J.P.Morgan Results Presentation Deck

Corporate & Investment Bank1

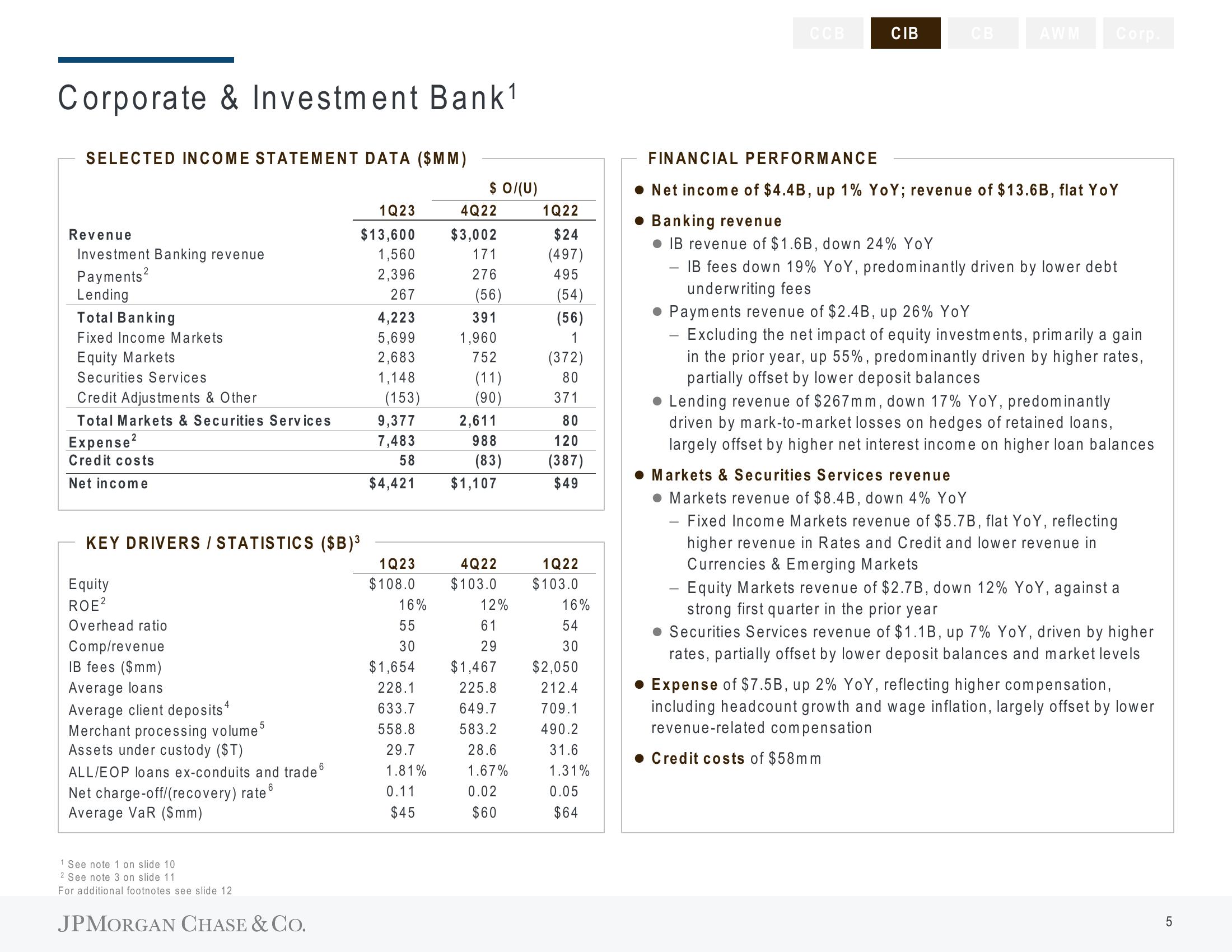

SELECTED INCOME STATEMENT DATA ($MM)

Revenue

Investment Banking revenue

Payments²

Lending

Total Banking

Fixed Income Markets

Equity Markets

Securities Services

Credit Adjustments & Other

Total Markets & Securities Services

Expense ²

Credit costs

Net income

KEY DRIVERS / STATISTICS ($B)³

Equity

ROE²

Overhead ratio

Comp/revenue

IB fees ($mm)

Average loans

Average client deposits

Merchant processing volume 5

Assets under custody ($T)

6

ALL/EOP loans ex-conduits and trade

Net charge-off/(recovery) rate

Average VaR ($mm)

1 See note 1 on slide 10

2 See note 3 on slide 11

For additional footnotes see slide 12.

1Q23

$13,600

1,560

2,396

267

JPMORGAN CHASE & CO.

4,223

5,699

2,683

1,148

(153)

9,377

7,483

58

$4,421

1Q23

$108.0

16%

55

30

$1,654

228.1

633.7

558.8

29.7

1.81%

0.11

$45

$ 0/(U)

4Q22

$3,002

171

276

(56)

391

1,960

752

(11)

(90)

2,611

988

(83)

$1,107

4Q22

$103.0

12%

61

29

$1,467

225.8

649.7

583.2

28.6

1.67%

0.02

$60

1Q22

$24

(497)

495

(54)

(56)

1

(372)

80

371

80

120

(387)

$49

1Q22

$103.0

16%

54

30

$2,050

212.4

709.1

490.2

31.6

1.31%

0.05

$64

CCB

CIB

CB

AWM Corp.

FINANCIAL PERFORMANCE

• Net income of $4.4B, up 1% YoY; revenue of $13.6B, flat YoY

• Banking revenue

-

IB revenue of $1.6B, down 24% YoY

IB fees down 19% YoY, predominantly driven by lower debt

underwriting fees

● Payments revenue of $2.4B, up 26% YoY

Excluding the net impact of equity investments, primarily a gain

in the prior year, up 55%, predominantly driven by higher rates,

partially offset by lower deposit balances

• Lending revenue of $267mm, down 17% YoY, predominantly

driven by mark-to-market losses on hedges of retained loans,

largely offset by higher net interest income on higher loan balances

Markets & Securities Services revenue

• Markets revenue of $8.4B, down 4% YoY

Fixed Income Markets revenue of $5.7B, flat YoY, reflecting

higher revenue in Rates and Credit and lower revenue in

Currencies & Emerging Markets

-

- Equity Markets revenue of $2.7B, down 12% YoY, against a

strong first quarter in the prior year

• Securities Services revenue of $1.1B, up 7% YoY, driven by higher

rates, partially offset by lower deposit balances and market levels

• Expense of $7.5B, up 2% YoY, reflecting higher compensation,

including headcount growth and wage inflation, largely offset by lower

revenue-related compensation

● Credit costs of $58mm

LO

5View entire presentation