Astra SPAC Presentation Deck

VALUATION

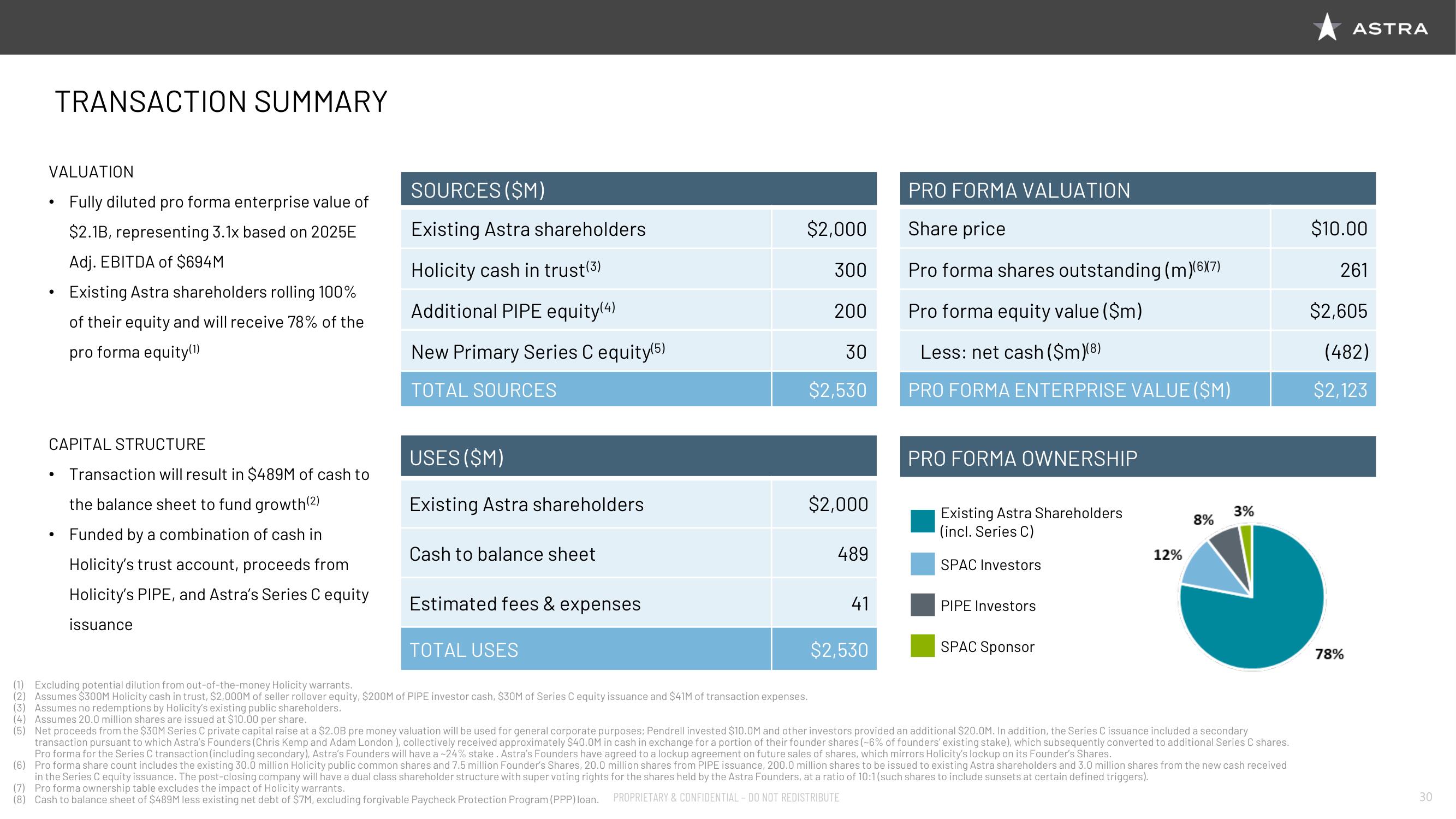

Fully diluted pro forma enterprise value of

$2.1B, representing 3.1x based on 2025E

Adj. EBITDA of $694M

TRANSACTION SUMMARY

●

●

●

Existing Astra shareholders rolling 100%

of their equity and will receive 78% of the

pro forma equity(1)

CAPITAL STRUCTURE

Transaction will result in $489M of cash to

the balance sheet to fund growth(2)

Funded by a combination of cash in

Holicity's trust account, proceeds from

Holicity's PIPE, and Astra's Series C equity

issuance

SOURCES ($M)

Existing Astra shareholders

Holicity cash in trust(³)

Additional PIPE equity(4)

New Primary Series C equity(5)

TOTAL SOURCES

USES ($M)

Existing Astra shareholders

Cash to balance sheet

Estimated fees & expenses

TOTAL USES

$2,000

300

200

30

$2,530

$2,000

489

41

$2,530

PRO FORMA VALUATION

Share price

Pro forma shares outstanding (m)(6X7)

Pro forma equity value ($m)

Less: net cash ($m)(8)

PRO FORMA ENTERPRISE VALUE ($M)

PRO FORMA OWNERSHIP

Existing Astra Shareholders

(incl. Series C)

SPAC Investors

PIPE Investors

SPAC Sponsor

12%

8%

3%

(1) Excluding potential dilution from out-of-the-money Holicity warrants.

(2) Assumes $300M Holicity cash in trust, $2,000M of seller rollover equity, $200M of PIPE investor cash, $30M of Series C equity issuance and $41M of transaction expenses.

(3) Assumes no redemptions by Holicity's existing public shareholders.

(4) Assumes 20.0 million shares are issued at $10.00 per share.

(5) Net proceeds from the $30M Series C private capital raise at a $2.0B pre money valuation will be used for general corporate purposes; Pendrell invested $10.0M and other investors provided an additional $20.0M. In addition, the Series C issuance included a secondary

transaction pursuant to which Astra's Founders (Chris Kemp and Adam London), collectively received approximately $40.0M in cash in exchange for a portion of their founder shares (~6% of founders' existing stake), which subsequently converted to additional Series C shares.

Pro forma for the Series C transaction (including secondary), Astra's Founders will have a -24% stake. Astra's Founders have agreed to a lockup agreement on future sales of shares, which mirrors Holicity's lockup on its Founder's Shares.

(6) Pro forma share count includes the existing 30.0 million Holicity public common shares and 7.5 million Founder's Shares, 20.0 million shares from PIPE issuance, 200.0 million shares to be issued to existing Astra shareholders and 3.0 million shares from the new cash received

in the Series C equity issuance. The post-closing company will have a dual class shareholder structure with super voting rights for the shares held by the Astra Founders, at a ratio of 10:1 (such shares to include sunsets at certain defined triggers).

(7) Pro forma ownership table excludes the impact of Holicity warrants.

(8) Cash to balance sheet of $489M less existing net debt of $7M, excluding forgivable Paycheck Protection Program (PPP) loan.

PROPRIETARY & CONFIDENTIAL- DO NOT REDISTRIBUTE

ASTRA

$10.00

261

$2,605

(482)

$2,123

78%

30View entire presentation