Embracer Group Mergers and Acquisitions Presentation Deck

Transaction

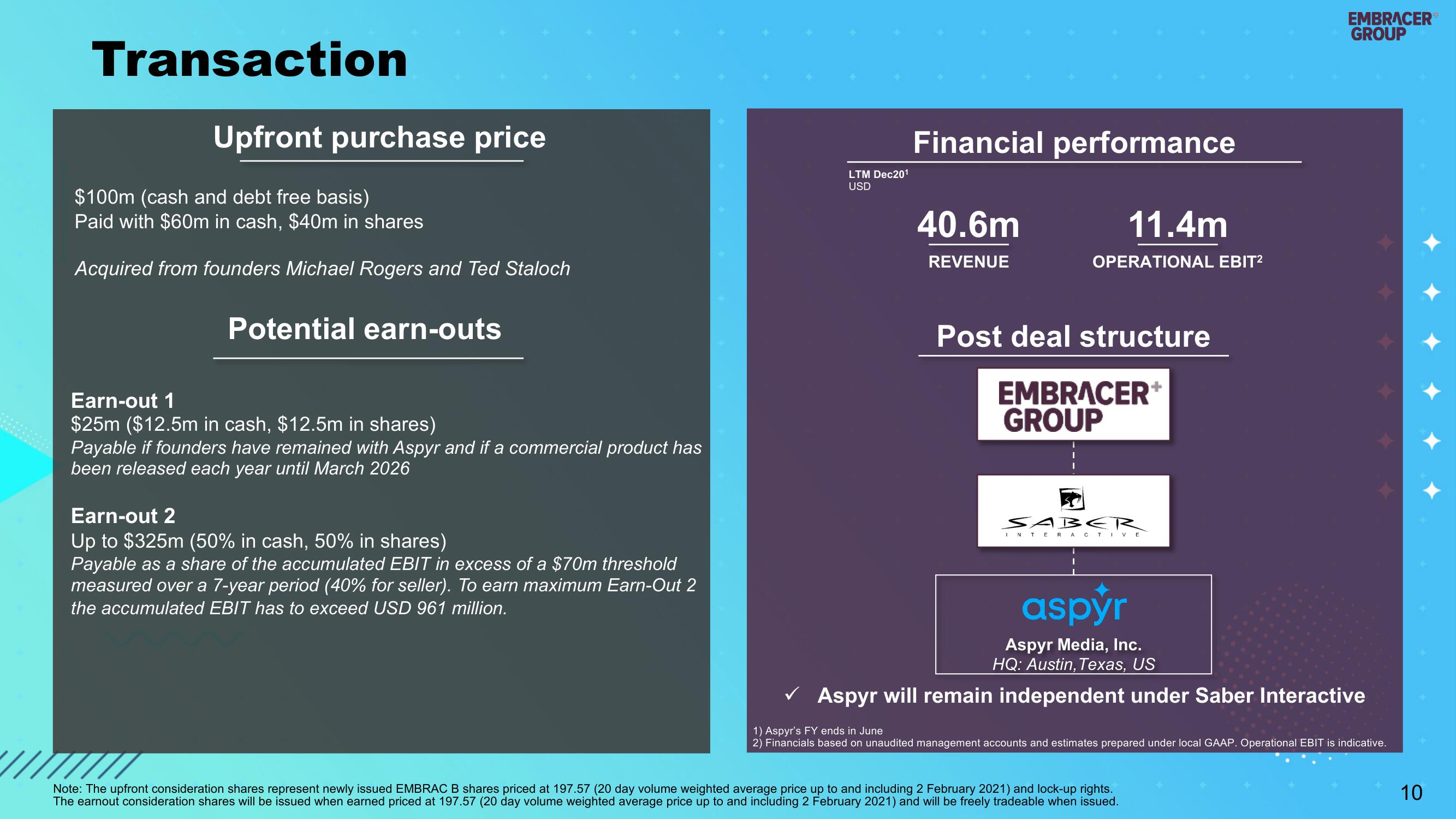

Upfront purchase price

$100m (cash and debt free basis)

Paid with $60m in cash, $40m in shares

Acquired from founders Michael Rogers and Ted Staloch

Potential earn-outs

Earn-out 1

$25m ($12.5m in cash, $12.5m in shares)

Payable if founders have remained with Aspyr and if a commercial product has

been released each year until March 2026

Earn-out 2

Up to $325m (50% in cash, 50% in shares)

Payable as a share of the accumulated EBIT in excess of a $70m threshold

measured over a 7-year period (40% for seller). To earn maximum Earn-Out 2

the accumulated EBIT has to exceed USD 961 million.

LTM Dec20¹

USD

Financial performance

40.6m

REVENUE

11.4m

OPERATIONAL EBIT²

Post deal structure

EMBRACER*

GROUP

SABER

INTERACTIVE

Note: The upfront consideration shares represent newly issued EMBRAC B shares priced at 197.57 (20 day volume weighted average price up to and including 2 February 2021) and lock-up rights.

The earnout consideration shares will be issued when earned priced at 197.57 (20 day volume weighted average price up to and including 2 February 2021) and will be freely tradeable when issued.

EMBRACER

GROUP

aspyr

Aspyr Media, Inc.

HQ: Austin, Texas, US

✓ Aspyr will remain independent under Saber Interactive

1) Aspyr's FY ends in June

2) Financials based on unaudited management accounts and estimates prepared under local GAAP. Operational EBIT is indicative.

10View entire presentation