Kinnevik Results Presentation Deck

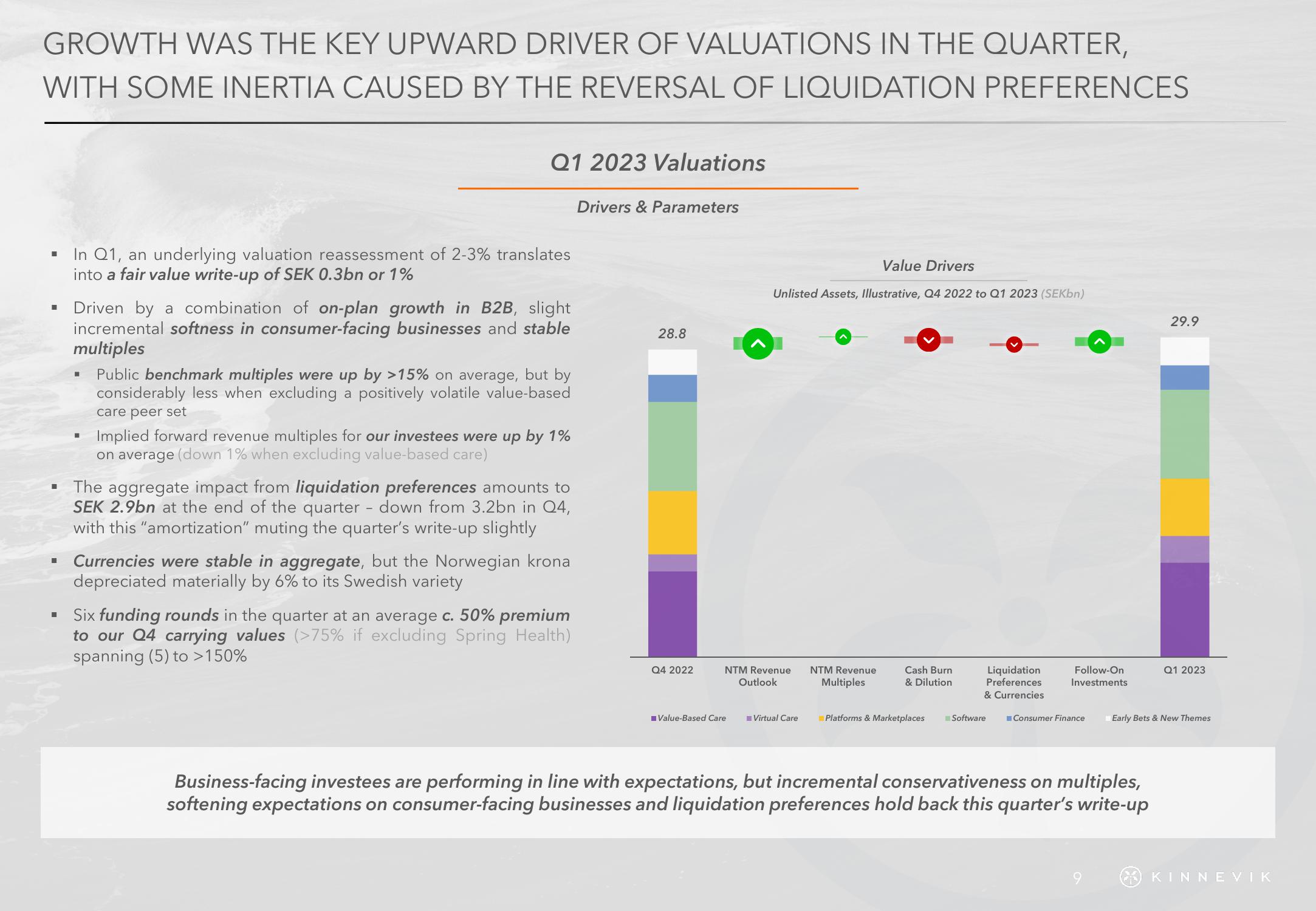

GROWTH WAS THE KEY UPWARD DRIVER OF VALUATIONS IN THE QUARTER,

WITH SOME INERTIA CAUSED BY THE REVERSAL OF LIQUIDATION PREFERENCES

■

■

U

Q1 2023 Valuations

In Q1, an underlying valuation reassessment of 2-3% translates

into a fair value write-up of SEK 0.3bn or 1%

Driven by a combination of on-plan growth in B2B, slight

incremental softness in consumer-facing businesses and stable

multiples

■

Public benchmark multiples were up by >15% on average, but by

considerably less when excluding a positively volatile value-based

care peer set

Implied forward revenue multiples for our investees were up by 1%

on average (down 1% when excluding value-based care)

The aggregate impact from liquidation preferences amounts to

SEK 2.9bn at the end of the quarter - down from 3.2bn in Q4,

with this "amortization" muting the quarter's write-up slightly

Currencies were stable in aggregate, but the Norwegian krona

depreciated materially by 6% to its Swedish variety

Six funding rounds in the quarter at an average c. 50% premium

to our Q4 carrying values (>75% if excluding Spring Health)

spanning (5) to >150%

Drivers & Parameters

28.8

Q4 2022

Value Drivers

Unlisted Assets, Illustrative, Q4 2022 to Q1 2023 (SEKbn)

NTM Revenue NTM Revenue

Outlook

Multiples

■Value-Based Care

Virtual Care

Cash Burn

& Dilution

Platforms & Marketplaces

Liquidation

Preferences

& Currencies

Software

Follow-On

Investments

Consumer Finance

29.9

Business-facing investees are performing in line with expectations, but incremental conservati eness on multiples,

softening expectations on consumer-facing businesses and liquidation preferences hold back this quarter's write-up

Q1 2023

Early Bets & New Themes

KINNEVIKView entire presentation