Bank of America Investment Banking Pitch Book

Price as of 3/14/2014

(2)

Price as % of 52 Wk High

Price as % of 52 Wk Low

Market Value

Enterprise Value (1¹)

Moody's Credit Rating

EV/CY 2014E EBITDA

EV/CY 2015E EBITDA

Price / CY 2014E Earnings

Price / CY 2015E Earnings 2

LT EPS Growth Rate

Net Debt / CY 2014E EBITDA

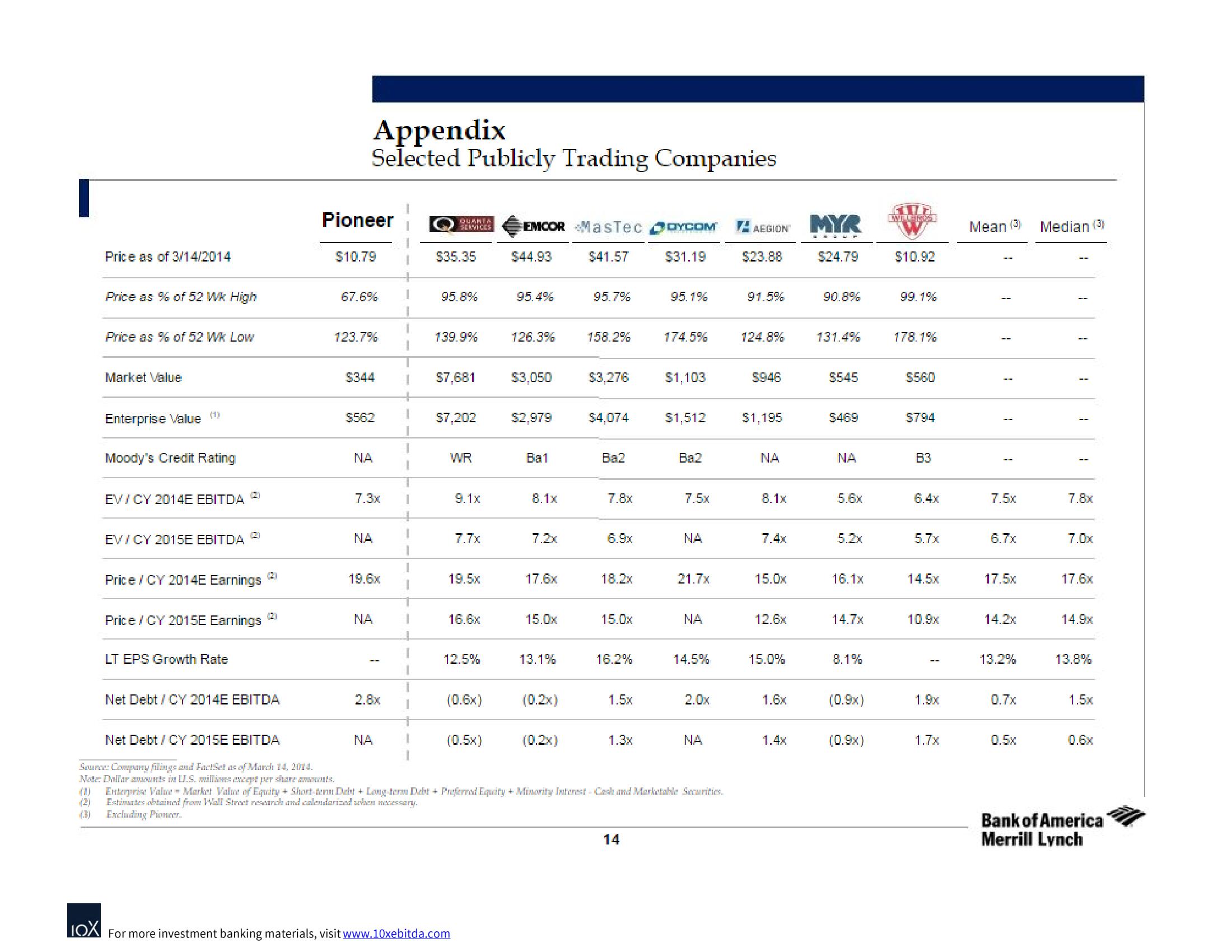

Appendix

Selected Publicly Trading Companies

Pioneer

$10.79

67.6%

123.7%

$344

$562

NA

7.3x I

NA

NA

2.8x

I

NA

QUARTA

SERVICES

$35.35

95.8%

139.9%

$7,681

$7,202

WR

9.1x

7.7x

15.Ex

16.6x

12.5%

(0.6x)

LOX For more investment banking materials, visit www.10xebitda.com

(6.5x)

EMCOR MasTec

$41.57

$44.93

95.4%

126.3%

$3,050

$2,979

Bal

8.1x

7.2x

17.6x

15.0x

13.1%

(0.2x)

95.7%

(0.2x)

158.2%

$3,276

$4,074

Ba2

7.8x

6.9x

18.2x

15.0x

16.2%

1.5x

1.3x

DYCOM

14

$31.19

95.1%

174.5%

$1,103

$1,512

Ba2

Net Debt/CY 2015E EBITDA

Source: Company filings and FactSet as of March 14, 2014.

Note: Dallar amounts in I.S. millions except per shares.

Enterprise Value - Market Value of Equity+Short-term Debt + Long-term Debt + Preferred Equity + Minority Interest - Cach and Marketable Securities.

Estimates obtained from Wall Street research and calendarized when necessary.

Excluding Pioneer.

7.5x

NA

21.7x

NA

14.5%

2.0x

NA

AEGION

$23.88

91.5%

124.8%

$946

$1,195

NA

8.1x

7.4x

15.0x

12.6x

15.0%

1.6x

1.4x

MYR

P

$24.79

90.8%

131.4%

$545

$469

NA

5.6x

5.2x

16.1x

14.7x

8.1%

(0.9x)

(0.9x)

408

WILL-IRS

$10.92

99.1%

178.1%

$560

$794

63

6.4x

5.7x

14.5x

10.9x

1.9x

1.7x

Mean (3)

1

1

1

7.5x

6.7x

17.Ex

14.2x

13.2%

0.7x

0.5x

Median (3)

T

1

1

7.8x

7.0x

17.6x

14.9x

13.8%

1.5x

0.6x

Bank of America

Merrill LynchView entire presentation