First Citizens BancShares Results Presentation Deck

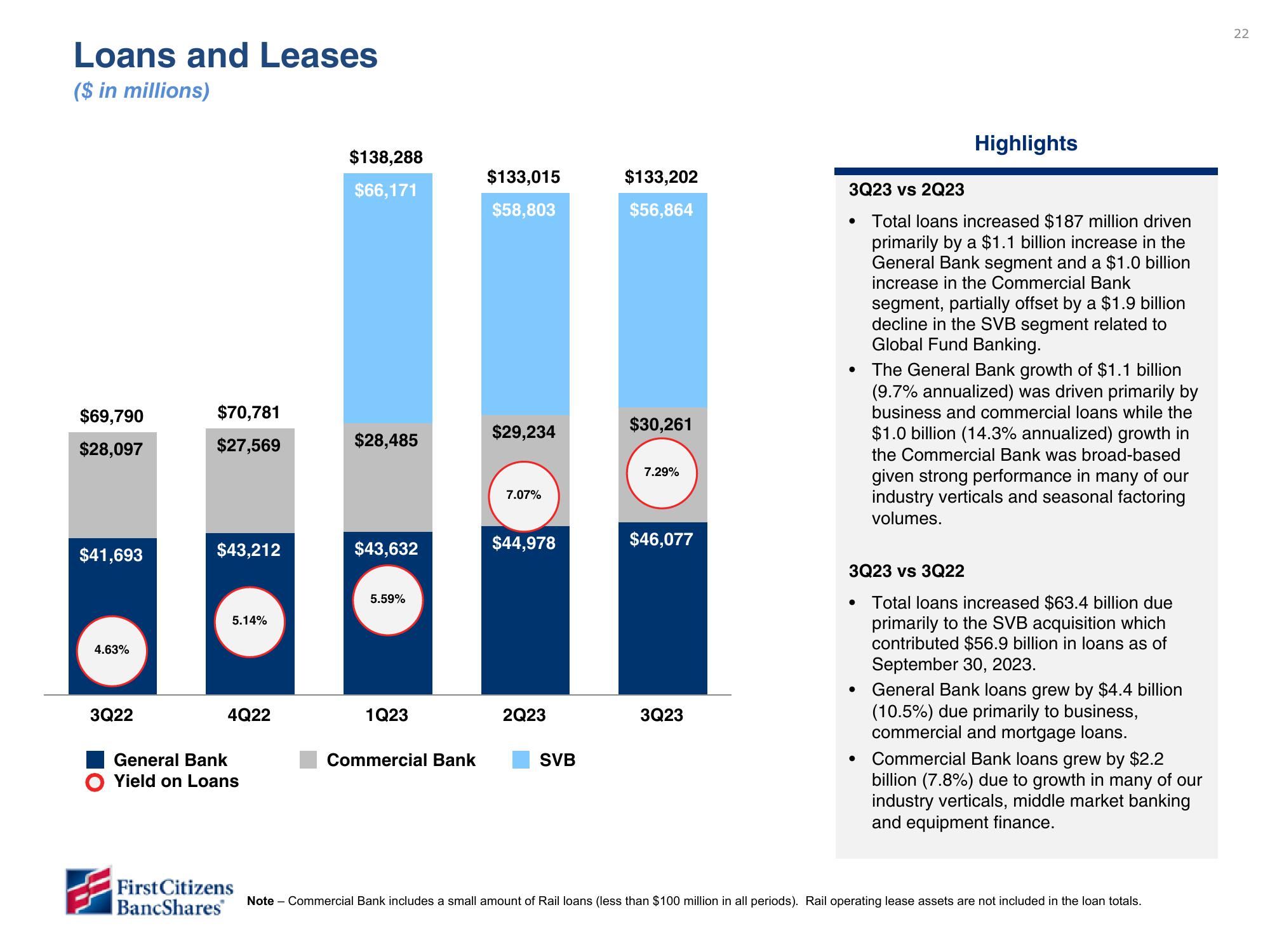

Loans and Leases

($ in millions)

$69,790

$28,097

$41,693

4.63%

3Q22

$70,781

$27,569

$43,212

5.14%

4Q22

General Bank

Yield on Loans

First Citizens

BancShares

$138,288

$66,171

$28,485

$43,632

5.59%

1Q23

Commercial Bank

$133,015

$58,803

$29,234

7.07%

$44,978

2Q23

SVB

$133,202

$56,864

$30,261

7.29%

$46,077

3Q23

3Q23 vs 2Q23

Total loans increased $187 million driven

primarily by a $1.1 billion increase in the

General Bank segment and a $1.0 billion

increase in the Commercial Bank

segment, partially offset by a $1.9 billion

decline in the SVB segment related to

Global Fund Banking.

●

●

Highlights

●

3Q23 vs 3Q22

Total loans increased $63.4 billion due

primarily to the SVB acquisition which

contributed $56.9 billion in loans as of

September 30, 2023.

●

The General Bank growth of $1.1 billion

(9.7% annualized) was driven primarily by

business and commercial loans while the

$1.0 billion (14.3% annualized) growth in

the Commercial Bank was broad-based

given strong performance in many of our

industry verticals and seasonal factoring

volumes.

General Bank loans grew by $4.4 billion

(10.5%) due primarily to business,

commercial and mortgage loans.

Commercial Bank loans grew by $2.2

billion (7.8%) due to growth in many of our

industry verticals, middle market banking

and equipment finance.

Note - Commercial Bank includes a small amount of Rail loans (less than $100 million in all periods). Rail operating lease assets are not included in the loan totals.

22View entire presentation