HBT Financial Results Presentation Deck

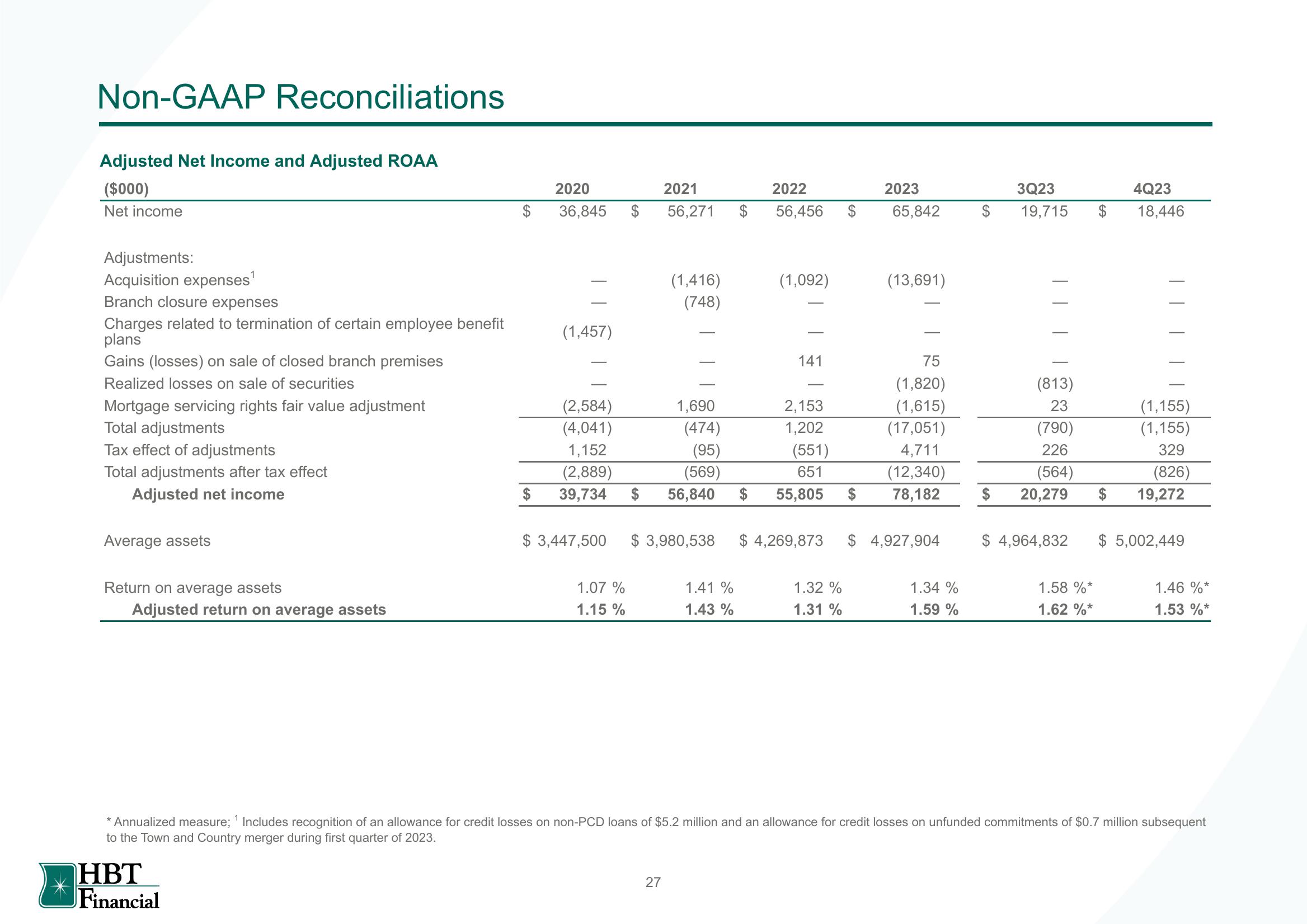

Non-GAAP Reconciliations

Adjusted Net Income and Adjusted ROAA

($000)

Net income

Adjustments:

Acquisition expenses¹

Branch closure expenses

Charges related to termination of certain employee benefit

plans

Gains (losses) on sale of closed branch premises

Realized losses on sale of securities

Mortgage servicing rights fair value adjustment

Total adjustments

Tax effect of adjustments

Total adjustments after tax effect

Adjusted net income

Average assets

Return on average assets

Adjusted return on average assets

2020

36,845

HBT

Financial

(1,457)

$

1.07%

1.15 %

2021

56,271

(2,584)

(4,041)

1,152

(2,889)

39,734 $ 56,840

(1,416)

(748)

1,690

27

$ 3,447,500 $ 3,980,538

(474)

(95)

(569)

1.41 %

1.43%

2022

56,456

(1,092)

141

-

2,153

1,202

(551)

651

$ 55,805 $

2023

1.32%

1.31 %

65,842

(13,691)

75

(1,820)

(1,615)

(17,051)

4,711

(12,340)

78,182

$ 4,269,873 $ 4,927,904

1.34 %

1.59%

3Q23

19,715

T

(813)

23

(790)

226

(564)

$ 20,279

$

1.58 %*

1.62 %*

4Q23

18,446

(1,155)

(1,155)

329

(826)

19,272

$4,964,832 $ 5,002,449

* Annualized measure; Includes recognition of an allowance for credit losses on non-PCD loans of $5.2 million and an allowance for credit losses on unfunded commitments of $0.7 million subsequent

to the Town and Country merger during first quarter of 2023.

1.46 %*

1.53 %*View entire presentation