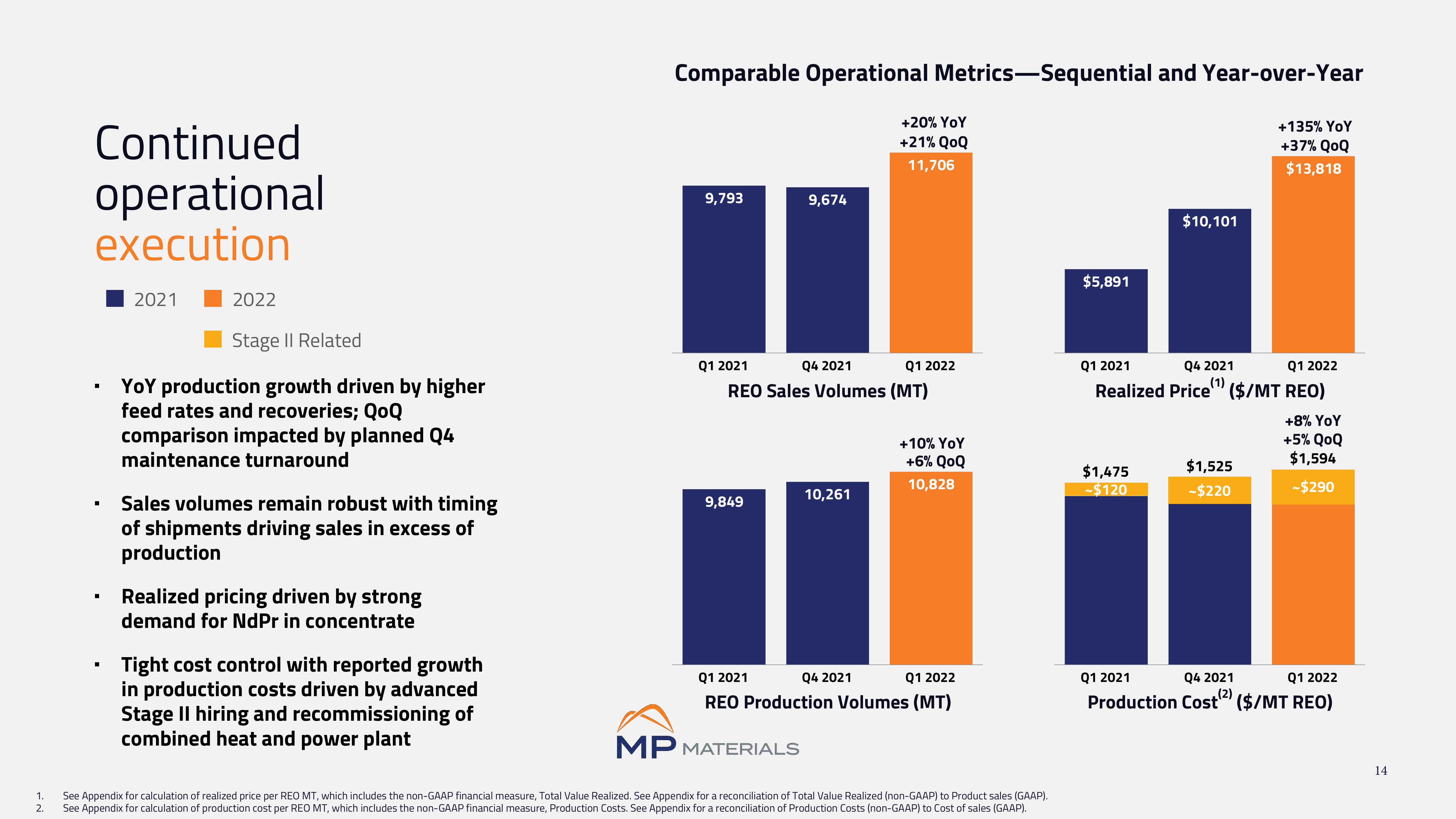

YoY production growth driven by higher

feed rates and recoveries; QoQ

comparison impacted by planned Q4

maintenance turnaround

Sales volumes remain robust with timing

of shipments driving sales in excess of

production

Realized pricing driven by strong

demand for NdPr in concentrate

Tight cost control with reported growth

in production costs driven by advanced

Stage II hiring and recommissioning of

combined heat and power plant

Comparable Operational Metrics-Sequential and Year-over-Year

+135% YoY

+37% QOQ

$13,818

9,793

Q1 2021

9,674

Q4 2021

REO Sales Volumes (MT)

9,849

+20% YoY

+21% QOQ

11,706

10,261

Q1 2022

+10% YoY

+6% QOQ

10,828

Q1 2021

Q4 2021

Q1 2022

REO Production Volumes (MT)

MP MATERIALS

See Appendix for calculation of realized price per REO MT, which includes the non-GAAP financial measure, Total Value Realized. See Appendix for a reconciliation of Total Value Realized (non-GAAP) to Product sales (GAAP).

See Appendix for calculation of production cost per REO MT, which includes the non-GAAP financial measure, Production Costs. See Appendix for a reconciliation of Production Costs (non-GAAP) to Cost of sales (GAAP).

$5,891

$10,101

Q1 2021

Q1 2022

Q4 2021

(1)

Realized Price ($/MT REO)

$1,475

-$120

$1,525

-$220

+8% YoY

+5% QOQ

$1,594

-$290

Q1 2021

Q4 2021

Q1 2022

Production Cost ($/MT REO)

14View entire presentation