Maersk Investor Presentation Deck

Financial highlights Q3 2020

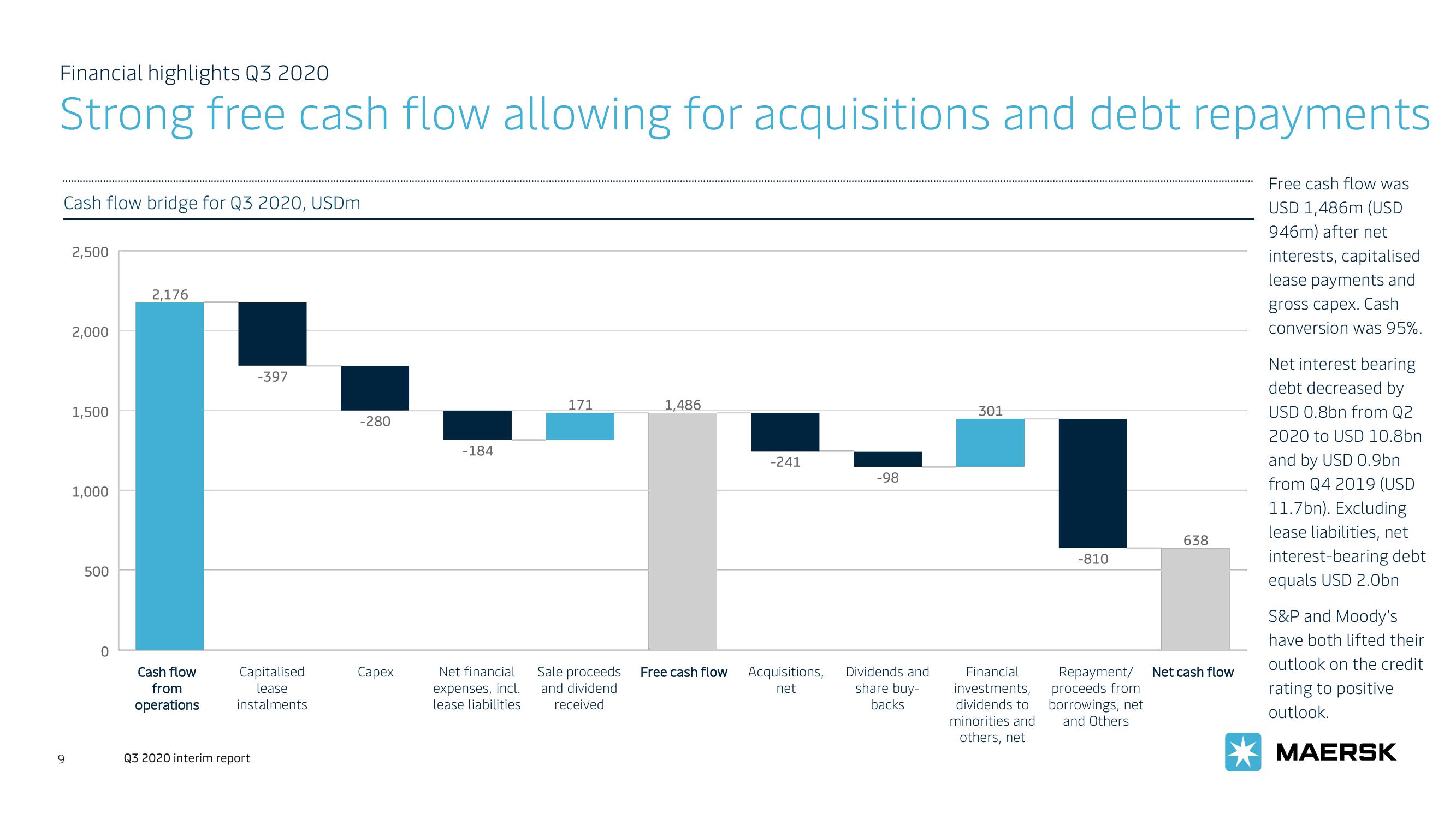

Strong free cash flow allowing for acquisitions and debt repayments.

Cash flow bridge for Q3 2020, USDm

9

2,500

2,000

1,500

1,000

500

0

2,176

Cash flow

from

operations

-397

Capitalised

lease

instalments

Q3 2020 interim report

-280

Capex

-184

Net financial

expenses, incl.

lease liabilities

171

1,486

Sale proceeds Free cash flow

and dividend

received

-241

Acquisitions,

net

-98

Dividends and

share buy-

backs

301

Financial

investments,

dividends to

minorities and

others, net

-810

Repayment/

proceeds from

borrowings, net

and Others

638

Net cash flow

Free cash flow was

USD 1,486m (USD

946m) after net

interests, capitalised

lease payments and

gross capex. Cash

conversion was 95%.

Net interest bearing

debt decreased by

USD 0.8bn from Q2

2020 to USD 10.8bn

and by USD 0.9bn

from Q4 2019 (USD

11.7bn). Excluding

lease liabilities, net

interest-bearing debt

equals USD 2.0bn

S&P and Moody's

have both lifted their

outlook on the credit

rating to positive

outlook.

MAERSKView entire presentation