First Foundation Investor Presentation Deck

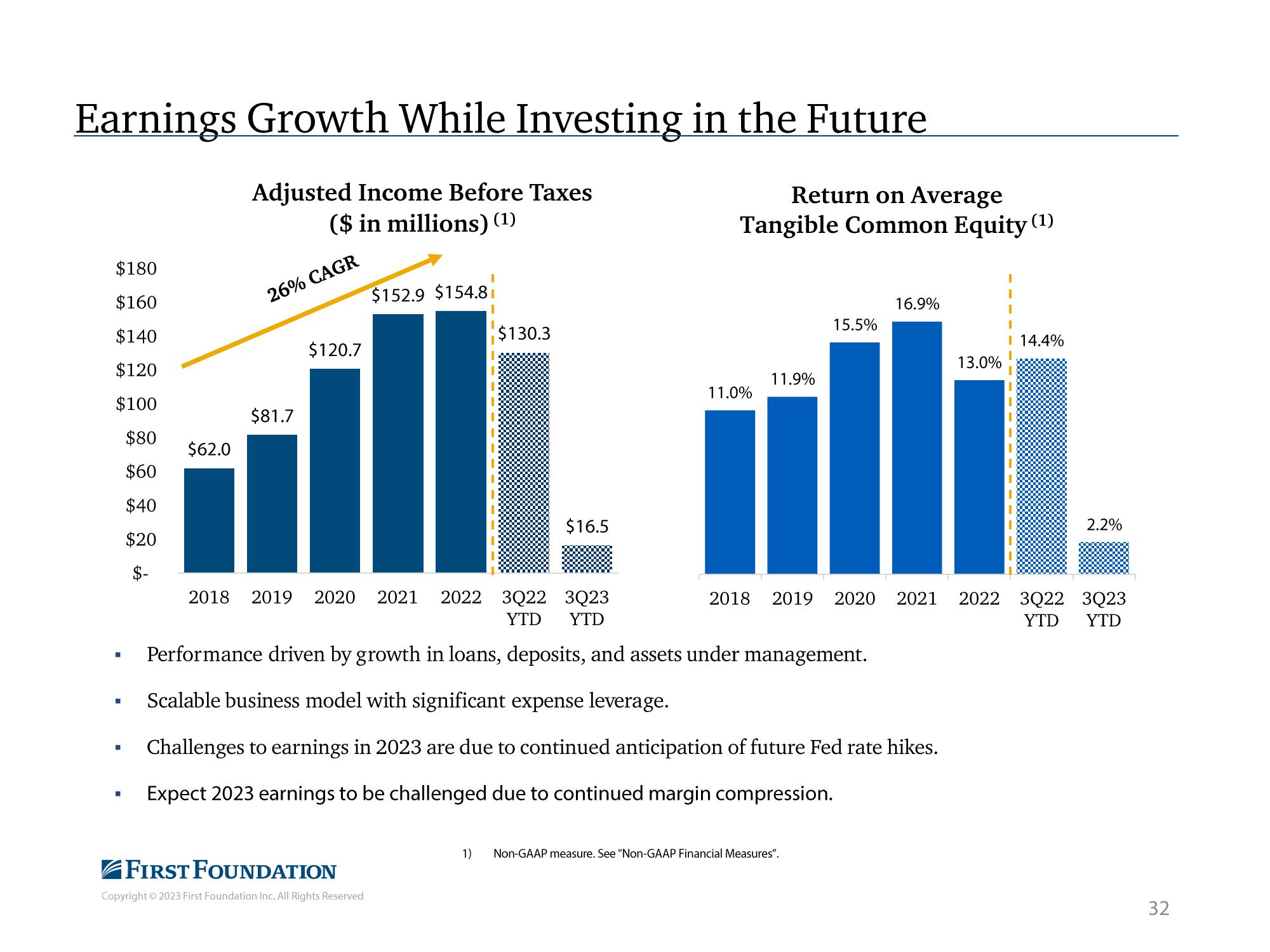

Earnings Growth While Investing in the Future

Adjusted Income Before Taxes

($ in millions) (1)

26% CAGR

$180

$160

$140

$120

$100

$80

$60

$40

$20

$-

I

I

■

■

$62.0

$81.7

$120.7

$152.9 $154.81

FIRST FOUNDATION

Copyright © 2023 First Foundation Inc. All Rights Reserved

$130.3

$16.5

Return on Average

Tangible Common Equity (1)

11.0%

11.9%

15.5%

2018 2019 2020 2021 2022 3Q22 3Q23

YTD YTD

Performance driven by growth in loans, deposits, and assets under management.

Scalable business model with significant expense leverage.

Challenges to earnings in 2023 are due to continued anticipation of future Fed rate hikes.

Expect 2023 earnings to be challenged due to continued margin compression.

2018 2019 2020

1) Non-GAAP measure. See "Non-GAAP Financial Measures".

16.9%

13.0%

I

I

I 14.4%

2.2%

2021 2022 3Q22 3Q23

YTD YTD

32View entire presentation