Servicing Portfolio Growth Deck

10 |

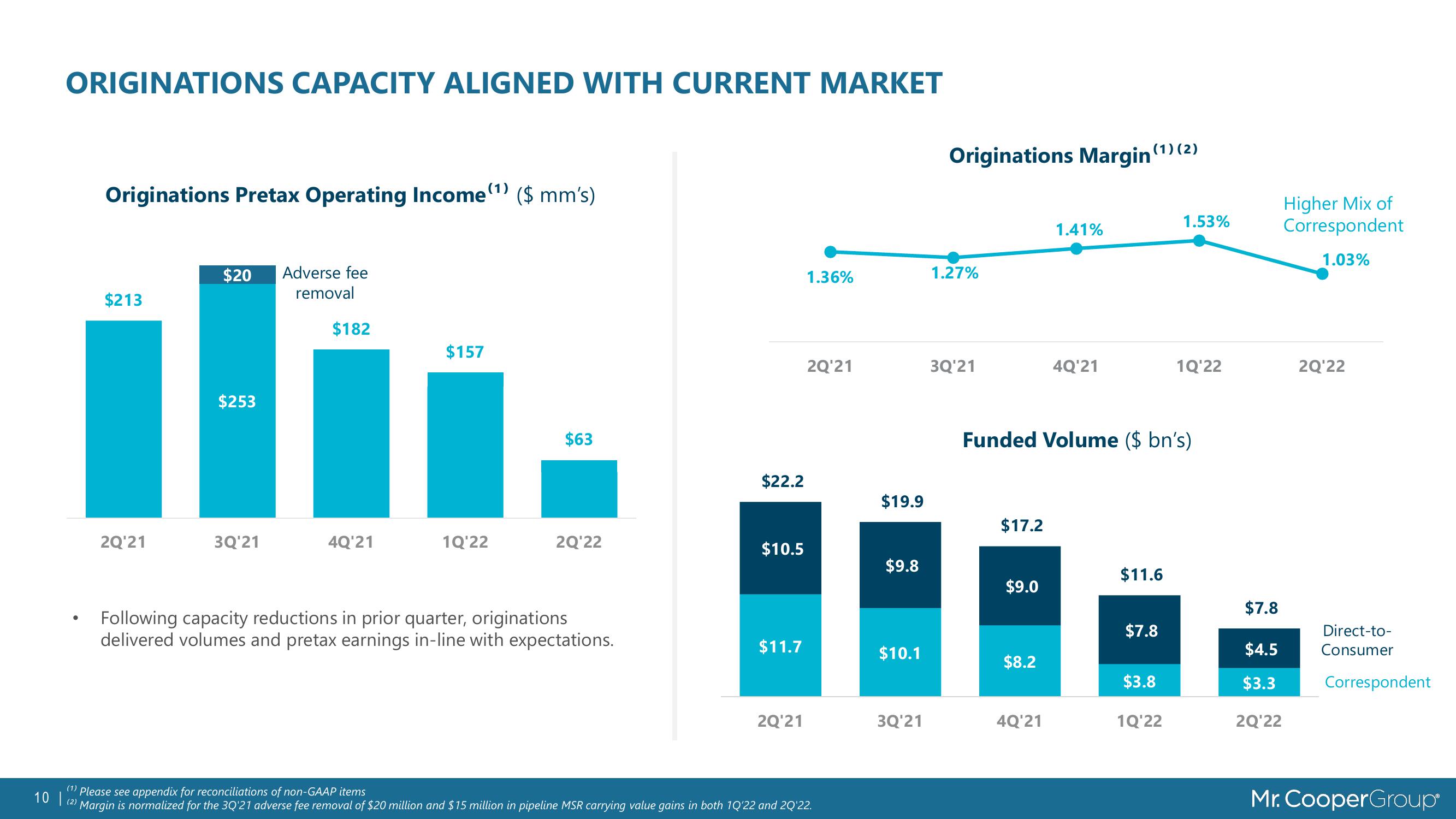

ORIGINATIONS CAPACITY ALIGNED WITH CURRENT MARKET

Originations Pretax Operating Income (¹) ($ mm's)

$213

2Q¹21

$20 Adverse fee

removal

$253

3Q'21

$182

4Q'21

$157

1Q'22

$63

2Q'22

Following capacity reductions in prior quarter, originations

delivered volumes and pretax earnings in-line with expectations.

$22.2

$10.5

$11.7

2Q¹21

1.36%

2Q'21

(1) Please see appendix for reconciliations of non-GAAP items

(2)

Margin is normalized for the 3Q'21 adverse fee removal of $20 million and $15 million in pipeline MSR carrying value gains in both 10'22 and 2Q'22.

$19.9

$9.8

$10.1

3Q'21

Originations Margin (1) (2)

1.27%

3Q'21

$17.2

$9.0

$8.2

1.41%

Funded Volume ($ bn's)

4Q'21

4Q'21

$11.6

$7.8

1.53%

$3.8

1Q'22

1Q'22

$7.8

$4.5

$3.3

2Q'22

Higher Mix of

Correspondent

1.03%

2Q'22

Direct-to-

Consumer

Correspondent

Mr. CooperGroupView entire presentation